Markets regulator Sebi on Friday requested brokerages to arrange a mechanism permitting traders to voluntarily freeze or block their trading accounts.

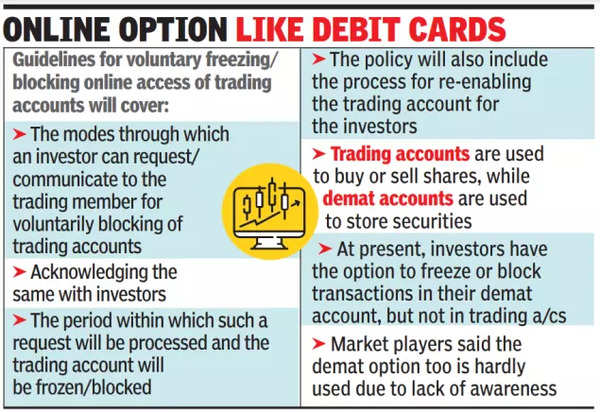

At current, traders have the choice to freeze or block transactions of their demat account, however not in trading a/cs.Market gamers stated although the demat choice is offered it is hardly utilized by traders on account of lack of knowledge. The transfer by Sebi is below its ‘ease of doing investments by traders’ initiative.

When suspicious actions are seen by traders, the power of freezing/blocking of accounts is presently not out there with majority of the brokers. This was the principle set off for Sebi to place in place a mechanism for freezing/blocking of trading accounts.

By April 1, the framework for freezing and blocking of trading accounts needs to be made public by the Brokers’ Industry Standards Forum (ISF), an business commerce physique that units processes that brokers ought to comply with. The framework needs to be operational by July 1, Sebi stated.

Sebi stated that there needs to be detailed pointers on how brokers ought to act as soon as they obtain an intimation concerning the freezing and blocking of accounts. Sebi additionally desires every dealer to tell their purchasers about this facility. “Many times, investors raise issues of suspicious activities in their trading accounts and thus, there is an urgent need to address the situation of having a facility for blocking of trading accounts as it is available for blocking of ATM cards and credit cards,” Sebi stated in its launch.

After this course of is launched on July 1, the inventory exchanges must submit a compliance report about its facility to the regulator by August 31, Sebi stated. “Stock exchanges shall put in place an appropriate reporting requirement by (brokers) to enforce the above system.”

In one other round, Sebi stated that inventory exchanges ought to put in place a mechanism to observe traders’ funds with inventory brokers. Earlier, Sebi had stated that traders’ funds and securities parked with their brokers needs to be periodically settled. This was to make sure that traders’ funds and securities mendacity in brokers’ pool account isn’t utilized by the latter to fulfill obligations of different traders. The new mechanism is geared toward higher monitoring of such funds and might be efficient instantly.