The resolution was made because of the chance that outdated cellular numbers might be issued to new customers, resulting in inadvertent transfers. The new pointers require Third Party App Providers (TPAP) and Payment Service Providers (PSP) to take motion by December 31, 2023.

- TPAPs and PSP banks should determine UPI IDs and related UPI numbers and telephone numbers of shoppers who haven’t performed any monetary or non-monetary transactions for a yr via UPI apps.

- The UPI IDs and UPI numbers of such clients will be disabled for inward credit score transactions, and the identical telephone numbers will be deregistered from the UPI mapper.

- Customers with blocked UPI IDs and telephone numbers for inward credit score transactions should re-register of their UPI apps for UPI mapper linkage. They can proceed making funds and non-monetary transactions utilizing their UPI PIN as required.

Additionally, UPI apps are required to carry out Requester Validation (ReqValAd) earlier than initiating ‘Pay-to-contact’ and ‘pay to cellular quantity’ transactions. The apps should show the client title that has been fetched earlier than initiating the transaction and mustn’t show the title saved on the app’s finish.

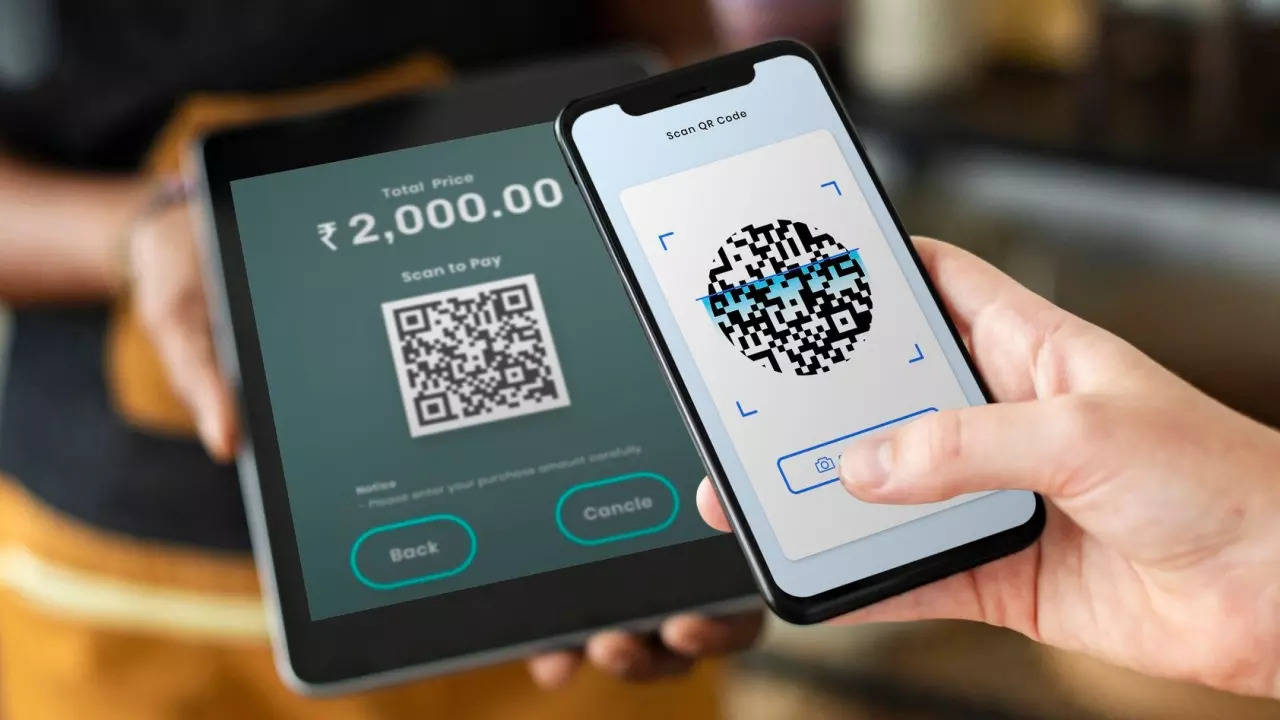

UPI Transactions & RuPay Cards: What’s The Next Milestone for India’s Digital Payments Revolution?

This initiative goals to make sure a protected and safe transactional expertise for customers. The NPCI round emphasizes the significance of shoppers frequently reviewing and verifying their data inside the banking system to make sure this. It has been noticed that clients typically change to new cellular numbers with out disassociating their earlier numbers from the banking system.