Many Canadians really feel worse off than they did 10 years in the past, says this report from Desjardins

Article content material

When it involves Canada’s productivity emergency, “the entire country is feeling the pain.”

That’s based on the economists at Fédération des caisses Desjardins du Québec who say output per capita fell in each province final 12 months, making it the most broad-based decline in standard-of-living in Canadian history outside of the pandemic.

“Only at the peak of the pandemic did we see all 10 provinces report a decrease,” they stated.

Advertisement 2

Article content material

What’s extra, early information from 2024 suggests the development is constant.

Earlier this 12 months, Carolyn Rogers, senior deputy governor of the Bank of Canada, warned that the nation was dealing with a “productivity emergency.”

Canada in 2022 was producing simply 71 per cent of the worth generated in the United States financial system per hour and the capital spending hole had widened, she stated.

The nation’s inhabitants surpassed 41 million for the primary time this 12 months, and although these positive factors are holding the financial system afloat on the floor, output per particular person has fallen in six of the previous seven quarters, stated Desjardins economist Marc Desormeaux.

Per capita output measures our way of life.

“So even though Canada’s economy is still growing and churning out jobs, many people and businesses feel worse off than they did a year and a half to two years ago,” he stated.

It may even be worse relying on the place you reside.

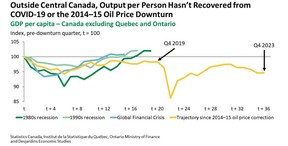

Outside of Quebec and Ontario, gross domestic product per particular person just isn’t solely decrease than earlier than the pandemic, it’s decrease than the height in 2014-15.

“That means many people outside our two biggest provinces feel worse off today than they did 10 years ago,” he stated.

Article content material

Advertisement 3

Article content material

Desjardins says a part of the issue is that output and employment have shifted away from extremely productive industries like mining and oil and gas towards decrease productiveness sectors equivalent to lodging, meals companies, recreation and public administration.

Investment has fallen in Canada’s oil trade and “other sectors haven’t stepped up to fill the gap.”

“Although oil and gas investment will remain a critical driver of Canada’s prosperity going forward, neither the Alberta government nor the Alberta Energy Regulator see it returning to pre‑2014 rates this decade,” stated Desormeaux.

Another drawback is that small- and medium-sized companies, that are much less productive than bigger corporations, make up a much bigger share of Canada’s financial system than in the United States.

Canada is nice at producing start-ups, nevertheless it falls in need of rising them to scale.

Desjardins says Canada’s innovation policy must be expanded to assist development, commercialization and early‑stage funding in addition to analysis and growth.

The report stresses that population growth and immigration will not be chargeable for Canada’s slide in way of life. Over time expert staff from different international locations ought to increase productiveness.

Advertisement 4

Article content material

In truth, Dejardins’ analysis means that Ottawa’s choice to chop the non permanent resident inhabitants will weigh on, slightly than profit, the financial system.

Sign up here to get Posthaste delivered straight to your inbox.

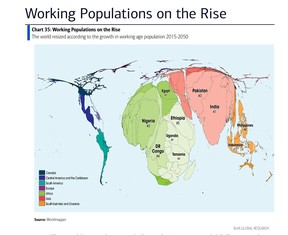

The world’s population has grown by 1 billion since 2010 and is expected to surpass 10 billion by 2050, but some populations are aging, says BofA Global Research, which brings us today’s chart.

Countries with the largest projected rise in working population over the next 25 years are India, Nigeria and Pakistan. The countries with the biggest decline in this population are China, Japan and Russia.

“A nation’s potential growth is a function of working-age population growth, labour productivity and innovation,” said BofA.

Take India, for example. Last year it overtook China as the world’s most populous nation with more than 1.4 billion people. Its demographics are a big factor behind the country’s share of the MSCI EM equity index rising from 4 per cent to 19 per cent in the past 20 years, the strategists said.

- Changes to the capital positive factors tax introduced in the 2024 price range come into impact.

- Statistics Canada will launch its newest studying for inflation this morning when it publishes its client value index for May. The annual inflation price cooled to 2.7 per cent in April in contrast with 2.9 per cent in March as will increase in the costs for meals slowed.

- Leading automotive trade associations will announce the Countdown to 2035, monitoring progress towards Canada’s 100 per cent zero-emission automobile gross sales goal.

- BlackBerry Ltd. will maintain its annual assembly of shareholders right now and launch its newest quarterly outcomes on Wednesday. The firm introduced a deal in April to work with chipmaker AMD on new robotic techniques know-how.

- Today’s Data: United States S&P CoreLogic house value index, U.S. Conference Board confidence

- Earnings: Alimentation Couche-Tard Inc, Carnival Corp, FedEx Corp

Advertisement 5

Article content material

Recommended from Editorial

People are working longer, however most ultimately plan to retire sometime. Like one reader who has a decent-sized portfolio, however hasn’t been actively investing since 2010, when she switched most of her portfolio to money. We requested retirement planner Eliott Einarson to assist her get again on observe. Find out the answer

Are you anxious about having sufficient for retirement? Do you want to modify your portfolio? Are you questioning find out how to make ends meet? Drop us a line along with your contact information and the gist of your drawback and we’ll attempt to discover some consultants that will help you out, whereas writing a Family Finance story about it (we’ll maintain your identify out of it, in fact). If you’ve got an easier query, the crack workforce at FP Answers, led by Julie Cazzin, can provide it a shot.

Advertisement 6

Article content material

McLister on mortgages

Want to study extra about mortgages? Mortgage strategist Robert McLister’s Financial Post column may also help navigate the complicated sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus examine his mortgage rate page for Canada’s lowest nationwide mortgage charges, up to date every day.

Today’s Posthaste was written by Pamela Heaven, with extra reporting from Financial Post workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Email us at posthaste@postmedia.com.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you want to know — add financialpost.com to your bookmarks and join our newsletters here.

Article content material