The common yearly financial savings in Toronto and Vancouver quantities to $1,860 and $1,994, respectively

Article content material

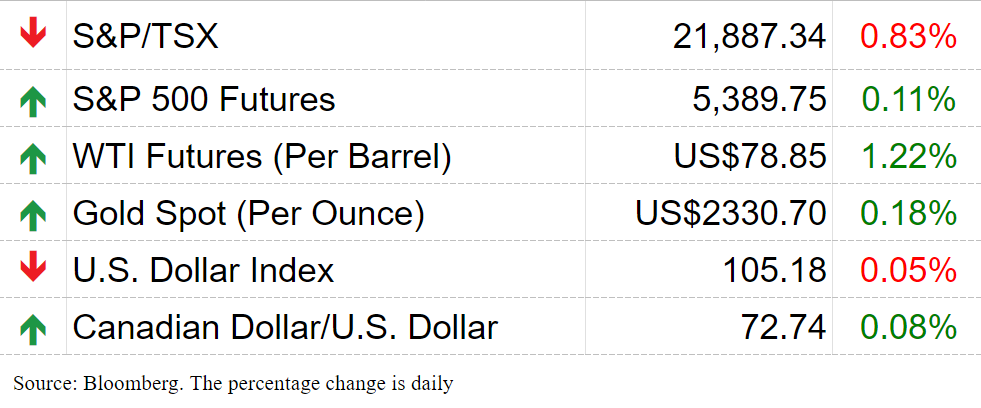

For these with a variable rate mortgage, final week’s Bank of Canada curiosity rate lower was welcome aid, however how a lot Canadians finally saved actually is dependent upon the place they dwell.

A brand new report from the actual property web site Zoocasa discovered the typical month-to-month financial savings for somebody with a five-year variable rate mortgage is $155 monthly in Toronto and $166.20 in Vancouver.

Advertisement 2

Article content material

The common yearly financial savings in Toronto and Vancouver quantities to $1,860 and $1,994, respectively.

On the opposite finish, month-to-month financial savings quantity to only $76.60 for the typical mortgage holder in Regina, essentially the most reasonably priced metropolis Zoocasa included in the report.

While the financial savings may not appear to be a lot in some areas, economists are expecting between two and three extra cuts by the top of 2024, which might start as quickly as the following curiosity rate choice in July.

“A perceived dovish tone suggests the likelihood of a greater number of follow-up moves,” Andrew Grantham, senior economist at CIBC, mentioned in a observe final week.

“We continue to forecast a further 25 (basis point) reduction at the next meeting in July, and a total of four cuts (three more after today’s) by the end of the year.”

James Laird, co-chief government of Ratehub.ca and president of CanWise mortgage lender, agreed that extra cuts are doubtless incoming.

“Usually if there’s one rate cut, more will follow,” Laird mentioned in the Zoocasa report. “Now, Canadians will be wondering where the Bank wants to get to and when, which will be exciting if you are a borrower.”

Article content material

Advertisement 3

Article content material

If Canada does lower three extra instances by the top of the 12 months, Canadian variable mortgage rate holders might see month-to-month financial savings of greater than $500 in a few of Canada’s costliest cities.

The mortgage aid can be anticipated to open the door for extra individuals to enter the housing market.

A Zoocasa survey discovered 51 per cent of residents in Canada and the U.S. cite excessive costs as the primary purpose they have not purchased a house, however that determine might shrink as charges go down.

“With lower lending rates, prospective buyers will be motivated to get off the sidelines, ultimately leading to more sales activity and the potential for an increase in prices,” Zoocasa chief government Carrie Lysenko mentioned.

“Now is an excellent time to get off the sidelines, before the competition gets too fierce, explore your options and take advantage of the greater negotiating power you have with the current surge in inventory.”

Sign up here to get Posthaste delivered straight to your inbox.

Amid a global labour shortage, IKEA struggled to keep workers, with each employee who quit costing the retailer about US$5,000 to replace, Bloomberg reports.

Advertisement 4

Article content

To keep employees happy, IKEA began offering front-line employees salary raises, more workplace flexibility and more technology to make their job easier.

The result? Voluntary attrition (read: quitting) fell by nearly five per cent in just two years, even in an industry known for high turnover. Read more.

- 2:00 p.m.: U.S. FOMC Announcement and Summary of Economic Projections

- 2:30 p.m.: U.S. Federal Reserve Chair Jerome Powell’s press briefing

- 3:00 p.m.: Bank of Canada Governor Tiff Macklem speaks in Montreal

- Data: U.S. Consumer Price Index

- Earnings: Dollarama, Broadcom

Recommended from Editorial

While a tax-free financial savings account is an effective way for some Canadians to save cash, it isn’t for everybody. Certified monetary planner Jason Heath suggests these with debt, employer matching packages and people trying to purchase their first residence could possibly be in the place to contemplate different choices. Find out more.

Advertisement 5

Article content material

Are you nervous about having sufficient for retirement? Do that you must modify your portfolio? Are you questioning easy methods to make ends meet? Drop us a line along with your contact information and the gist of your drawback and we’ll attempt to discover some specialists that will help you out, whereas writing a Family Finance story about it (we’ll hold your identify out of it, in fact). If you have an easier query, the crack crew at FP Answers, led by Julie Cazzin, can provide it a shot.

McLister on mortgages

Want to study extra about mortgages? Mortgage strategist Robert McLister’s Financial Post column may help navigate the advanced sector, from the most recent tendencies to financing alternatives you received’t wish to miss. Plus verify his mortgage rate page for Canada’s lowest nationwide mortgage charges, up to date day by day.

Today’s Posthaste was written by Ben Cousins, with extra reporting from Financial Post workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Email us at posthaste@postmedia.com.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information that you must know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material