Investing at file-excessive inventory market ranges poses a major problem, particularly with Nifty nearing 20,000 and mid-cap and small-cap shares already at very excessive ranges. Many traders are unsure about how to invest lump sum quantities in such circumstances. Investors are notably caught in a dilemma on whether or not it’s higher to maintain money with markets in any respect time highs and invest after they appropriate.

Wealth managers acknowledge that sure market segments seem stretched however advise towards avoiding the market fully. Instead, they advocate investing in easy merchandise and diversifying investments throughout equities, fixed deposits, and gold. ET spoke to some wealth managers on what’s the very best route to investing an quantity of Rs 20 lakh in the markets in the current circumstances.

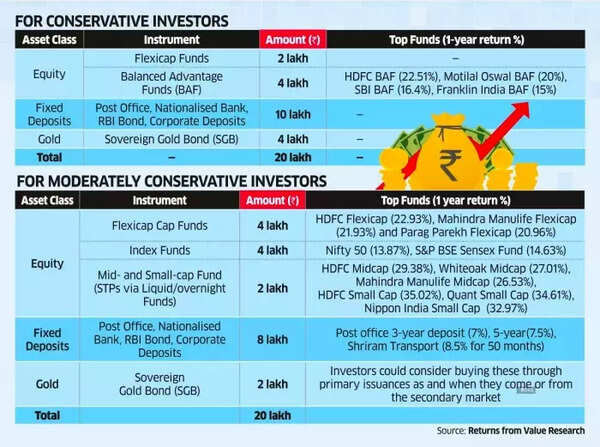

For reasonably conservative traders, a balanced method with a 50% allocation to equities and a 50% allocation to gold and fixed revenue is prudent, say wealth managers. Within equities, they recommend index funds or flexi-cap funds for giant-cap publicity. Given the latest spikes in mid-cap shares and small-cap shares, it is advisable to stagger investments in these schemes over the following 12 months and likewise keep away from investing lump sums, they are saying.

For extra conservative traders, limiting fairness publicity to a most of 30% or choosing asset allocator merchandise like balanced benefit funds is a safer technique, the ET report stated. Allocate roughly 50% to fixed revenue and 20% to gold in the face of difficult fairness market circumstances, wealth managers advised the monetary every day.

For instance, a reasonably conservative investor can look to invest round Rs 8 lakh in fixed deposits out of Rs 20 lakh and a conservative investor can put Rs 10 lakh in fixed deposits. Similarly whereas a conservative investor can allocate Rs 6 lakh in fairness devices, a reasonably conservative investor can put Rs 10 lakh in fairness merchandise.

Wealth managers acknowledge that sure market segments seem stretched however advise towards avoiding the market fully. Instead, they advocate investing in easy merchandise and diversifying investments throughout equities, fixed deposits, and gold. ET spoke to some wealth managers on what’s the very best route to investing an quantity of Rs 20 lakh in the markets in the current circumstances.

For reasonably conservative traders, a balanced method with a 50% allocation to equities and a 50% allocation to gold and fixed revenue is prudent, say wealth managers. Within equities, they recommend index funds or flexi-cap funds for giant-cap publicity. Given the latest spikes in mid-cap shares and small-cap shares, it is advisable to stagger investments in these schemes over the following 12 months and likewise keep away from investing lump sums, they are saying.

For extra conservative traders, limiting fairness publicity to a most of 30% or choosing asset allocator merchandise like balanced benefit funds is a safer technique, the ET report stated. Allocate roughly 50% to fixed revenue and 20% to gold in the face of difficult fairness market circumstances, wealth managers advised the monetary every day.

For instance, a reasonably conservative investor can look to invest round Rs 8 lakh in fixed deposits out of Rs 20 lakh and a conservative investor can put Rs 10 lakh in fixed deposits. Similarly whereas a conservative investor can allocate Rs 6 lakh in fairness devices, a reasonably conservative investor can put Rs 10 lakh in fairness merchandise.

Where to invest Rs 20 lakh?

The really useful funds listed above by ET are chosen based mostly on their one-12 months efficiency.