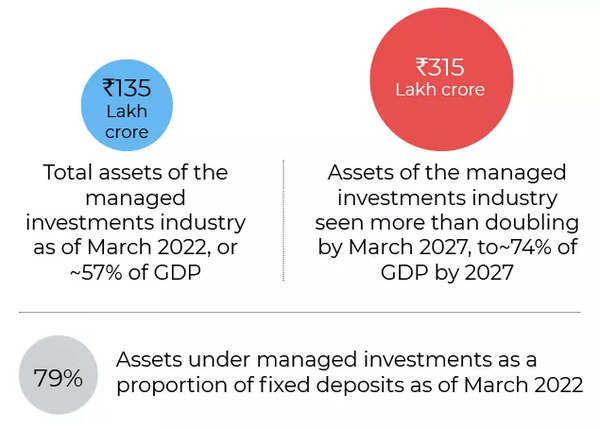

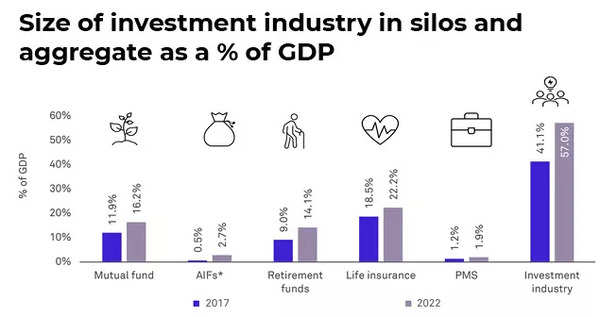

Rating company Crisil forecasts monetary savings to rise to Rs 315 lakh crore, or 74 p.c of the GDP by 2027, from Rs 135 lakh crore or 57 p.c final fiscal.

While financial institution mounted deposits stay essentially the most most well-liked monetary instrument in the nation, their share has declined over the years, with traders transferring in direction of capital market devices.

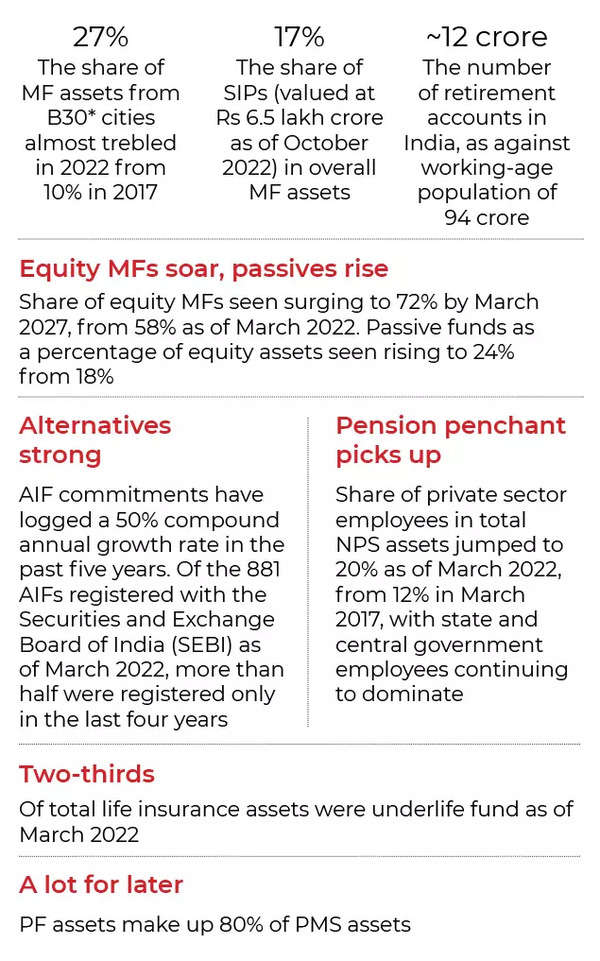

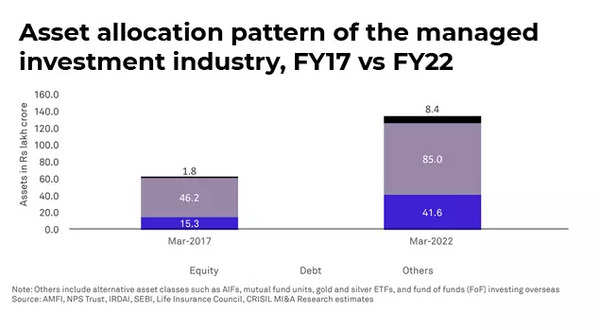

Fixed earnings devices, as seen in their penchant for financial institution mounted deposits, accounted for 41% of the family savings pie as of March 2022. Within the funding panorama, the share of fairness has elevated from 24% in fiscal 2017 to 31% in fiscal 2022 whereas the share of different merchandise as represented by AIFs has grown from 1% to 5% in the previous 5 years.

