Family assist to get on the property ladder has turn out to be the norm in Canada with the dimensions of gifts hovering

Article content material

Parents giving cash to their children to purchase a house took off throughout the pandemic when actual property went via the roof.

But has right now’s cooler housing market modified that?

Not actually, says a brand new examine by CIBC Capital Markets economists Benjamin Tal and Katherine Judge.

Since 2015, the share of first-time homebuyers who acquired monetary assist from members of the family rose from 20 per cent to 31 per cent, and although that pattern has levelled off in recent times, it has not declined.

Advertisement 2

Article content material

“Homebuyers relying on a wealth transfer from their parents in order to purchase a home is becoming the norm in Canada,” stated the economists.

Moreover, the quantity of those gifts has continued to climb, rising 73 per cent increased than in 2019. The common present nationally now sits at $115,000.

“While the benchmark home price has fallen by 14 per cent since its COVID-era peak, prices are still 33 per cent above pre-COVID levels, and that means that gifts have risen faster than home prices over that period,” stated the examine.

Parental help is particularly obvious in Ontario and British Columbia, the place excessive dwelling costs have necessitated the next reliance on household assist.

In these provinces, 36 per cent of first-time homebuyers obtain a serving to hand, 5 proportion factors increased than the nationwide common.

The dimension of the gifts in British Columbia, Canada’s priciest market, has soared 90 per cent since 2019, effectively above the nationwide enhance of 73 per cent.

Parents right here on common are giving their kids $204,000 in direction of a primary dwelling.

Even Ontario is tame by comparability. The quantity of gifts on this province — the place actual property is much from low cost — rose simply 52 per cent since 2019 and now sits at $128,000.

Article content material

Advertisement 3

Article content material

A latest study by Ratehub.ca on how a lot revenue is required to purchase a house affords clues to why household gifts proceed to rise.

Affordability worsened in 11 of the 13 cities the examine covers between April and May as homebuyers confronted increased mortgage rates and rising dwelling costs in most cities.

In only one month, the revenue wanted to purchase a house in Victoria, B.C., rose $1,230 to $172,180 a 12 months.

Vancouver’s required revenue hit $232,950, up $800.

Hamilton, Ont., noticed the most important enhance, Homebuyers now want an revenue of $171,100 to afford a house right here, up $1,550.

Toronto was the exception. The average home price right here fell $5,900 between April and May, that means that homebuyers required $1,250 much less annual revenue.

But the $215,920 a 12 months it’s good to afford a house in Canada’s greatest metropolis continues to be out of attain for a lot of.

Wherein lies the issue. Not all people’s parents can afford to assist their kids onto Canada’s very costly property ladder.

Tal and Judge level out that whereas the phenomenon of parental gifts helps to ease the chunk of housing inflation, it is usually widening “the already wide wealth gap in Canada.”

Advertisement 4

Article content material

Sign up here to get Posthaste delivered straight to your inbox.

The International Monetary Fund estimates artificial intelligence may endanger 33 per cent of jobs in superior economies, 24 per cent in rising economies and 18 per cent in low-income nations. At the identical time it has “enormous potential” to spice up productiveness, create new jobs and even new industries.

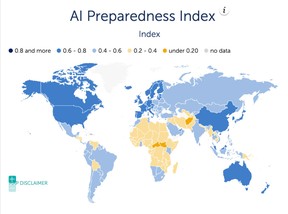

Some nations, nevertheless, are extra prepared for the AI revolution than others. This IMF chart ranks that readiness assessing digital infrastructure, human capital and labour market insurance policies, innovation and financial integration and regulation. Countries within the deeper shade of blue are probably the most ready. The United States, for instance, achieves one of many highest scores at 0.77, whereas Canada scores 0.71. Denmark tops the world at 0.78.

- CNN hosts the primary United States presidential debate, between President Joe Biden and former President Donald Trump, beginning at 9 p.m. ET.

- Alberta’s finance minister will launch the province’s 2023-24 fiscal year-end outcomes.

- Today’s Data: United States GDP, private consumption, sturdy items orders and pending dwelling gross sales

- Earnings: McCormick & Co Inc, Walgreens Boots Alliance Inc, Nike Inc.

Advertisement 5

Article content material

Recommended from Editorial

The $1 rule, loud budgeting and reverse budgeting: Kelley Keehn, founding father of Money Wise Workplaces, is aware of all the newest developments in private finance. Watch her video to get suggestions on methods to hold your funds on observe throughout what may be an costly time of the 12 months.

Are you nervous about having sufficient for retirement? Do it’s good to alter your portfolio? Are you questioning methods to make ends meet? Drop us a line along with your contact information and the gist of your drawback and we’ll attempt to discover some specialists that can assist you out, whereas writing a Family Finance story about it (we’ll hold your title out of it, after all). If you may have a less complicated query, the crack workforce at FP Answers, led by Julie Cazzin, may give it a shot.

McLister on mortgages

Want to study extra about mortgages? Mortgage strategist Robert McLister’s Financial Post column may help navigate the complicated sector, from the newest developments to financing alternatives you received’t wish to miss. Plus verify his mortgage rate page for Canada’s lowest nationwide mortgage charges, up to date day by day.

Today’s Posthaste was written by Pamela Heaven, with further reporting from Financial Post workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? Email us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s good to know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material