More funding {dollars} going to actual property than to sectors that give financial system greater enhance

Article content material

Canada’s poor productivity is the results of an absence of funding in enterprise and expertise whereas funding in housing has soared, says a brand new report from the Fraser Institute.

The assume tank’s report, which compares funding in Canada and the United States, discovered that over the previous 20 years capital funding in Canada was better than within the U.S. “relative to the size of the economy.”

Advertisement 2

Article content material

However, the report’s writer attributes this principally to the “enormous investments made in housing in Canada versus the U.S.” From 2014 to 2021, housing accounted for 34.1 per cent of whole funding in Canada, versus 18.5 per cent for our neighbour to the south.

Meanwhile, U.S. funding in areas thought of to spice up productivity dwarfed that of Canada’s throughout the identical time interval.

For instance, whole funding in IT was 10.4 per cent in Canada and 16.5 per cent within the U.S. Investment in analysis and improvement and different mental merchandise represented 27.7 per cent of whole funding in contrast with 12.6 per cent in Canada.

“Weak business investment in technologies like IT and research and development — which help Canadian workers be more productive — impedes improvements in Canadian living standards,” stated Steven Globerman, senior fellow on the Fraser Institute and writer of the report.

It may appear counterintuitive that the Fraser Institute is apprehensive about housing funding, on condition that the nation is within the midst of a full-blown housing scarcity and affordability disaster.

Article content material

Advertisement 3

Article content material

Globerman doesn’t say there may be an excessive amount of housing funding.

“Canada clearly does need more investment in residential housing, but policies need to be put in place to encourage more domestic savings to finance increased business investment as well, especially given newly implemented government policies that are aimed at promoting more investment in residential housing,” the writer stated in an e-mail. “The worry raised by the study is that the increased demand for financial capital to finance new residential housing will crowd out business borrowing for investments in things like R&D, AI, software, data centres, etc.”

Productivity is necessary as a result of when it’s weak it may hinder the financial system and eat into individuals’s lifestyle, the Fraser Institute stated.

Bank of Canada senior deputy governor Carolyn Rogers introduced it to the nation’s consideration when she declared productivity an “emergency” throughout a speech in March.

Rogers warned that weak productivity would make the financial system vulnerable to components that might gas future inflation.

During the speech, the financial institution official famous that, in 2022, Canada was producing 71 per cent of the worth per hour generated by the United States financial system. “While U.S. spending continues to increase, Canadian investment levels are lower than they were a decade ago,” Rogers advised her viewers.

Advertisement 4

Article content material

The knowledge proceed to help the productivity disaster narrative.

The most up-to-date numbers confirmed Canadian companies’ labour productivity fell by 0.3 per cent within the first quarter in comparison with the earlier quarter, Statistics Canada stated in June. The decline in productivity through the first quarter adopted a 0.2 per cent improve within the fourth quarter of 2023 — the primary after six consecutive quarterly declines.

From 2014 to 2022, output per hours labored elevated at a mean annual fee of 1.35 per cent in Canada, in contrast with 1.78 per cent within the U.S., the Fraser Institute stated.

“If governments in Canada want to promote rising living standards through faster productivity growth, they must create a policy environment that’s attractive to productivity-enhancing business investments and not simply focus on building more housing,” stated Globerman.

Sign up here to get Posthaste delivered straight to your inbox.

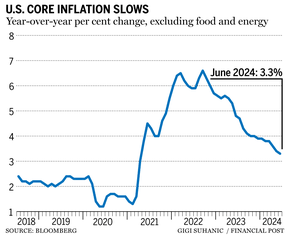

U.S. inflation cooled broadly in June, driven by a long-awaited slowdown in housing costs and providing another dose of confidence for United States Federal Reserve officers that they will minimize rates of interest quickly. — Bloomberg

Advertisement 5

Article content material

- Harley Finkelstein, president of Shopify Inc., and David Segal, co-founder of DAVIDsTEA, Firebelly Tea, and Mad Radish, host a stay model in Montreal of their present about Jewish entrepreneurs referred to as Big Shot. Heather Reisman, chief govt of Indigo, will be part of them on stage at Startupfest, 3:00 pm – 4:00 pm EDT

- Apple begins promoting VisionPro glasses in Canada

- Today’s knowledge: Canada constructing permits for May and present house gross sales for June, U.S. producer value index for June

- Earnings: Citigroup Inc., JPMorgan Chase & Co., Wells Fargo & Co.

Recommended from Editorial

There’s a typical false impression that Indigenous individuals in Canada merely don’t pay tax, however that’s typically not true since as a way to be exempt from tax, the revenue earned have to be located on a reserve. A current case, determined earlier this month, handled the exemption and the way it’s utilized. Jamie Golombek has the story.

Advertisement 6

Article content material

FP Answers

Are you apprehensive about having sufficient for retirement? Do you want to modify your portfolio? Are you questioning the way to make ends meet? Drop us a line at aholloway@postmedia.com together with your contact data and the overall gist of your downside and we’ll attempt to discover some consultants that will help you out whereas writing a Family Finance story about it (we’ll hold your identify out of it, after all). If you’ve got an easier query, the crack crew at FP Answers led by Julie Cazzin or one among our columnists may give it a shot.

McLister on mortgages

Want to study extra about mortgages? Mortgage strategist Robert McLister’s Financial Post column may also help navigate the complicated sector, from the newest developments to financing alternatives you gained’t need to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with extra reporting from Financial Post workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Email us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you want to know — add financialpost.com to your bookmarks and enroll for our newsletters here.

Article content material