Russia stands poised to additional cement its place as Europe’s prime provider.

The retired salt caverns, aquifers, and gas depots that maintain Europe’s stockpiles of pure fuel have by no means been so empty at this level in winter.

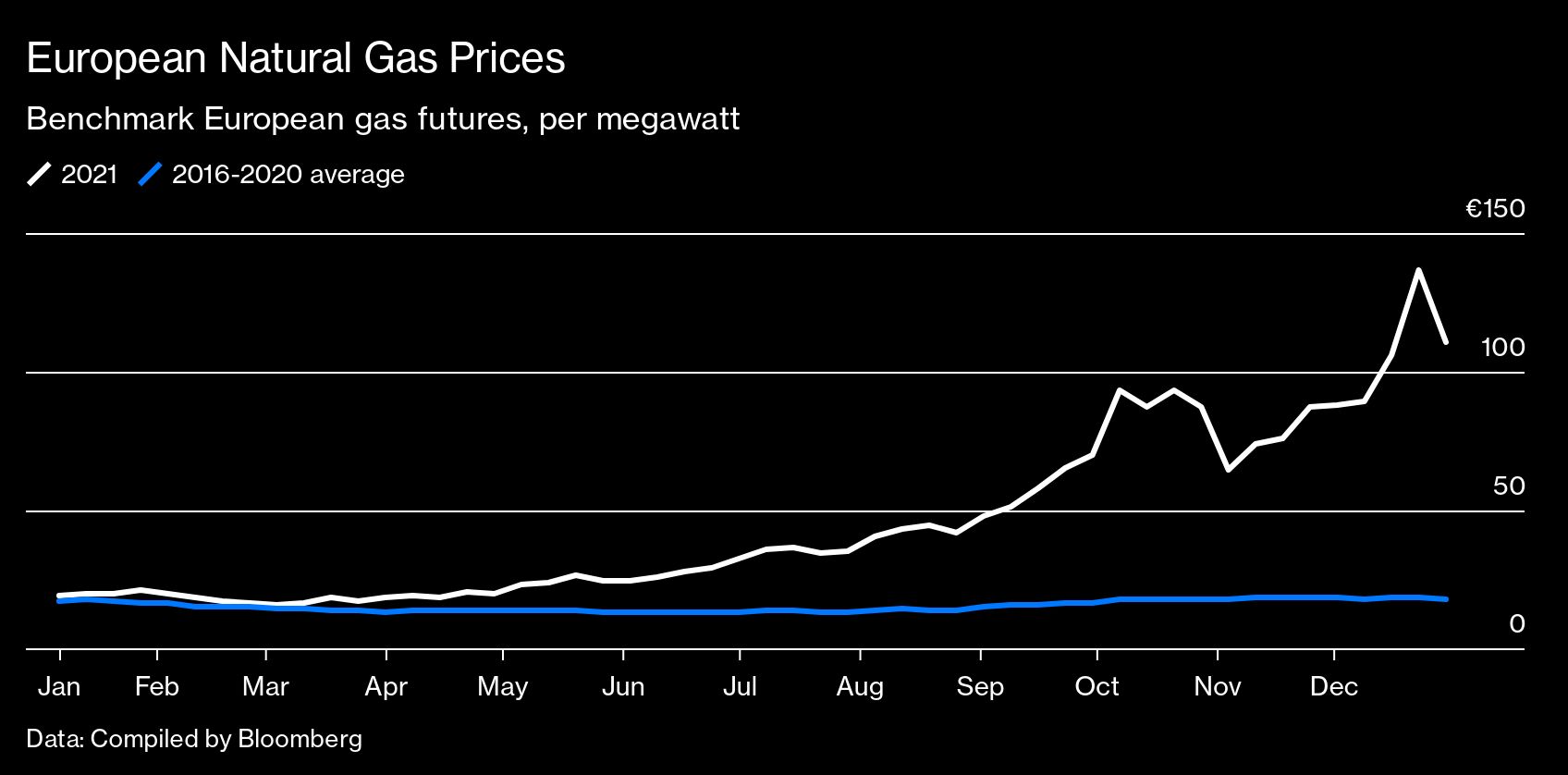

Just 4 months after Amos Hochstein, the U.S. envoy for power safety, mentioned Europe wasn’t doing sufficient to organize for the darkish and chilly season forward, the continent is grappling with a provide crunch that is triggered benchmark fuel costs to greater than quadruple from final 12 months’s ranges, squeezing companies and households. The disaster has left the European Union on the mercy of the climate and Russian President Vladimir Putin’s wiles, each notoriously troublesome to foretell.

“The energy crisis hit the bloc when security of supply was not on the menu of EU policymakers,” says Maximo Miccinilli, head of power and local weather at consultants FleishmanHillard EU. He expects the power crunch to maintain costs unstable and in addition set off extra political pressure between regulators in Brussels and the leaders of the bloc’s 27 member states.

