A photograph of Fenix Marine Services rail terminal on June 8, 2023, taken by a trucker.

The “slow and go” tempo of the International Longshore and Warehouse Union workforce at West Coast ports has slowed floor port productiveness to a crawl. As a consequence, provide chain intelligence firm MarineVisitors information reveals what it’s calling a “significant surge” in the typical variety of containers ready exterior of port limits.

At the Port of Oakland, in the course of the week of June 5, the typical TEUs (ton equal items) ready off port limits rose to 35,153 from 25,266, in accordance with MarineVisitors. At the Port of Los Angeles and Long Beach, California, the typical TEUs ready off port limits rose to 51,228 from 21,297 the earlier week, stated a MarineVisitors spokeswoman.

The worth of the mixed 86,381 containers floating off the ports of Oakland, Los Angeles, and Long Beach reached $5.2 billion, based mostly on a $61,000 worth per container, and customs information.

According to information completely pulled for CNBC by Vizion, which tracks container shipments, the seven-day charge for a container cleared by way of the Port of Oakland is working at 58%; at Port of Long Beach it’s 64%; and at Port of Los Angeles it’s 62%.

“Our data shows that vessels will continue arriving at West Coast ports in the coming days with significant amounts of cargo to unload,” stated Kyle Henderson, CEO of Vizion. There are not any indications right now that ocean carriers have plans to cancel any sailings to those ports, he stated, however he added, “If these labor disputes continue to affect port efficiency, we could see backlogs similar to those experienced during the pandemic. Obviously, that’s the last thing that any shipper wants as we turn the corner into the back half of the year and peak season.”

Logistics managers with information of the way in which the union rank-and-file displeased with unresolved points in negotiations with port administration are influencing work shifts inform CNBC the slowdown will be attributed to expert labor not exhibiting up for work. CNBC has additionally realized that at choose port terminals, requests for extra work made by way of official work orders should not being positioned on the wall of the union corridor for achievement. The Pacific Maritime Association, which negotiates on behalf of the ports, shouldn’t be allowed in the union corridor to see if the terminal orders are certainly being requested. CNBC has been advised that if the extra job postings had been being put up the info would present they aren’t being stuffed. Only authentic labor ordered from the PMA is being stuffed.

The PMA stated in an announcement on Friday afternoon that between June 2 and June 7, the ILWU on the Ports of Los Angeles and Long Beach refused to dispatch lashers who safe cargo for trans-Pacific voyages and unfasten cargo after ships arrive. “Without this vital function, ships sit idle and cannot be loaded or unloaded, leaving American exports sitting at the docks unable to reach their destination,” the assertion learn. “The ILWU’s refusal to dispatch lashers had been part of a broader effort to withhold necessary labor from the docks.”

PMA cited a failure on Wednesday morning to fill 260 of the 900 jobs ordered on the Ports of Los Angeles and Long Beach, and in complete, 559 registered longshore staff who got here to the dispatch corridor had been denied work alternatives by the union, PMA asserted in its assertion.

“Each shift without lashers working resulted in more ships sitting idle, occupying berths and causing a backup of incoming vessels,” it said.

However, the PMA stated ILWU’s choice to cease withholding labor has allowed terminals on the Ports of Los Angeles and Long Beach to avert, for now, “the domino effect that would have resulted in backups not seen since last year’s supply chain meltdown.”

The PMA cited “generally improved” operations on the Ports of Los Angeles, Long Beach, and Oakland, however on the Ports of Seattle and Tacoma, a continuation of “significant slowdowns.”

The ILWU has declined to remark, citing a media blackout throughout ongoing labor talks.

Truck and container backups

The common truck turns to go in and out of the West Coast ports are up.

A trucker ready for a container at LA’s Fenix Marine Services terminal shared images from their truck with CNBC exhibiting congestion on each rail and the highway the place truckers wait to select up their containers.

Shippers have gotten more and more involved in regards to the potential want to search out various provide chain choices.

A spokesperson for Long Beach, California-based Cargomatic, which focuses on drayage and short-haul trucking logistics, stated it is not but seeing commerce diversions, however added, “As a national drayage partner, we have contingency plans built in with capacity ready to service our customers anywhere in the U.S. We know that shippers are very nervous and it’s only a matter of time before they pivot if this situation becomes prolonged.”

