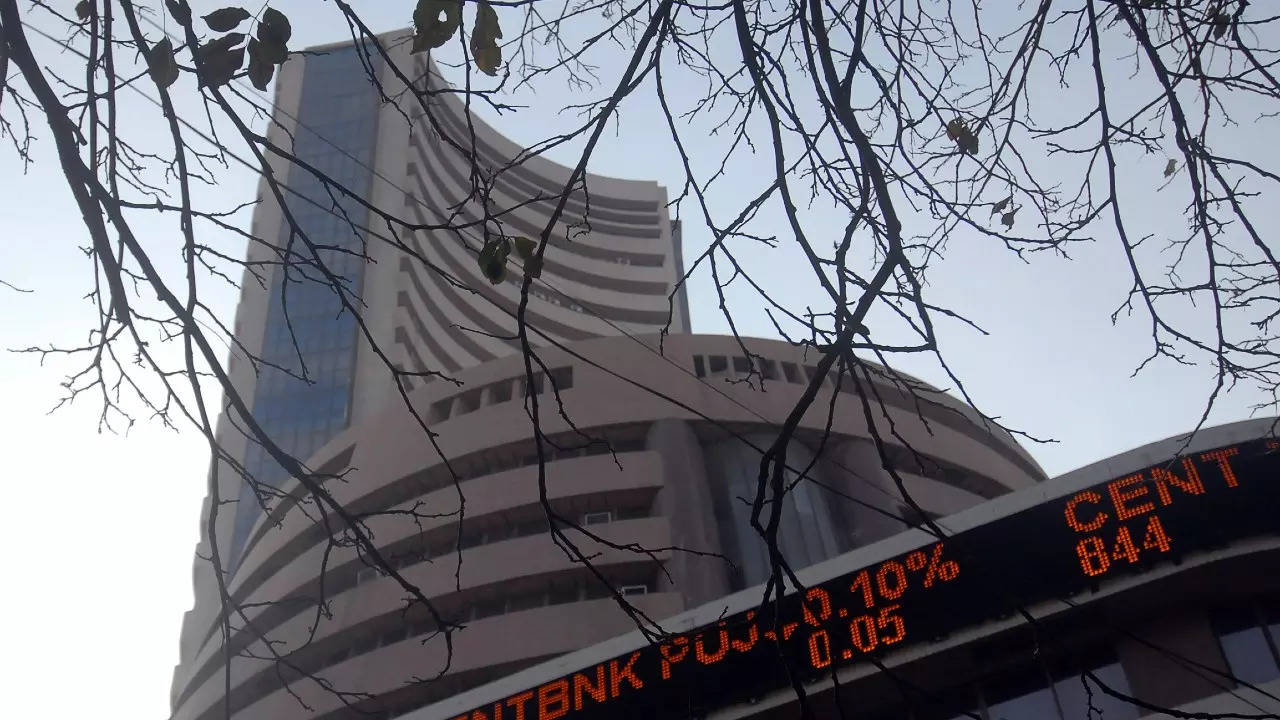

MUMBAI: Equity benchmarks Sensex and Nifty surrendered early features to shut with losses on Thursday, snapping their 4-day profitable streak as buyers pared publicity to auto, bank and IT stocks after the RBI left its key rate of interest unchanged.

After remaining within the constructive territory for essentially the most a part of the session, the 30-share BSE Sensex fell 294.32 factors or 0.47 per cent to settle at 62,848.64. During the day, it tumbled 353.23 factors or 0.55 per cent to 62,789.73.

The NSE Nifty declined 91.85 factors or 0.49 per cent to finish at 18,634.55.

Kotak Mahindra Bank was the largest loser within the Sensex pack, sliding 2.68 per cent, adopted by Tech Mahindra, Mahindra & Mahindra, Axis Bank, Hindustan Unilever, Tata Motors, Tata Consultancy Services, Bajaj Finserv, Bajaj Finance, Nestle and Titan.

In distinction, NTPC, Power Grid, Larsen & Toubro, HDFC, Reliance and HDFC Bank had been the gainers.

In Asian markets, Seoul and Tokyo ended decrease, whereas Shanghai and Hong Kong settled within the inexperienced.

