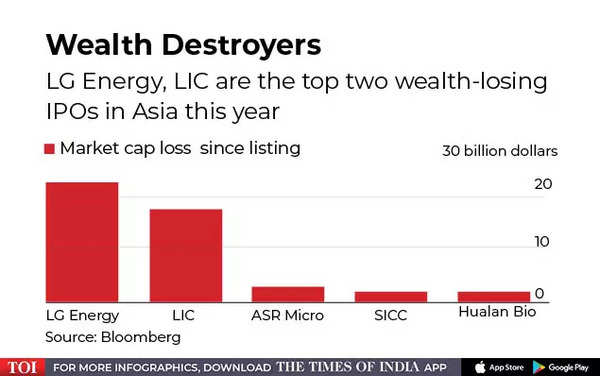

Having plunged 29% since its May 17 debut, India’s greatest ever IPO now ranks second when it comes to market capitalization loss since itemizing, based on information compiled by Bloomberg. The drop puts it simply behind South Korea’s LG Energy Solution Ltd., which noticed a greater than 30% peak-to-trough decline in its share worth after an preliminary spike on debut.

Almost a month after itemizing, LIC’s $2.7 billion IPO has turned out to be one in all Asia’s greatest new inventory flops this 12 months, as rising rates of interest and inflation ranges globally damage demand for share gross sales and with India’s inventory market dealing with unprecedented promoting strain by foreigners. The benchmark S&P BSE Sensex is down greater than 9% this 12 months.

LIC’s shares are poised to fall for a 10th consecutive session, slipping as a lot as 5.6% Monday after a compulsory lock-up interval for anchor traders ended Friday. The rout has anxious the federal government, with officers saying the corporate’s administration will “look into all these aspects and will raise shareholders’ value.”

LIC’s lengthy-delayed IPO was dubbed India’s “Aramco moment” in reference to Gulf oil large Saudi Arabian Oil Co.’s $29.4 billion itemizing in 2019, the world’s largest. It was a part of Prime Minister Narendra Modi’s plans to broaden the nation’s capital markets. The share sale, which was oversubscribed by almost thrice, was geared toward narrowing the federal government’s finances deficit after spending elevated through the pandemic.

More ache could possibly be forward for the inventory given its lackluster quarterly outcomes, based on Avinash Gorakshakar, head of analysis with low cost brokerage Profitmart Securities Pvt. “The management’s communication with investors is confusing. They haven’t held an analyst call after the results,” he mentioned. “So there is no clarity on how the company is planning to grow, what is going to be its strategy.”