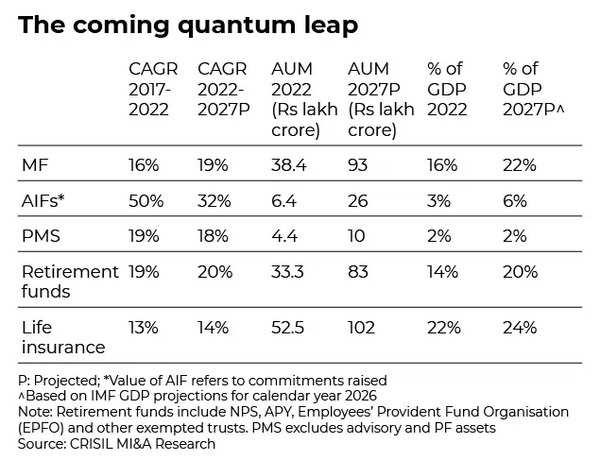

Assets of the managed investments trade in India have more than doubled in 5 years, from simply Rs 63 lakh crore in March 2017 to Rs 135 lakh crore in March 2022. By quantum, property of mutual funds and insurers leapt Rs 20 lakh crore every.

“As of last fiscal, AUM of the managed funds industry amounted to 57% of India’s gross domestic product,” mentioned Ashish Vora, President & Head, CRISIL Market Intelligence & Analytics. “In the subsequent 5 years, we see this proportion rising to 74% as financialisation will increase. Much has occurred in the funding panorama over the previous 5 fiscals, but the trade has barely scratched the floor given the potential in completely different classes and in contrast with how such property have grown in the developed international locations.”

Household savings comprised over two-thirds of India’s gross savings except for the pandemic period when it shot up to 78% touching Rs 43.9 lakh crore.

Directed efforts at financial inclusion, digitalisation, a longerterm trend of rising middle-class disposable incomes, and government incentives on these instruments, have better channelled these savings to the industry. With rising inflation, households too, are seeking higher returns beyond fixed deposits.

Life insurance companies comprised the biggest chunk of managed investments with a 39% market share at Rs 52 lakh crore. Mutual funds with assets under management of Rs 28 lakh crore and a market share of over 28% came next, the Crisil study showed. Though these still represent only 10% of households’ gross financial savings, they have gained from a big shift out of bank deposits.

CRISIL MI&A estimates the industry to grow to Rs 315 lakh crore in the next five years. And this growth will be led by a mix of macro and segment-specific factors.

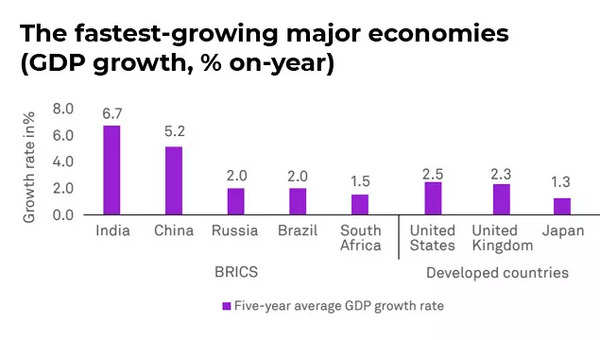

Strong GDP growth

CRISIL MI&A Research expects India to regain its tag of one of the fastest-growing economies globally in the medium term. The IMF has also forecast that the country’s GDP will grow at a faster pace compared with other economies.

Per-capita income surpasses inflection point

India’s per-capita income crossed the $2,000 threshold in 2021, i.e., the inflection point when income crosses the subsistence expenditure level and moves on to spending and investments. India’s per-capita income expanded 7.6% last fiscal.

“High per-capita earnings, prospects of robust financial development, financialisation of family savings, emergence of know-how, and entry to capital market merchandise present a fillip to the funding local weather in the nation,” said Crisil.

