The present tips of the Reserve Bank of India (RBI) limit foreign possession in new non-public banks. The central financial institution’s residency standards for promoters applies just for newly setup banks and wouldn’t apply to an current entity like IDBI Bank, the division of funding and public asset administration (Dipam) stated in a response to bidders’ queries. “The residency criteria would not apply to a consortium consisting of funds investment vehicle incorporated outside India,” it stated.

The authorities and the RBI would additionally contemplate re-laxing the 5-12 months lock-in interval for shares if a non-banking monetary firm is merged into IDBI Bank, it stated. The clarifications come forward of a December 16 deadline to submit expressions of curiosity for a majority stake in IDBI Bank, one of the few lenders that the federal government is attempting to dump its stake in.

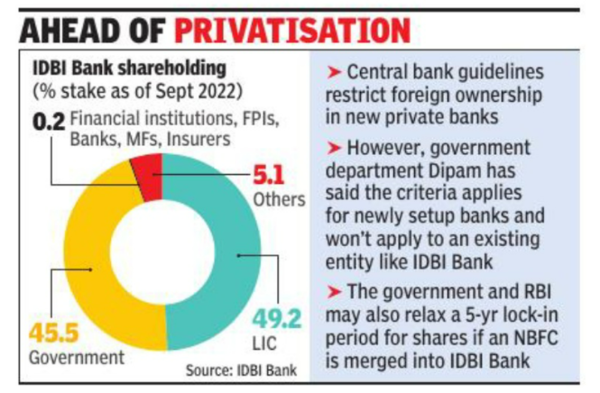

The authorities and LifeInsurance Corporation (LIC) of India collectively maintain a stake of practically 95% in IDBI Bank and want to promote 60. 7%. At present costs, IDBI Bank has a market capitalisation of over Rs 63,000 crore and is value greater than Union Bank of India, which is way larger in dimension. The financial institution’s share value has run up forward of the privatisation and followingits return to profitability.

According to sources, the expression of curiosity will allow the RBI to conduct a ‘fit and proper’ examine on the potential bidders. The ones who don’t qualify are prone to be sounded off, which can be sure that solely those that qualify will be capable of decide up a stake.

In phrases of classification, IDBI Bank is already reckoned as a non-public sector financial institution following the authorized amendments that have been launched to allow the LIC to purchase a 50% stake. However, given the general public sector possession, it’s nonetheless seen as a quasi-PSU by the market.

Meanwhile, IDBI Bank would proceed its main vendor enterprise even when a foreign financial institution acquires majority stake and administration management in the non-public sector financial institution, the finance ministry stated on Tuesday.