Puri, who give up his job as head of Citibank Malaysia to launch HDFC Bank in 1994, has created the nation’s second-largest lender and most useful financial institution with a market cap of about Rs 6 lakh crore. Under his management, the financial institution has given 20% development with a consistency that analysts started to explain as “boring”. The financial institution is now the third most valued listed entity in India, behind Reliance Industries (Rs 14 lakh crore) and TCS (Rs eight lakh crore).

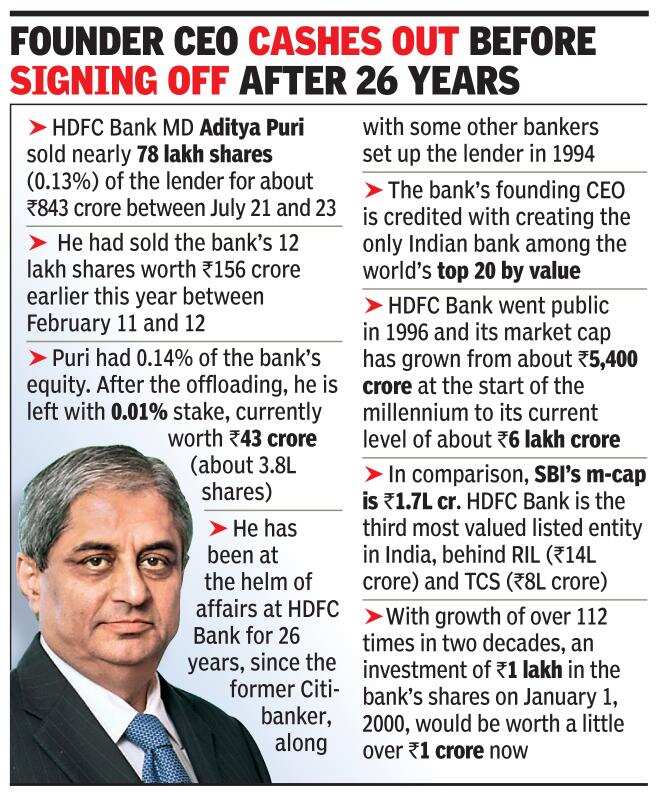

Puri had 0.14% of the financial institution’s fairness. After the offloading, which was equal to 0.13%, he’s left with 0.01% stake, presently worth Rs 43 crore (about 3.eight lakh shares), in line with BSE disclosure.

According to the financial institution’s submitting with the BSE up to now this month, 39 of HDFC Bank’s executives who’re designated ‘insiders’ below Sebi guidelines, have offered the financial institution’s shares aggregating Rs 884 crore. This contains gross sales by Puri and Ashok Khanna, who just lately give up as the top of the lender’s auto mortgage enterprise.

Market analysts and fund managers world wide often maintain a detailed watch on insider transactions, for a cue in regards to the future course of the enterprise of the entity and its inventory worth. Generally, it’s believed that insider promoting signifies a probable slide within the inventory worth whereas insider shopping for factors to a spurt in inventory worth. From falling to a yr-low stage of Rs 739 on March 23, up to now HDFC Bank’s inventory worth has rallied 53% to its present shut at Rs 1,131 on the BSE.

On Sunday, HDFC Bank mentioned that the shares that Puri offered had been allotted to him “at different times and at different price points” and weren’t allotted at par. “Therefore, the net amount realized by Puri is not Rs 843 crore as stated. The acquisition cost of shares and the tax payable on the transaction has to be accounted for,” it mentioned.

After being arrange in mid-1994, HDFC Bank went public in 1996. In the final 20 years, for which information is on the market, the financial institution’s market cap has grown from about Rs 5,400 crore at first of the millennium to its present stage of above Rs 6 lakh crore: That’s a development of over 112 instances in twenty years. Seen one other manner, an funding of Rs 1 lakh within the financial institution’s shares on January 1, 2000, could be worth a bit of over Rs 1 crore now. In addition, the financial institution has additionally paid dividends over this era, which is outdoors of the inventory return.