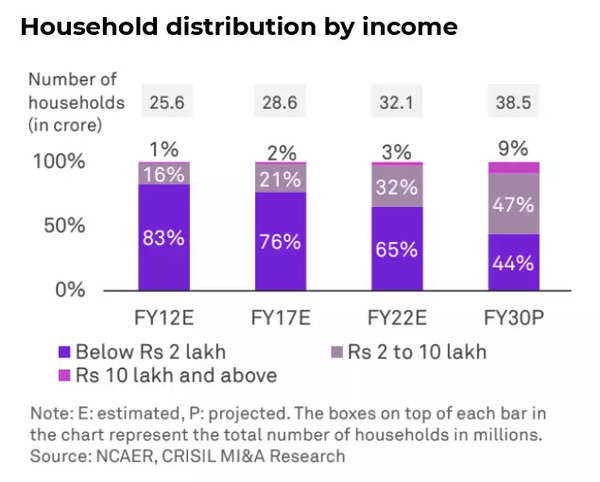

Rising middle-income population and demographic dividend

An estimated 83% of households in India had an annual income of less than Rs 2 lakh in fiscal 2012. That number reduced to 76% in fiscal 2017, and is expected to touch 65% this fiscal owing to the continuous increase in GDP and household incomes. The proportion of middle-income India — defined as households with annual income between Rs 2 lakh and Rs 10 lakh — has been rising over the past decade. CRISIL MI&A Research estimates there were 4.1 crore households in India in this category in fiscal 2012. By fiscal 2030, these are projected to reach 18.1 crore.That’s around 1.5 times the number of households (12.4 crore) in the US as of 2021.

As per United Nations inhabitants projections, about 94 crore individuals, or 67% of India’s inhabitants, at present belong to the working age group of 15- 64 years. This cohort will improve by 10 crore over the subsequent decade, regardless of declining delivery charge.” Indeed, over the subsequent decade, more than a fifth (22.5%) of the incremental international workforce will come from India,” said Crisil.

What is improving the financialisation of savings rate of Indian households?

India’s financial inclusion improved significantly over 2014-21 — the share of adult population with a bank account increased from 53% to 78% on the back of government measures and proliferation of supporting institutions.

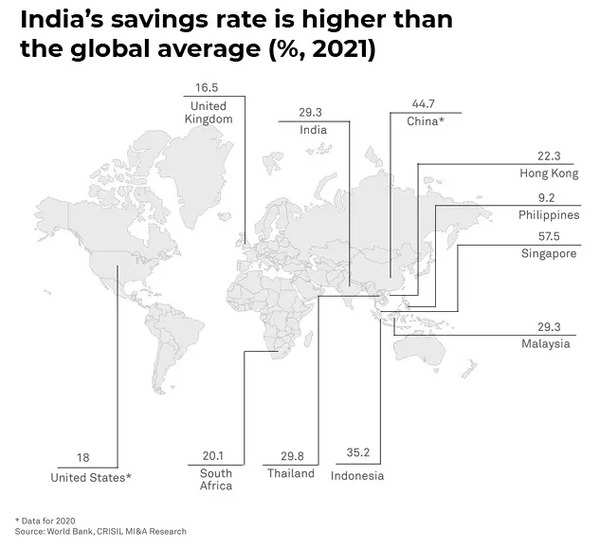

This is improving the financialisation of savings rate of Indian households, which is one of the highest in the world. At end-2021, the domestic savings rate of 29.3% was higher than the global average of 26.9%.

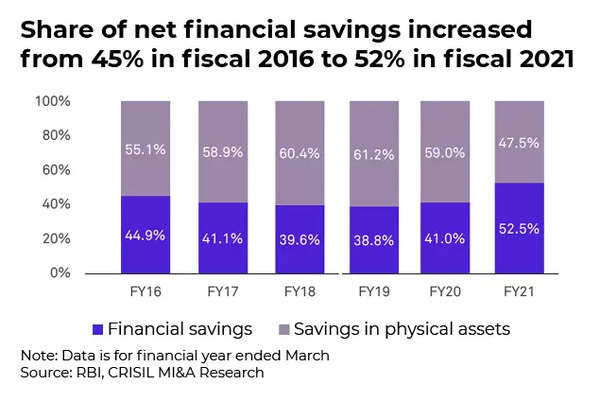

According to the RBI, the share of financial savings increased from 45% in fiscal 2016 to 52% in fiscal 2021, while that of physical savings fell from 55% to 48%.