The PMA stated in its assertion that despite the fact that some port operations have improved, “the ILWU’s repeated disruptive work actions at strategic ports along the West Coast are increasingly causing companies to divert cargo to more customer-friendly and reliable locations along the Gulf and East Coasts.”

West Coast ports, which had misplaced vital quantity to East Coast ports over the previous yr as a consequence of volatility in the labor contract talks, had in latest months begun to achieve again quantity.

A photograph of a truck construct up at Fenix Marine Services terminal on the Port of Los Angeles ready to select up containers taken by a trucker.

Ocean freight intelligence firm Xeneta says its information reveals that container spot freight charges jumped 15% in the primary days of June on account of a number of simultaneous disruptions. Recent Panama Canal low water ranges restricted cargo throughput, and quickly after that, giant elements of U.S. West Coast ports stopped dealing with inbound and outbound container commerce.

“Shippers in search of more reliable and resilient supply chains now consider their options,” stated Peter Sand, chief analyst at Xeneta. “The longer this drags on, the more severe the consequences will be for shippers and terminals,” he stated.

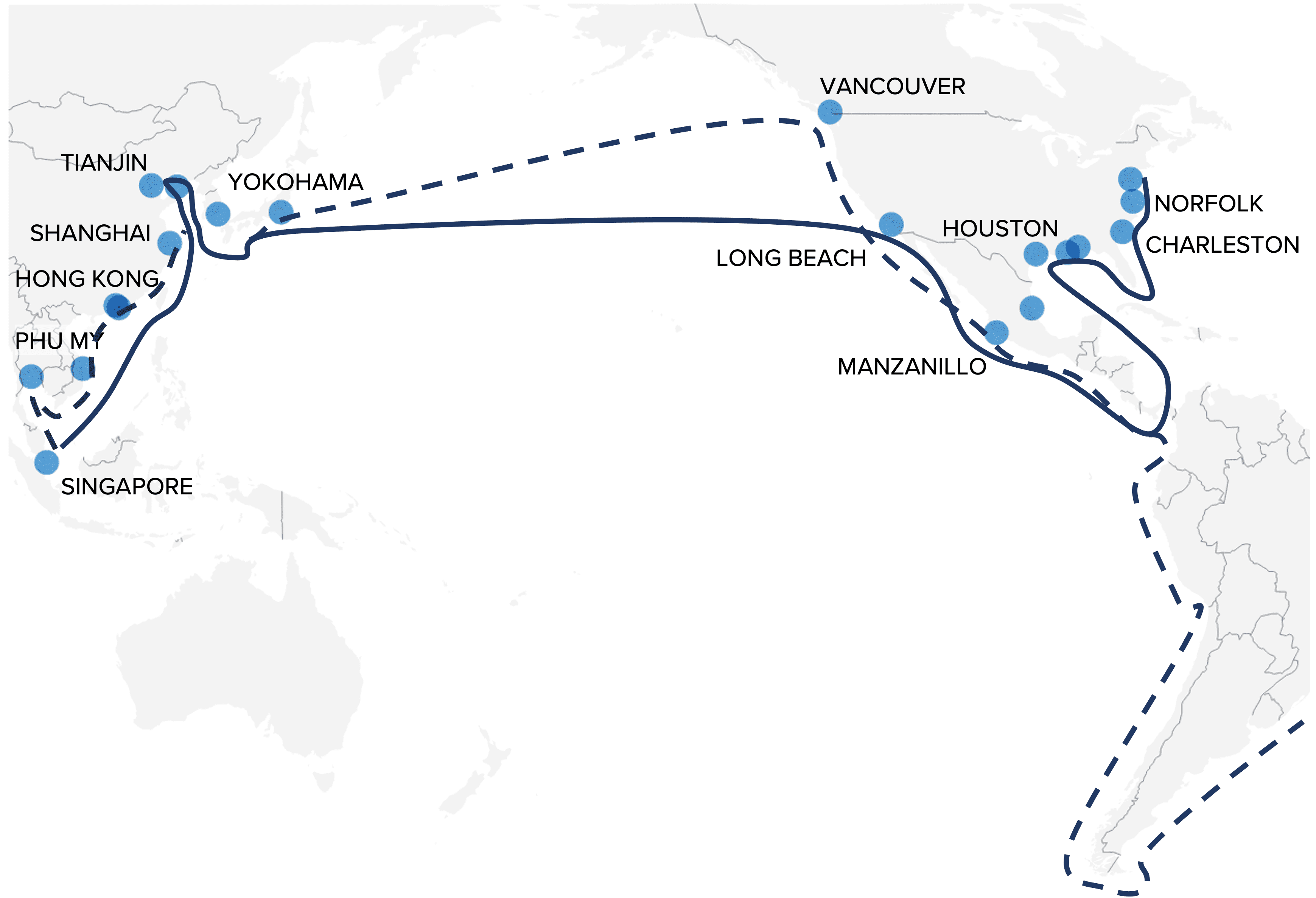

During Covid, the provision chain breakdowns noticed the pileup of vessels ready off the West Coast influence trade to move to the Gulf and East Coast Ports. If vessels do begin diverting once more, there are additional prices tacked onto the products being transferred, which the shipper can be charged. If the vessels divert and go to the Gulf or East Coast ports, they should both use the Panama Canal, the place additional costs on high of the traditional further costs are levied as a result of the Panama Canal is in a crucial scenario with decrease water ranges as a consequence of drought.

Routes for month-to-month long-term ‘tramp sailings’ from Asia to the Americas

— Core commerce route — Alternate route

The Panama Canal’s water points exacerbate prices that may be incurred in any commerce re-routing. It has instituted weight necessities for vessels — they should be lighter to maneuver by way of. If the vessel is at or beneath that weight requirement, shippers can be paying further costs. In addition to the canal charges, some ocean carriers like Hapag Lloyd have instituted a $260 container price for touring by way of the canal. CMA CGM is charging $300 a container. If vessels are heavier than the present requirement, they might be pressured to traverse the Pacific Ocean and go across the horn of South America, which might add weeks of journey time and journey prices.

