Measured by output, the world economy is properly on the technique to restoration from a hunch the likes of which barely any of its 7.7 billion individuals have seen of their lifetimes. Vaccines ought to speed up the rebound in 2021. But different legacies of Covid-19 will form international progress for years to return.

Some are already discernible. The takeover of manufacturing facility and repair jobs by robots will advance, whereas white-collar employees get to remain house extra. There’ll be extra inequality between and inside international locations. Governments will play a bigger position in the lives of residents, spending—and owing—extra money. What follows is an outline of a few of the transformations underneath method.

Leviathan

Big authorities staged a comeback as the social contract between society and the state bought rewritten on the fly. It turned commonplace for authorities to trace the place individuals went and who they met—and to pay their wages when employers couldn’t handle it. In international locations the place free-market concepts had reigned for many years, security nets needed to be patched up.

To pay for these interventions, the world’s governments ran funds deficits that add as much as $11 trillion this yr, in keeping with McKinsey & Co. There’s already a debate about how lengthy such spending can proceed, and when taxpayers must begin footing the invoice. At least in developed economies, ultralow rates of interest and unfazed monetary markets don’t level to a close to-time period disaster.

In the longer run, an enormous rethink in economics is altering minds about public debt. The new consensus says governments have extra room to spend in a low-inflation world, and may use fiscal coverage extra proactively to drive their economies. Advocates of Modern Monetary Theory say they pioneered these arguments and the mainstream is just now catching up.

Even easier money

Central banks had been plunged again into printing cash. Interest charges hit new document lows. Central bankers stepped up their quantitative easing, widening it to purchase company in addition to authorities debt.

All these financial interventions have created a few of the best monetary circumstances in historical past—and unleashed a frenzy of speculative funding, which has left loads of analysts nervous about ethical hazards forward. But the central-financial institution insurance policies will likely be laborious to reverse, particularly if labor markets stay fractured and firms proceed their latest run-up in saving.

And historical past reveals that pandemics depress rates of interest for a very long time, in keeping with a paper printed this yr. It discovered {that a} quarter-century after the illness struck, charges had been sometimes some 1.5 share factors decrease than they in any other case would have been.

Debts and zombies

Governments supplied credit score as a lifeline throughout the pandemic—and enterprise grabbed it. One outcome was a surge in company debt ranges throughout the developed world. The Bank for International Settlements calculates that nonfinancial firms borrowed a internet $3.36 trillion in the first half of 2020.

With revenues plunging in many industries due to lockdowns or shopper warning, and losses consuming into enterprise stability sheets, the circumstances are in place for a “major corporate solvency crisis,” in keeping with one new report.

Some additionally see hazard in providing an excessive amount of assist for firms, with too little discrimination over who will get it. They say that’s a recipe for creating “zombie firms” that may’t survive in a free market and are solely saved alive by state assist—making the complete economy much less productive.

Great divides

The stimulus debate can really feel like a first-world luxurious. Poor international locations lack the assets to guard jobs and companies — or put money into vaccines — the method wealthier friends have completed, they usually’ll have to tighten belts sooner or threat foreign money crises and capital flight.

The World Bank warns that the pandemic is spawning a brand new era of poverty and debt turmoil, and the IMF says creating nations threat getting set again by a decade.

Creditor governments in the G-20 have taken some steps to ease the plight of the poorest debtors, however they’ve been slammed by assist teams for providing solely restricted debt reduction and failing to rope personal buyers into the plan.

Okay-formed

Low-paying work in companies, the place there’s extra face-to-face contact with prospects, tended to vanish first as economies locked down. And monetary markets, the place property are largely owned by the wealthy, got here roaring again a lot quicker than job markets.

The upshot has been labeled a “K-shaped recovery.” The virus has widened revenue or wealth gaps throughout faultlines of sophistication, race and gender.

Women have been hit disproportionately laborious—partly as a result of they’re extra prone to work in the industries that struggled, but additionally as a result of they needed to shoulder a lot of the additional childcare burden as faculties closed. In Canada, ladies’s participation in the labor drive fell to the lowest since the mid-1980s.

