Data for June from Association of Mutual Funds in India (Amfi) confirmed that whereas flexi cap funds web pulled in over Rs 2,500 crore, the determine for big cap funds was Rs 2,130 crore and for big & midcap funds almost Rs 2,000 crore. All progress and fairness -oriented funds confirmed constructive flows.

The sturdy flows into fairness schemes, despite the market volatility that was witnessed in June, point out that investors are placing their cash into these MFs with the intention to generate returns in the long term, mentioned Priti Rathi Gupta, founding father of the monetary platform for girls — LXME. “It could also be a result of investors being more conscious of how important it is to have assets in their portfolios that can combat inflation,” Gupta mentioned.

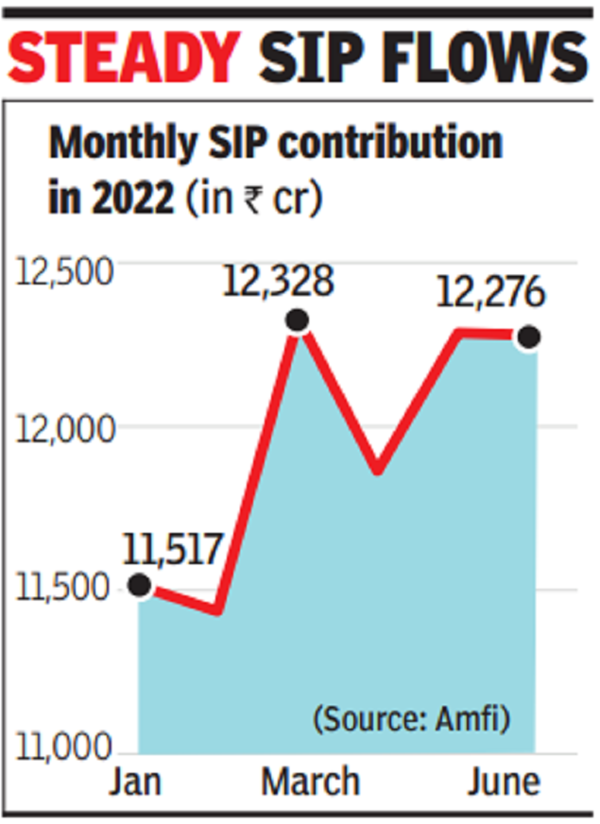

Data from the fund trade commerce physique Amfi additionally confirmed that in June, whole inflows by the SIP route was Rs 12,276 crore, nearly on the identical stage as Rs 12,286 crore within the earlier month. Additionally, at almost 5.54 crore, the variety of SIP accounts touched a brand new excessive.

According to Akhil Chaturvedi, chief enterprise officer of Motilal Oswal AMC, month-to-month SIP contribution persevering with to stay above the Rs 12,000-crore mark signifies “better awareness among retail investors about long-term orientation of equity investments and understanding of current volatility as part and parcel of equity investing”. He additionally identified that in June, together with flows into fairness schemes, hybrid funds additionally remained resilient despite relentless promoting by international funds and market correction in the course of the yr thus far.

In June, international funds had web bought shares value Rs 50,203 crore, the best such determine since March 2020, information from CDSL confirmed. Amfi’s June information additionally confirmed a Rs 92,248-crore web outflow from debt funds. But this was primarily due to company withdrawals in the course of the first half of the month to satisfy advance tax obligations that fell on June 15. Part of the outflow is also attributed to banks desirous to keep away from capital cost enforced by the RBI, mentioned N S Venkatesh, chief govt of Amfi.