“Vessel diversions are some of the most difficult activities that shippers and our clients deal with during a crisis,” stated Paul Brashier, vice chairman of drayage and intermodal at ITS Logistics. During the pandemic and its aftermath, containers destined for Los Angeles or Long Beach would present up unannounced in Houston or Savannah with little to no discover, he stated. “We have visibility applications that alert us prior to the container arriving so we can reassign trucking capacity at the new port. But if you don’t have this visibility, if you are not able to track the containers like that in real time, you could face thousands of dollars more in shipping and D&D costs per container to accommodate those changes. That inflationary pressure adversely not only affects the shipper but the consumer of those goods,” he added.

ITS Logistics raised its freight rail alert level to “red” this week, signifying extreme threat.

Supply chain costs have come down considerably on a worldwide foundation, in accordance with the Federal Reserve’s information, although they’ve been talked about by Fed Chair Jerome Powell as one inflationary set off the central financial institution has no management over. In a report by Georgetown economist Jonathan Ostry, the spike in delivery prices elevated inflation by greater than two proportion factors in 2022.

“These slowdowns leave little options for shippers who have containers already en route to the West Coast,” stated Adil Ashiq, head of North America for MarineVisitors, who advised CNBC earlier this week that the maritime provide chain points had been “breaking normal.”

“They could skip a port and go to another West Coast port, but they are all experiencing levels of congestion,” he stated on Friday. “So do they wait or divert and go to Houston as the next closest port to discharge cargo?”

If vessels do determine to reroute, it would add days to their journey, which might delay the arrival of the product much more.

For instance, if a vessel inbound from Asia determined to reroute to Houston, it could add one other 7 to 11 day journey to the Panama Canal. If a vessel is accepted to transit by way of the canal, that provides 8-10 hours of transit time. “You then have to add travel time once out of the canal to the port. So we’re looking at conservatively, a 12 to 18 day additional delay if a vessel decides to go to Houston directly from the Canal. Even more, if you have to travel around South America,” he stated.

Key sectors of the U.S. financial system have been pleading with the Biden administration to step in and dealer a labor settlement, together with commerce teams for the retail and manufacturing sectors. On Friday, the U.S. Chamber of Commerce added its voice to this effort, expressing its issues a couple of “serious work stoppage” on the ports of Los Angeles and Long Beach which might doubtless price the U.S. financial system practically half a billion {dollars} a day. It estimates a extra widespread strike alongside the West Coast may price roughly $1 billion per day.

“The best outcome is an agreement reached voluntarily by the negotiating parties. But we are concerned the current sticking point – an impasse over wages and benefits – will not be resolved,” U.S. Chamber of Commerce CEO Suzanne Clark wrote in a letter to President Biden.