Economists say the numbers out at the moment may sway the Bank of Canada to carry rates of interest in July

Article content material

May’s inflation rate got here in surprisingly excessive, main some economists to solid doubt on their predictions of a second interest rate cut subsequent month.

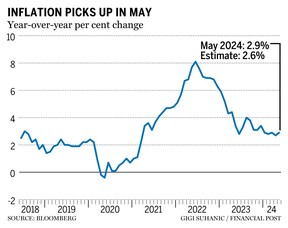

Statistics Canada on Tuesday stated inflation accelerated to 2.9 per cent for May, beating economists’ expectations of additional easing from April’s 2.7 per cent enhance.

The soar places inflation on the higher fringe of the Bank of Canada’s goal vary of between one per cent and three per cent.

Advertisement 2

Article content material

Given the shock figures, economists at the moment are rethinking their curiosity rate predictions for the yr. Here’s what a few of them needed to say in regards to the announcement:

‘Not the best news’: Canadian Chamber of Commerce

Andrew DiCapua, a senior economist on the Canadian Chamber of Commerce, stated the Bank of Canada is now prone to pause at its July assembly.

“Not the best news on the Canadian front this morning,” he stated in a be aware. “The increase in services inflation is not helpful, especially as wage growth is elevated. The risk of a strong rebound in the housing market hasn’t materialized yet, but slowing shelter inflation is welcome news.”

DiCapua stated the chances of a July cut are decrease, however the remaining determination will nonetheless rely on the central financial institution’s financial forecasts.

“The (Bank of Canada) will want to take a slow and measured approach, especially with inflation accelerating,” he stated. “This bumpy road on inflation could keep the bank overly restrictive for the Canadian economy risking any soft landing.”

July cut on ‘shaky ground’: Capital Economics

The sturdy month-to-month positive aspects on some core measures are “cause for concern,” in accordance with Olivia Cross, a North America economist at Capital Economics Ltd.

Article content material

Advertisement 3

Article content material

“However, with some of that strength due to factors that are likely to be one-offs, and given there is another CPI report before the late July meeting, for now we are sticking with our view that the (Bank of Canada) will cut again next month,” she stated in a be aware.

Cross pointed to a number of measures that aren’t prone to have additional positive aspects, together with the two.4 per cent hike in journey providers, a 0.5 per cent soar in meals costs and a 0.9 per cent month-over-month climb in hire.

‘Shaves the odds’ of a July cut: BMO

Douglas Porter, chief economist with the Bank of Montreal, stated future data factors will finally resolve the prospects of a July cut, however the odds actually acquired longer after the inflation spike.

“No bones about it, this is not what the Bank of Canada wanted to see at this point,” he stated in a press release. “With inflation back on a bumpy path, the outlook for BoC moves is similarly bumpy. For now, our official call remains that the next BoC rate cut will be in September, and this report does nothing to move that needle.”

‘Disappointment’: TD

“While this wasn’t as big of a letdown as the Oilers’ game last night, today’s CPI print was a disappointment,” James Orlando, director and senior economist at Toronto-Dominion Bank, stated in a be aware.

Advertisement 4

Article content material

“Not only did the headline print unexpectedly rise, the average of the BoC’s core inflation rates increased for the first time in 2024. This was driven by big price swings in a number of services categories.”

Orlando is predicting a pause in July earlier than one other cut in September.

Recommended from Editorial

‘Wrong direction’: CIBC

The most up-to-date inflation data “moved in the wrong direction,” Katherine Judge, director and senior economist at CIBC Capital Markets, stated in a press release.

“Overall, with the data showing much faster price pressures than expected, this casts a lot of doubt on the possibility of a July cut.”

• Email: bcousins@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material