Equity markets in Europe had been buying and selling largely in constructive territory. The US markets ended largely decrease on Wednesday.

The Reserve Bank of India on Thursday left its key rate of interest unchanged for a second straight coverage assembly however signalled that it needs to see inflation reasonable extra whereas preserving the expansion momentum.

The financial coverage committee (MPC), which has three members from RBI and an equal variety of exterior consultants, voted unanimously to maintain the benchmark repurchase, or repo price unchanged at 6.50 per cent.

While client worth inflation eased throughout March-April 2023 and moved into the tolerance band, headline inflation continues to be above the goal of four per cent and is anticipated to stay so throughout the remainder of the present fiscal, RBI Governor Shaktikanta Das mentioned saying the financial coverage determination.

“Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain,” he mentioned. “Our goal is to achieve the inflation target of 4 per cent and keeping inflation within the comfort band of 2-6 per cent is not enough.”

Dhiraj Relli, MD and CEO, HDFC Securities, mentioned, “The RBI MPC left the repo rates unchanged at its meeting on June 8 in line with street expectations. MPC members were in a sweet spot in the backdrop of higher than expected GDP numbers and moderating headline and core inflation print”.

Global oil benchmark Brent crude dipped 0.31 per cent to USD 76.71 a barrel.

Foreign Institutional Investors (FIIs) purchased equities value Rs 1,382.57 crore on Wednesday, in keeping with alternate information.

The BSE benchmark had climbed 350.08 factors or 0.56 per cent to settle at 63,142.96 on Wednesday. The NSE Nifty superior 127.40 factors or 0.68 per cent to finish at 18,726.40.

After remaining within the constructive territory for essentially the most a part of the session, the 30-share BSE Sensex fell 294.32 factors or 0.47 per cent to settle at 62,848.64. During the day, it tumbled 353.23 factors or 0.55 per cent to 62,789.73.

The NSE Nifty declined 91.85 factors or 0.49 per cent to finish at 18,634.55.

Kotak Mahindra Bank was the largest loser within the Sensex pack, sliding 2.68 per cent, adopted by Tech Mahindra, Mahindra & Mahindra, Axis Bank, Hindustan Unilever, Tata Motors, Tata Consultancy Services, Bajaj Finserv, Bajaj Finance, Nestle and Titan.

In distinction, NTPC, Power Grid, Larsen & Toubro, HDFC, Reliance and HDFC Bank had been the gainers.

In Asian markets, Seoul and Tokyo ended decrease, whereas Shanghai and Hong Kong settled within the inexperienced.

Equity markets in Europe had been buying and selling largely in constructive territory. The US markets ended largely decrease on Wednesday.

The Reserve Bank of India on Thursday left its key rate of interest unchanged for a second straight coverage assembly however signalled that it needs to see inflation reasonable extra whereas preserving the expansion momentum.

The financial coverage committee (MPC), which has three members from RBI and an equal variety of exterior consultants, voted unanimously to maintain the benchmark repurchase, or repo price unchanged at 6.50 per cent.

While client worth inflation eased throughout March-April 2023 and moved into the tolerance band, headline inflation continues to be above the goal of four per cent and is anticipated to stay so throughout the remainder of the present fiscal, RBI Governor Shaktikanta Das mentioned saying the financial coverage determination.

“Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain,” he mentioned. “Our goal is to achieve the inflation target of 4 per cent and keeping inflation within the comfort band of 2-6 per cent is not enough.”

Dhiraj Relli, MD and CEO, HDFC Securities, mentioned, “The RBI MPC left the repo rates unchanged at its meeting on June 8 in line with street expectations. MPC members were in a sweet spot in the backdrop of higher than expected GDP numbers and moderating headline and core inflation print”.

Global oil benchmark Brent crude dipped 0.31 per cent to USD 76.71 a barrel.

Foreign Institutional Investors (FIIs) purchased equities value Rs 1,382.57 crore on Wednesday, in keeping with alternate information.

The BSE benchmark had climbed 350.08 factors or 0.56 per cent to settle at 63,142.96 on Wednesday. The NSE Nifty superior 127.40 factors or 0.68 per cent to finish at 18,726.40.