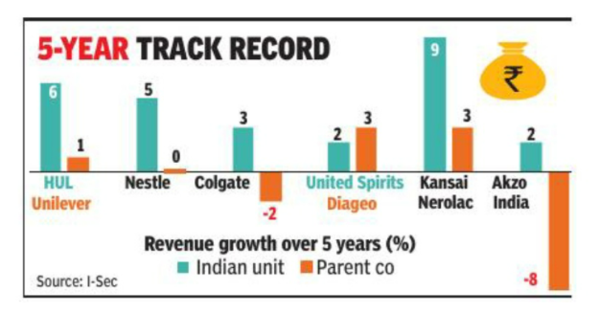

That’s not all. In sure circumstances, their Indian business may turn into the biggest in worth phrases over a interval of time, amongst all geographies they function in. For occasion, Hindustan Unilever (HUL) and Maruti are driving intensive worth in phrases of valuation help to the dad or mum firm inventory, based on an I-Sec Research report (see graphic). HUL’s CEO & MD Sanjiv Mehta mentioned in a latest interview to Financial Times that India, the patron group’s largest market by quantity, will overtake the US to turn into the biggest by worth, with out specifying a timeframe.

At current, HUL’s market valuation at $72 billion is about 62% of its dad or mum’s market cap of $115 billion, whereas its income is over 10% of Unilever group gross sales.

A powerful presence in a ‘high-growth’ rising market like India is a powerful narrative for MNCs, in the pursuit of rising their model and widening their base to achieve the untapped and burgeoning center class. The evaluation by I-Sec Research is in line with a Bain WEF Report launched in 2019, which revealed that shopper demand in India will proceed to develop at a wholesome clip, including about 140 million center-earnings and 21 million excessive-earnings households by 2030. While Covid might need set this again by a couple of quarters, the India consumption story continues to be intact. FMCG companies have bounced again to double-digit income development over the past one yr.

Bain & Co companion Karthik Ganesan mentioned that MNCs which have been profitable in India have scaled profitably by understanding the India shopper and retail panorama higher. “They understand what the Indian consumer needs and develop a ‘good enough’ product, which is key as many MNCs launch their global portfolio as-is at unsustainable margins and struggle to scale up,” he mentioned.

Other elements embrace localising the advertising and marketing combine based mostly on granular insights, take part in each mainstream and premium elements throughout classes as having the correct value factors to win with a number of shopper cohorts is vital to scale and profitability. Besides, it additionally consists of constructing and empowering an area group to have deep distribution at a low-value.

Interestingly, many buyers consider that proudly owning the ‘cheap’ dad or mum firm inventory is a greater efficient play to have the India publicity (Unilever, Suzuki, Kansai), the report mentioned.

Further, India has confirmed to be a case research for FMCG majors in pioneering frugal innovation, significantly to faucet the agricultural shopper. Several tech-pushed low-value interventions are being replicated in different creating international locations.

A Nestle India spokesperson mentioned, “India has a huge consumer base both in urban and rural centres. The consumer household isgoing to expand further in the coming years. Moreover, over the last few years we have also witnessed the emergence of aspirational India. This combined with the potential of penetration-led volume growth, makes India a promising market for any company. ”

Meanwhile, the expansion momentum appears to have continued in the July-September quarter for the India companies of Unilever, and Coco-Cola, amongst others.

“The present development is pushed strongly by pricing, however we count on quantity and blend (premiumisation) development contribution to extend in the approaching quarters,’’ analysts mentioned.

Multiple MNC associates listed in India have created great worth for the dad or mum — they’ve outperformed the dad or mum entity on development and shareholder returns. Keeping this development in thoughts, MNCs that may orient themselves to profitable in India would possibly undoubtedly think about itemizing their Indian subsidiary, Ganesan added.

It could also be famous that the income and revenue contribution of most Indian shopper MNCs to their dad or mum has elevated considerably over the previous couple of years, but it surely nonetheless stays round low-to-mid-single digit (barring HUL and Kansai Nerolac).