BlockFi brand displayed on a cellphone display screen and illustration of cryptocurrencies are seen on this illustration picture taken in Krakow, Poland on November 14, 2022.

Jakub Porzycki | Nurphoto | Getty Images

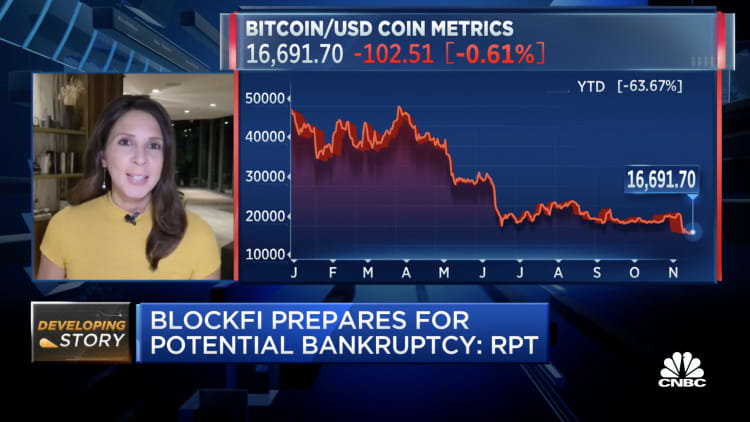

Distressed crypto firm BlockFi has filed for Chapter 11 bankruptcy safety within the United States Bankruptcy Court for the District of New Jersey following the implosion of putative acquirer FTX.

In the submitting, the corporate indicated that it had greater than 100,000 collectors, with liabilities and property starting from $1 billion to $10 billion.

In the submitting, the corporate listed an excellent $275 million mortgage to FTX US, the American arm of Sam Bankman-Fried’s now-bankrupt empire.

A BlockFi subsidiary additionally moved for bankruptcy in Bermuda concurrently with the American submitting.

Bermuda, just like the Bahamas, has embraced crypto as the way forward for finance. Both established frameworks to deal particularly with crypto property and digital currencies. Both the Bahamas, with FTX’s bankruptcy, and now Bermuda, with BlockFi’s, face the primary vital authorized assessments of their crypto laws.

BlockFi’s bankruptcy submitting reveals that the corporate’s largest disclosed consumer has a steadiness of almost $28 million. A $30 million settlement with the SEC and a

“BlockFi looks forward to a transparent process that achieves the best outcome for all clients and other stakeholders,” Berkeley Research Group’s Mark Renzi said in a press statement. BRG serves as BlockFi’s monetary advisor.

The crypto firm, which gives a buying and selling change and interest-bearing custodial service for cryptocurrencies, was one in every of many corporations to face severe liquidity points after the implosion of Three Arrows Capital.

The Jersey City, New Jersey-based firm had already halted withdrawals of buyer deposits and admitted that it had “significant exposure” to the now-bankrupt crypto change FTX and its sister buying and selling home, Alameda Research.

“We do have significant exposure to FTX and associated corporate entities that encompasses obligations owed to us by Alameda, assets held at FTX.com, and undrawn amounts from our credit line with FTX.US,” BlockFi previously said.

The firm began speaking with restructuring professionals within the days after FTX’s bankruptcy submitting, in keeping with folks accustomed to the matter.

A consultant from BlockFi didn’t instantly reply to requests for remark.

BlockFi — which was final valued at $4.eight billion, in keeping with PitchBook — is amongst many crypto corporations feeling the stress of FTX’s collapse. In July, FTX swooped in to assist BlockFi stave off bankruptcy by extending a $400 million revolving credit facility and providing to probably purchase the beleaguered lender.

Sam Bankman-Fried’s cryptocurrency change FTX filed for Chapter 11 bankruptcy protection within the U.S. on Nov. 11, and the contagion impact throughout the crypto sector has been swift.

Approximately 130 extra affiliated firms are a part of the proceedings, together with Alameda Research, Bankman-Fried’s crypto buying and selling firm, and FTX.us, the corporate’s U.S. subsidiary. FTX’s new CEO John Ray said in a filing with the Delaware Bankruptcy Court that “in his 40 years of legal and restructuring experience,” he had by no means seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Ray previously served as CEO of Enron after the implosion of the vitality titan.

In a matter of days, FTX went from a $32 billion valuation to bankruptcy as liquidity dried up, prospects demanded withdrawals and rival change Binance ripped up its nonbinding agreement to purchase the corporate. Gross negligence has since been uncovered. Ray added {that a} “substantial portion” of property held with FTX could also be “missing or stolen.”

FTX has extra than 1 million collectors, in keeping with up to date bankruptcy filings, hinting on the big impression of its collapse on crypto merchants and different counterparties with ties to Bankman-Fried’s empire.

Correction: A subsidiary of BlockFi additionally moved for bankruptcy in Bermuda, not the Bahamas.