Although the state of affairs got here to a head abruptly, it has been years within the making. Europe is within the midst of an power transition, shutting down coal-fired electrical energy crops and rising its reliance on renewables. Wind and photo voltaic are cleaner however typically fickle, as illustrated by the sudden drop in turbine-generated energy the continent recorded final 12 months.

Moscow’s elevated leverage over its neighbors turned obvious on the tail finish of the final winter, an unusually chilly and lengthy one which depleted Europe’s inventories of fuel simply as its economies had been rising from the pandemic-induced recession. Over the summer season, state-controlled Gazprom PJSC started capping flows to the continent, aggravating shortages brought on by deferred upkeep at oil and fuel fields within the North Sea and elevating the stakes on a pricey and long-delayed pipeline venture championed by the Kremlin.

At the identical time, nations from Japan to China had been boosting their imports of liquefied pure fuel (LNG) in preparation for the approaching winter. All of this left Europe struggling to replenish its dwindling stockpiles in the course of the heat months, when fuel is cheaper.

Still, Europe’s leaders betrayed no alarm. On July 14, the European Commission unveiled the world’s most bold package deal to eradicate fossil fuels in a bid to avert the worst penalties of local weather change. With their eyes educated on longer-term objectives, similar to lowering greenhouse fuel emissions not less than 55% by 2030 from 1990 ranges, the politicians didn’t sufficiently respect a few of the potential pitfalls that lay instantly forward on the street to decarbonization.

Europe’s pure fuel manufacturing has been in decline for years, which has left it extra reliant on imports. Now, Russia stands poised to additional cement its place because the bloc’s prime provider. Gazprom and its European companions have plowed $11 billion into Nord Stream 2, a 1,230-kilometer (764-mile) pipeline operating beneath the Baltic Sea from Russia to Germany.

Repeatedly delayed by U.S. sanctions, the decade-long venture hit one other roadblock this fall, when a brand new coalition authorities took energy in Germany and the nation’s power regulator put remaining approval on maintain. The transfer additional roiled European power markets, the place fuel costs had been breaking data day after day since July. Putin, in a televised speech delivered on Dec. 24, touted the advantages of the controversial conduit, saying “the additional volumes of gas on the European market would undoubtedly lower the price on the spot.”

A latest bump in LNG imports from the U.S. has offered some aid, nevertheless it’s momentary at finest. France must take a number of of its reactors offline for upkeep and repairs, leading to a 30% discount in nuclear capability in early January, whereas Germany is transferring forward with plans to close down all of its nuclear crops. With the 2 coldest months of winter nonetheless forward, the concern is that Europe might run out of fuel.

Storage websites are solely 56% full, greater than 15 share factors under the 10-year common. “In none of the past years since records began have we had comparably low storage levels at this time,” says Sebastian Bleschke, head of INES, the affiliation of German fuel and hydrogen storage system operators. Barring a rise in Russian exports, one thing that does not look like within the playing cards, ranges might be at lower than 15% by the tip of March, the bottom on file, in response to researcher Wood Mackenzie Ltd. And that is assuming regular climate circumstances.

With power coverage largely within the fingers of member states, EU officers lack the authority to compel nationwide governments to replenish fuel inventories extra rapidly. To make issues worse, Russia is constructing troops on the border with Ukraine, a transfer U.S. intelligence sources say presages a doable invasion. About a 3rd of Russian fuel flowing to Europe crosses Ukraine, and although shipments weren’t disrupted throughout Russia’s 2014 annexation of Crimea, there isn’t any assure that might stay the case if a struggle had been to interrupt out this 12 months.

The power state of affairs limits the scope of actions Western powers can take to counter Russian aggression, says Jason Bordoff, director of the Center on Global Energy Policy at Columbia University. “The ability of Europe and the U.S. to respond to a Russian invasion is constrained both by a desire not to exacerbate Europe’s energy crisis by sanctioning Russian energy exports and, more broadly, by the threat that Russia could retaliate to any confrontation by restricting gas flows into Europe, as Russia did in 2006 and 2009,” says Bordoff, a former power and local weather adviser within the Obama administration.

Traders are already making ready for the worst, with costs for fuel delivered from spring via 2023 surging about 40% over the previous month. Some say the crunch may final till 2025, when the subsequent wave of LNG tasks within the U.S. begins supplying the world market.

“It’s hard to see how a decent level of gas storage can be achieved without additional Russian exports via Nord Stream 2 or existing routes,” says Massimo Di-Odoardo, vice chairman for fuel and LNG analysis at Wood Mackenzie. “2022 will be another volatile year for European gas prices.”

(Except for the headline, this story has not been edited by NDTV workers and is printed from a syndicated feed.)