Earlier this month, S&P Global launched its “SPIVA U.S. Mid-Year 2022” report, highlighting the state of active administration and the way it performs in opposition to their benchmark. Despite this being the greatest 12 months to this point, the report discovered that 51% of large-cap active fund managers are underperforming.

And for the long run, the shortcomings balloon even additional: 84% underperform after 5 years, and 90% accomplish that after 10 years.

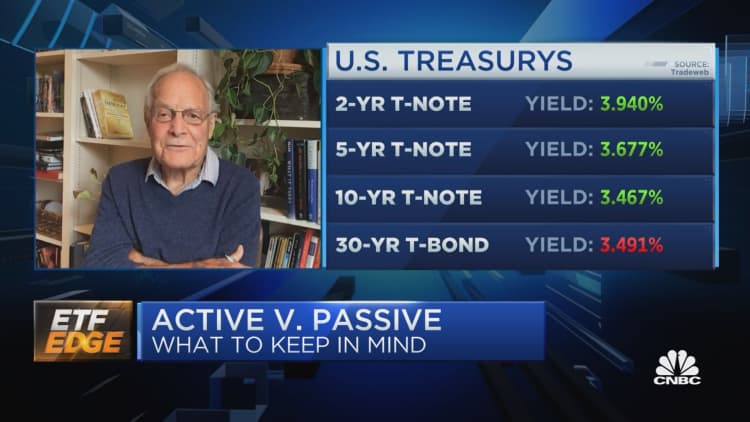

“The function of any market is to find the right price and make it available to people who want to buy or sell,” Charley Ellis, creator of “Winning the Loser’s Game,” informed CNBC’s Bob Pisani on “ETF Edge” on Monday.

“When I came out of Harvard Business School in 1963, there were no courses on investment management. Now there’s seven,” he added. “And trading volume on the NYSE was 3 million shares, now it’s somewhere between 6 and 8 billion shares a day.”

Ellis stated that the enhance in the variety of folks getting concerned in active investing over time, together with better entry to market information, has made it simpler for traders to do skilled buying and selling on their very own.

“Anytime you go into the market as an active manager, you’re buying from and selling to other people that know exactly what you know, just as fast as you know it,” he stated. “That makes it awfully hard to get ahead of anybody else.”

Amid the present volatility that is influenced by quite a lot of components, markets are particularly extra unpredictable no matter the info an investor is aware of.

“It’s important to remember that efficient market theory doesn’t say markets are priced correctly every day,” Nick Colas, co-founder of DataTrek Research, stated in the similar section. “It says that there’s no reliable way to find the mispricing, and that’s still true. And that is why active management is so hard.”

Colas stated that there is no constant methodology to determine outperformance of benchmarks, so it is as much as particular person traders to create their very own methods or hunt down an active supervisor to help.

“Every great investor has one phenomenal idea,” he stated. “A phenomenal idea that people didn’t believe for a long time. And that’s been proven true.”

While active administration is perhaps higher suited for laborious methods like enjoying the bond market, the traces between active and passive are changing into extra blurred.

“There’s actually no such thing as passive management,” Colas stated. “Everything, including buying an index fund is still a choice. Those choices are informed by emotion, and that is something that we battle a lot”

On the matter of listed funds, Colas additionally suggested to not take active administration for granted. He stated that he encourages his shoppers to take a look at longer-term developments on a world scale.

For instance, Colas advisable evaluating the S&P and Russell indexes to rising market ETFs. EFA and EEM are up 3% a 12 months for the final 10 years, he stated, and the S&P is up 10% in that point interval.

“We recommend underweighting [EFA and EEM] as dramatically as you can possibly stand,” Colas stated. “Because those are not moneymaking areas and, according to the current structure, they never will be.”