One of the proposed measures is the implementation of necessary filters for transactions above a sure financial threshold, in accordance to an ET report. This consists of the use of 1-time passwords (OTP) for digital payments. The goal is to improve safety and forestall fraudulent transactions. Additionally, the government is exploring the creation of intelligence inside cost techniques to establish and block suspicious actions.

To fight cloning of cell phone SIMs and the fraudulent utilization of QR codes, a number of authentication modules and filters are being thought of. These further safety measures will assist shield customers from potential monetary fraud.

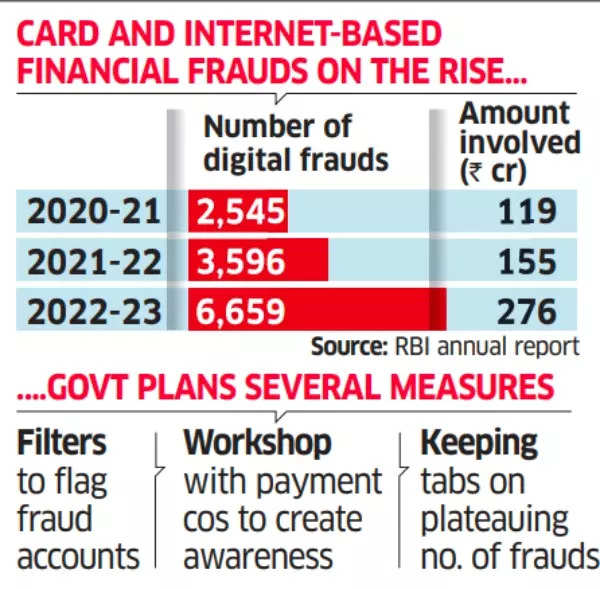

Card and Internet primarily based monetary frauds on the rise

With the growing adoption of digital payments, the dangers related to monetary fraud have additionally risen. According to government knowledge until November 15, 2023, over 1.three million complaints have been registered since the introduction of the nationwide cyber reporting system in August 2019.

UPI Transactions & RuPay Cards: What’s The Next Milestone for India’s Digital Payments Revolution?

In response to these challenges, numerous companies are carefully monitoring latest financial institution fraud instances. Their goal is to warn the public and implement efficient preventive measures. The government’s focus is to be sure that techniques are alert and clever sufficient to detect and forestall fraudulent transactions in a well timed method.

The urgency to deal with these points grew to become obvious after UCO Bank reported an inaccurate credit score of Rs 820 crore to its account holders by the Immediate Payment Service (IMPS). Authorities have already taken motion towards digital fraud by suspending roughly 7 million cellular numbers related to suspicious transactions.

To assess the present state of affairs and the effectiveness of measures taken so far, the Department of Financial Services (DFS) lately carried out a gathering with key stakeholders. Banks have been urged to strengthen their techniques and processes and lift consciousness amongst clients. The DFS plans to evaluate progress in January by one other assembly.