This mixture of images created on February 17, 2024, exhibits U.S. President Joe Biden waving from the South Lawn of the White House in Washington, D.C., on June 1, 2023, and former President Donald Trump waving to the media outdoors the White House on Jan. 12, 2021.

Jim Watson | Brendan Smialowski | AFP | Getty Images

As President Joe Biden and former President Donald Trump safe sufficient delegates to clinch their party nominations, coverage consultants are weighing how proposed tariffs could have an effect on American customers.

While the Trump marketing campaign hasn’t launched many tax policy specifics, he has renewed his support for tariffs, that are taxes levied on imported items from one other nation.

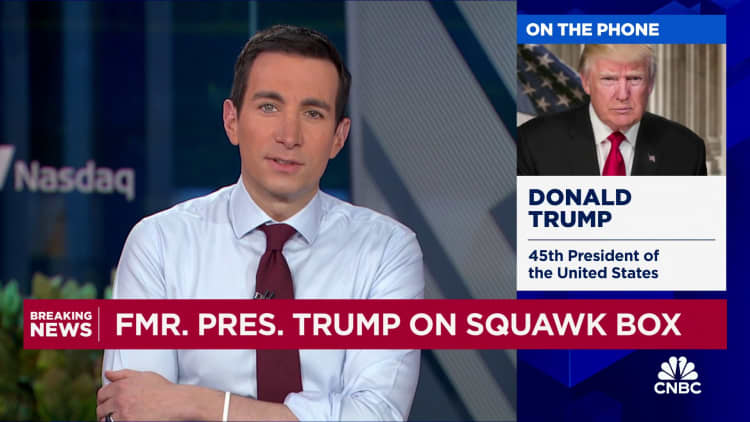

“I’m a big believer in tariffs,” Trump stated Monday on CNBC’s “Squawk Box,” suggesting that he is prone to reinstitute duties if elected for a second time period.

More from Personal Finance:

Nearly half of young adults have ‘money dysmorphia,’ survey finds

19 million people may qualify for free tax prep through the IRS this year

Here’s the inflation breakdown for February 2024 — in one chart

During this primary time period from 2017 to 2021, Trump added a variety of tariffs to bolster U.S. industries, together with levies on China, Mexico and the European Union, amongst others. The Biden administration has maintained a few of these tariffs.

“Here’s an area where the candidates are actually pretty similar — first what Trump imposed and then what Biden maintained,” stated Erica York, a senior economist and analysis supervisor with the Tax Foundation’s Center for Federal Tax Policy.

“That’s an area to pay attention to,” she added.

How tariffs could have an effect on Americans customers

While the Biden marketing campaign hasn’t launched specifics on tariffs, Trump has proposed a baseline 10% tariff on all U.S. imports and a levy of 60% or higher on Chinese goods.

“That would be a massive escalation in import taxes and have some really negative ramifications,” York stated.

For instance, a study from the Federal Reserve Bank of New York discovered that 2018 U.S. tariffs price the standard family $419 per 12 months.

The 10% tariff would elevate taxes on U.S. customers by more than $300 billion a 12 months and could trigger “retaliatory tax increases on U.S. exports from international trade partners,” in accordance with the Tax Foundation.

“When Trump was president, he always talked about China paying this tax, but China doesn’t pay it” as a result of American firms cross the added expense to shareholders, staff and customers, stated Howard Gleckman, senior fellow on the Urban-Brookings Tax Policy Center.

“If President Trump raises tariffs on imported goods, it means inevitably that American consumers are going to pay more” for each imported and home merchandise, he stated.

While critics warn that larger tariffs could add to inflation, the patron worth index did not exceed the historic common throughout Trump’s first time period.