Desjardins Financial seems at whether or not they’re reality or fiction in a brand new report

Article content material

Housing affordability in Canada is an issue. That’s a reality.

But there’s nonetheless loads of uncertainty in terms of the underlying causes and the potential coverage fixes — besides building a lot more homes — that would make it higher.

Desjardins Financial economist Marc Desormeaux looked at four popular solutions — from extending amortizations to lowering immigration — to find out whether or not they’re extra reality or fiction.

Advertisement 2

Article content material

Extending amortizations

Mortgages with a 25-year amortization — the reimbursement interval for the mortgage — are the “industry standard,” however longer amortizations have been touted as a possible repair for affordability as a result of they scale back month-to-month mortgage funds and decrease the quantity of earnings homebuyers have to qualify for a mortgage.

Desormeaux ran a state of affairs assuming a brand new commonplace of 35 years, however discovered that not solely would it not fail to enhance affordability, it additionally would make it worse in the long term, as will increase in disposable earnings stoked housing demand and costs.

“Affordability would eventually become even worse … as initial gains are overcome by a more dramatic rise in home values,” he stated.

Extending amortization intervals might additionally ratchet up monetary dangers in the lending system, he added.

Less immigration

In March, Ottawa introduced it will cut the number of non-permanent (NPR) residents by 25 to 30 per cent by 2026 beginning this fall because it regarded to reply critics who argue that record immigration has strained Canada’s housing provide.

Slowing inhabitants progress would weaken housing demand, Desormeaux stated, however might additionally result in fewer residence listings, which might trigger costs to rise.

Article content material

Advertisement 3

Article content material

He additionally stated much less immigration will damage efforts to construct extra houses.

“NPRs also tend to rent more than the broader Canadian population, so the policy’s potential impact on home prices may be limited,” Desormeaux stated.

A spike in residence listings

A flood of listings might assist to drive down costs and enhance affordability, Desormeaux acknowledged.

He stated a pointy rise in the variety of houses out there for buy is feasible if “financially strapped” householders resolve to promote because the housing market picks up or if baby boomers decide to promote to downsize or hire.

Still, a “spike” in listings in the months to return “is a highly unlikely trajectory,” the economist stated.

Even if listings per capita rise to ranges recorded throughout the Nineteen Nineties recession and the early 2000s, that gained’t be sufficient to deliver affordability again to pre-COVID ranges below Desjardins’ modelling.

Recession

Some say a monetary downturn might enhance housing affordability, however watch out what you want for, Desormeaux warns.

“While economic downturns do usually result in meaningful home value depreciation, they also tend to bring interest rate cuts, the stimulative effects of which mitigate price declines,” he stated.

Advertisement 4

Article content material

Economic downturns such because the Great Recession of 2008 additionally enhance unemployment and infrequently consequence in lack of earnings.

Under Desjardins’ recession scenario, family disposable earnings can be $20 billion decrease than below its base case by 2025, Desormeaux stated.

“With that in mind, those hoping for a recession should not only be weighing their homebuying ambitions against immense longer-term economic and social costs; they should also be thinking about how much more affordable a home would actually be for them if their financial situation changed,” he stated.

Sign up here to get Posthaste delivered straight to your inbox.

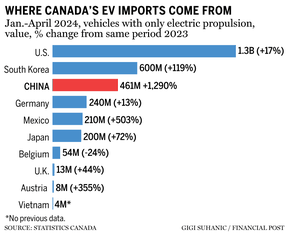

The rise of electric vehicles helped bring environmentalists and the Canadian auto sector closer together. Now, the threat of Chinese-made electric vehicles is pushing them apart.

A schism between the two sides came into view last week after the federal Liberals announced a 30-day consultation on find out how to defend Canadian auto staff from what Deputy Prime Minister Chyrstia Freeland characterised as a possible flood of low-cost EVs from China. — Gabe Friedman, Financial Post

Advertisement 5

Article content material

- Vancouver releases residence gross sales figures for June

- Francois-Philippe Champagne, minister of innovation, science and business, and Iliana Ivanova, European commissioner for innovation, analysis, tradition, schooling and youth, will signal an settlement on science, analysis and innovation to boost Canada’s collaboration with the European Union.

- Today’s information: Canada worldwide merchandise commerce, U.S. Challenger job cuts, preliminary and persevering with jobless claims, commerce stability

- Earnings: Constellation Brands Inc., TransAlta Renewables Inc.

Recommended from Editorial

Canadians who’re closely invested in their home market might be excused for trying with envy south of the border on the beneficial properties of the S&P 500 and the Nasdaq this 12 months as Canada’s S&P/TSX composite index continues to languish. Even past the United States, the TSX was one of many worst performers amongst markets in different developed international locations, writes investing columnist Peter Hodson. So, why is it so unhealthy relative to its world friends? Hodson gives five reasons here.

Advertisement 6

Article content material

FP Answers

Are you nervous about having sufficient for retirement? Do you have to regulate your portfolio? Are you questioning find out how to make ends meet? Drop us a line at aholloway@postmedia.com together with your contact information and the overall gist of your downside and we’ll attempt to discover some specialists that will help you out whereas writing a Family Finance story about it (we’ll preserve your identify out of it, after all). If you’ve got an easier query, the crack workforce at FP Answers led by Julie Cazzin or considered one of our columnists may give it a shot.

McLister on mortgages

Want to study extra about mortgages? Mortgage strategist Robert McLister’s Financial Post column may help navigate the advanced sector, from the most recent traits to financing alternatives you gained’t wish to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with further reporting from Financial Post employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? Email us at posthaste@postmedia.com.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you have to know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material