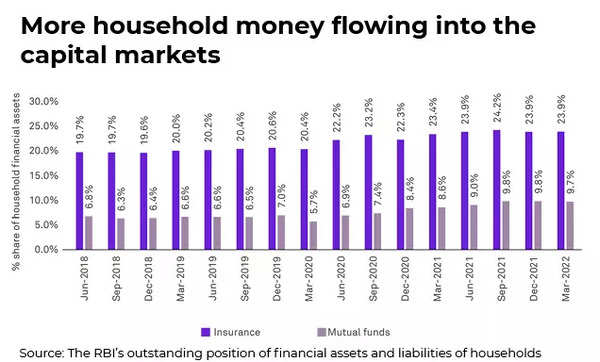

The money getting financialised is increasingly being invested in mutual funds and insurance funds. The share of mutual funds has increased from 7% in June 2018 to nearly 10% in March 2022, while the share of insurance funds has risen from 20% to 24% during the same period.

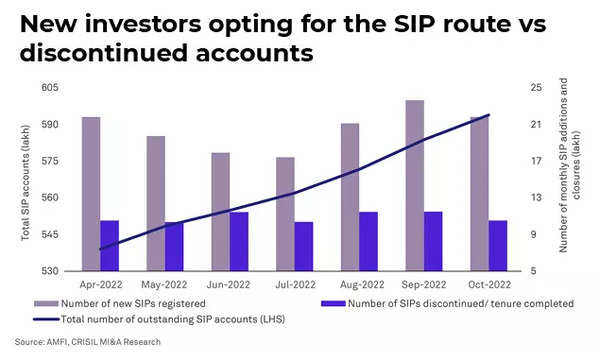

A case in level is the proliferation of SIP accounts to six crore as of October 2022, up 66 lakh accounts for the reason that begin of this fiscal.

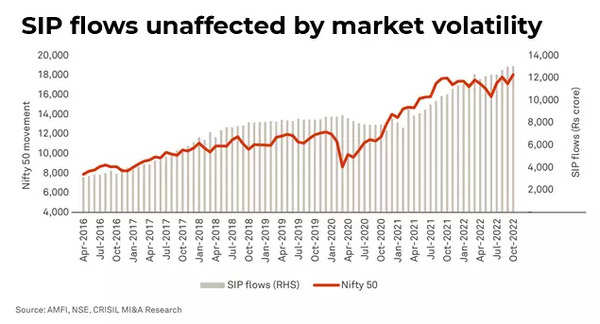

“The ratio of latest SIP accounts opened to these closed additionally stays wholesome, at about 2.4:1. Assets below SIPs crossed Rs 6.5 lakh crore as of October 2022, taking their share to almost 17% of the general trade AUM. Further, this circulation of cash into MFs has been rising regardless of market volatility. SIP investments have elevated from a mere Rs 3,000 crore as of April 2016 to over Rs 13,000 crore as of October 2022,” famous the research.

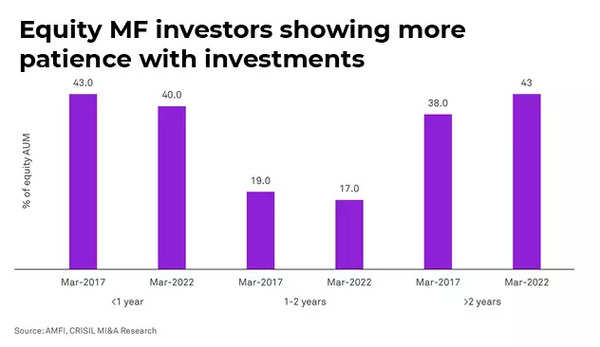

Even the maturity horizon amongst traders holding funds for more than two years has elevated to 43% as of March 2022 from 38 p.c 5 years in the past.

Formal sector driving retirement funds growth

The formalisation of the economy will be an important growth driver of the retirement fund industry as it brings individuals within the mainstream segment of the financial landscape. Subscribers from central government, state government and provident funds, which contribute mandatorily towards the retirement corpus, make up for 7.6 crore individuals. Voluntary contribution schemes such as NPS (corporate and unorganised sector), Atal Pension Yojana (APY), and Swavalamban have 4.4 crore individual subscribers.

The total number of accounts from these schemes is around 12 crore, compared with a working-age population of 94 crore individuals in the country.