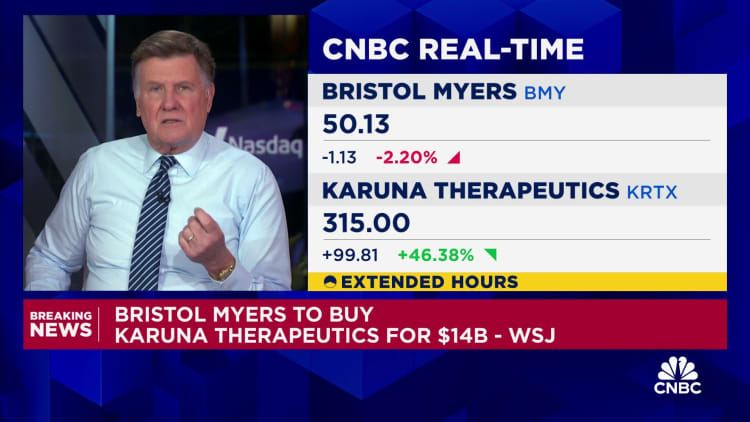

Bristol Myers Squibb on Friday announced it agreed to purchase biopharmaceutical firm Karuna Therapeutics for $14 billion in money, or $330 per share.

Karuna’s inventory popped greater than 47% on the information Friday morning, hitting round $317 a share. Bristol Myers Squibb shares rose greater than 2%.

The deal will assist increase Bristol Myers’ drug pipeline after competitors from a generic providing brought on demand for the corporate’s blood most cancers drug Revlimid to tumble in its third quarter.

The boards of administrators at each Bristol Myers and Karuna unanimously authorised the acquisition, and it’s anticipated to shut within the first half of 2024, in line with a release.

Karuna develops medicines for sufferers dwelling with neurological and psychiatric situations. The firm’s lead asset is an antipsychotic referred to as KarXT, which is anticipated to function a therapy for adults with schizophrenia starting in late 2024, the discharge stated.

“There are tremendous opportunities in neuroscience, and Karuna strengthens our position and accelerates the expansion and diversification of our portfolio in the space. We expect KarXT to enhance our growth through the late 2020s and into the next decade,” Bristol Myers Squibb CEO Christopher Boerner stated in a press release.

KarXT can also be being evaluated as a doable therapy for Alzheimer’s illness psychosis and a type of bipolar dysfunction, in line with the discharge. Karuna CEO Bill Meury stated the corporate’s portfolio “offers advancements in treatment not seen in many years.”

“With Bristol Myers Squibb’s long-standing expertise in developing and commercializing medicines on a global scale and legacy in neuroscience, KarXT and the other assets in our pipeline will be well-positioned to reach those living with schizophrenia and Alzheimer’s disease psychosis,” he stated in a press release.

Citi and Gordon Dyal & Co. suggested Bristol Myers on the deal, whereas Goldman Sachs served because the unique advisor for Karuna.

— CNBC’s Annika Kim Constantino contributed to this report.

Don’t miss these tales from CNBC PRO: