What’s behind the selection of Sashidhar Jagdishan?

I used to be solely an adviser on the search committee, which set out the standards. To take the financial institution to the subsequent degree, we mentioned we might look internally and at candidates from all internationally. We wanted somebody who has dealt with scale and has an understanding of points regarding expertise, the way forward for banking and likewise macroeconomic circumstances to get an thought of alternatives and risks if we went in the improper course. As a change agent, Sashi has been instrumental in implementing the elemental shift the place we compete with tech platforms fairly than banks and use expertise to develop the underneath-penetrated market in India.

At this level, does the financial institution want a CEO who’s extra cautious or progress-oriented?

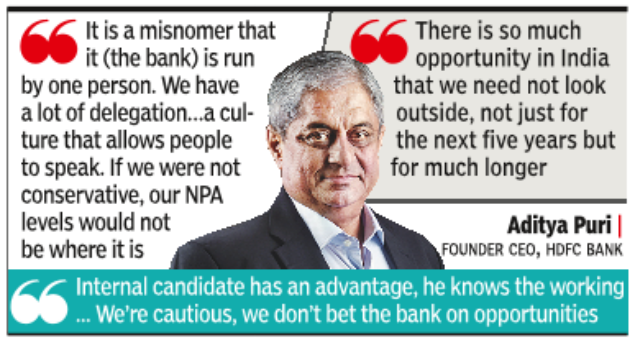

HDFC Bank has a tradition of being very cautious. We get progress as a result of the market alternative is obtainable. But after we see a chance, we don’t wager the financial institution however check it out first. Whether it was the closed consumer group for inventory exchanges, the 10-second mortgage, or increasing to semi-city and rural India — we take a look at, take a look at, take a look at.

Do you’re feeling that is the time to develop enterprise?

It’s a nice time to develop. But develop recognising that we’re a fiduciary organisation and should return the depositors’ cash. The alternative for us is the best way India will lead in digitisation, the place the fundamental framework is already in place. We have broadband and cell phones throughout, however we now have to repair the nuts and bolts like e-signature and e-paperwork. In semi-city and rural India, GDP per capita simply crossed $2,000, and 60% of the nation lives there. So, you’ll be able to really create a middle class that’s equal to the present middle class in the nation.

How do you see the connection with HDFC evolving? Some folks have been seeing a merger as an eventuality…

For now, it’s a win-win state of affairs for each. Unless one thing adjustments essentially, we don’t see any purpose to vary that. Because we originate loans through the use of our distribution functionality and we purchase again 70%, that provides us a lot on the precedence sector facet, which we might not be capable to do on our personal. So, we’re fairly proud of the association. And I don’t see why this could not proceed.

Why did you select to promote your holdings in the financial institution?

The shares have been acquired underneath ESOPs, which is permitted by the RBI, together with base wage and given at market worth. So, you need to issue in the acquisition worth and the tax. Higher the worth of the share, the extra money I have to train the choice and pay tax. Also, I’m 70, and may I not take into consideration my life?

There has been hypothesis that you could be be part of a enterprise group to assist them with monetary sector plans…

I’ve a massive buyer base, a few of whom are my largest clients. So, interacting with them is a part of my present job. Now, there are every kind of rumours and I don’t need to remark. Nobody has approached me but. If they do, I’ll take a look at it. If you might be asking me if I’m going to take a seat at house, the reply is not any. There are two areas the place I plan to do one thing. One is the place good healthcare might be prolonged to a massive part of the inhabitants at an reasonably priced worth. I’m additionally training in elective programs to make college students job-worthy. We may also do a lot extra in the uneducated however expert class. But that doesn’t imply that if a rattling good supply comes my manner, I cannot study it by itself deserves.