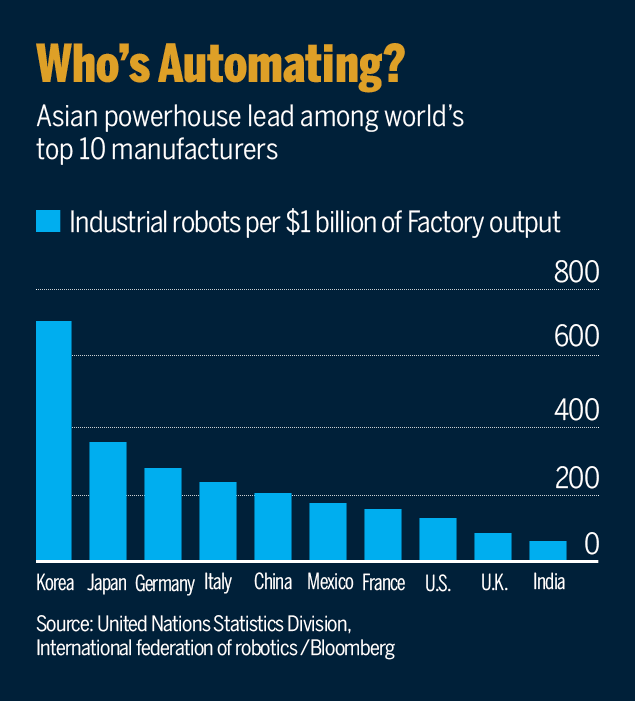

Rise of the robots

Covid-19 triggered new issues about bodily contact in industries the place social distancing is hard—like retail, hospitality or warehousing. One repair is to switch the people with robots.

Research means that automation usually positive factors floor throughout a recession. In the pandemic, firms accelerated work on machines that may test visitors into motels, reduce salads at eating places, or gather charges at toll cubicles. And buying moved additional on-line.

These improvements will make economies extra productive. But in addition they imply that when it’s protected to return to work, some jobs simply received’t be there. And the longer individuals keep unemployed, the extra their abilities can atrophy—one thing economists name “hysteresis.”

You’re on mute

Higher up the revenue ladder, distant places of work immediately turned the norm. One examine discovered that two-thirds of U.S. GDP in May was generated by individuals working at house. Many firms advised staff to avoid the workplace properly into 2021, and a few signaled they’ll make versatile work everlasting.

Work-from-house has largely handed the know-how check, giving employers and workers new choices. That’s a fear for companies catering to the previous infrastructure of workplace life, from business actual property to meals and transportation. It’s a boon for these constructing a brand new one: shares in videoconferencing platform Zoom jumped greater than six-fold this yr.

The possibility of distant work, together with concern of the virus, additionally triggered a stampede of urbanites towards the suburbs or countryside—and in some international locations, a surge in rural property costs.

Not going anyplace?

Some sorts of journey got here to a close to halt. Global tourism fell 72% in the yr by October, in keeping with the United Nations. McKinsey reckons 1 / 4 of enterprise journeys may disappear forever as conferences transfer on-line.

With holidays upended and mass occasions like festivals and live shows known as off, the development amongst customers to favor “experiences” over items has been disrupted. And when actions do resume, they might not be the identical. “We still don’t know how concerts are going to be, really,” says Rami Haykal, co-proprietor of the Elsewhere venue in Brooklyn. “People will be more mindful, I think, of personal space, and avoiding places that are overly packed.”

Travelers could have to hold necessary well being certificates and cross by new sorts of safety. Hong Kong based mostly China Tech Global has developed a cell disinfection sales space that it’s attempting to promote to airports. Chief Executive Sammy Tsui says it might probably clear pathogens from the physique and garments in 40 seconds or much less. “You feel some cool air on your body, and some mist,” he says. “But you don’t feel wet.”

A special globalization

When Chinese factories shut down early in the pandemic, it despatched shock waves by provide chains in all places—and made companies and governments rethink their reliance on the world’s manufacturing powerhouse.

Sweden’s NA-KD.com, for instance, is a part of a flourishing “fast fashion” retail trade that strikes with social media developments fairly than the conventional seasons. After deliveries bought jammed this yr, the firm shifted some manufacturing from China to Turkey, says Julia Assarsson, head of inbound and customs.

Globalization in Reverse

That’s an instance of globalization adjusting with out retreating. In different areas, the pandemic could encourage politicians who argue that it’s dangerous to depend on imports of products very important to nationwide safety—as ventilators and masks turned out to be this yr.

Going inexperienced

Before the pandemic, it was primarily environmentalists musing over theories of peak oil—the concept that the rise of electrical autos may completely dent the world’s demand for one among the most polluting fossil fuels.

But when 2020 noticed planes grounded and folks staying house, even oil majors like BP felt an actual menace from the world getting severe about local weather.

Cleaning Up

Governments from California to the UK introduced plans to ban the sale of recent gasoline and diesel automobiles by 2035. And Joe Biden was elected with a promise the US will rejoin the Paris Agreement.