We’re not out of the woods but, in accordance with Moody’s Analytics

Article content material

All issues thought-about, Canada’s economy has held up fairly nicely and with the Bank of Canada on the trail to decrease interest rates, the whole lot needs to be OK, proper?

Well, fingers crossed, as a result of in accordance with a current threat report from Moody’s Analytics a variety of threats nonetheless bubble under the floor that could derail the soft-landing situation.

Labour strikes

Advertisement 2

Article content material

Moody’s flags labour disputes as a rising threat for Canada, and there have definitely been loads of these within the headlines these days.

First the railway strike that threatened to “paralyze the country” final month. Ottawa stepped in shortly to end this with binding arbitration, however this was adopted shortly after by pilots at Canada’s largest airline threatening to stroll out over pay.

A strike at Air Canada would have floor 670 every day flights and 110,000 every day passengers, together with air freight, with one economist estimating the impression to the economy at $1.4 billion if it went on for 2 weeks.

The airline and enterprise teams referred to as on Ottawa to as soon as once more step in, however a last-minute deal averted the strike.

“These events echo the teacher, healthcare and public sector worker strikes in 2021 and 2022 and the spread of the U.S. auto workers’ dispute in 2023,” wrote Moody’s economist Charlie Houston.

“While inflation is cooling, wage earners evidently still feel the pinch from the increase in prices over the last few years.”

Supply-chain stress

This threat has fallen barely on Moody’s scale due to the fast motion by authorities and enterprise to go off disruption.

Article content material

Advertisement 3

Article content material

Though the federal authorities pressured arbitration between rail staff and the railways in late August, the risk stays because the rail union is combating for the appropriate to strike in courtroom.

Moody’s estimates that the financial impression of a nationwide rail strike would price the Canadian economy $341 million a day or 4 per cent of every day gross home product.

Industries similar to agriculture, mining, paper and wooden, exporters and motor automobiles that depend on rail freight can be hit the toughest.

“Supply-chain stress could reignite inflation pressures — particularly unwelcome as inflation is only just falling back within the Bank of Canada’s target range,” mentioned Houston.

Limp labour market

Moody’s sees the weakening job market as one other rising threat. Canada’s unemployment rate rose to six.6 per cent in August, the best stage since 2017, outdoors of the pandemic.

There was a slight uptick in new jobs however it wasn’t almost sufficient to maintain up with massive features within the inhabitants.

“A broader downturn in the labour market — extending beyond pockets of weakness such as higher unemployment among recent immigrants — could further depress consumer demand and pressure firms into cutting back on hiring to protect profits,” mentioned Houston.

Advertisement 4

Article content material

Global pandemic

Though the COVID-19 lockdowns have light into reminiscence, Moody’s sees pandemics as a rising threat.

“The possibility of a more elusive and deadly strain of the novel coronavirus, or an unaddressed surge of another pathogen, remains a major threat,” mentioned the report.

The World Health Organization final month declared the mpox outbreak in Africa a public health emergency of international concern.

“While Canadians have likely learned how to better live and work during a pandemic from the experience of 2020, a repeat would have a significant adverse economic impact on an economy still on fragile footing,” mentioned Houston.

Sign up here to get Posthaste delivered straight to your inbox.

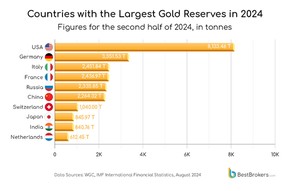

The United States isn’t the biggest gold buyer these days but it certainly has the biggest stockpile in the world — by a lengthy shot.

Most of the gold is stashed in deep storage at — you guessed it — Fort Knox in Kentucky. The United States Bullion Depository right here holds greater than 147 million ounces, all in gold bars. West Point, New York is the second location the place the U.S. Mint retains 54 million ounces and Denver, Colorado the third, with 43.8 million ounces.

Advertisement 5

Article content material

At at this time’s document costs the U.S. gold reserve is valued at greater than US$657.48 billion.

- Today’s Data: United States present dwelling gross sales, present account stability

- Earnings: FedEx Corp., Lennar Corp., Darden Restaurants Inc.

Recommended from Editorial

People will all the time seek for methods to decrease their tax payments when private tax charges strategy 50 per cent, particularly in the event that they really feel there may be not a lot worth in comparison with the fee. That’s why tax professional Kim Moody says Canada wants some wholesale adjustments to the prevailing regime. Read more

Build your wealth

Are you a Canadian millennial (or youthful) with a long-term wealth constructing aim? Do you need assistance getting there? Drop us a line along with your contact information and your aim and also you could be featured anonymously in a new column on what it takes to construct wealth.

McLister on mortgages

Advertisement 6

Article content material

Want to be taught extra about mortgages? Mortgage strategist Robert McLister’s Financial Post column may help navigate the complicated sector, from the most recent developments to financing alternatives you gained’t need to miss. Plus test his mortgage rate page for Canada’s lowest nationwide mortgage charges, up to date every day.

Today’s Posthaste was written by Pamela Heaven, with extra reporting from Financial Post employees, The Canadian Press and Bloomberg.

Have a story thought, pitch, embargoed report, or a suggestion for this text? Email us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material