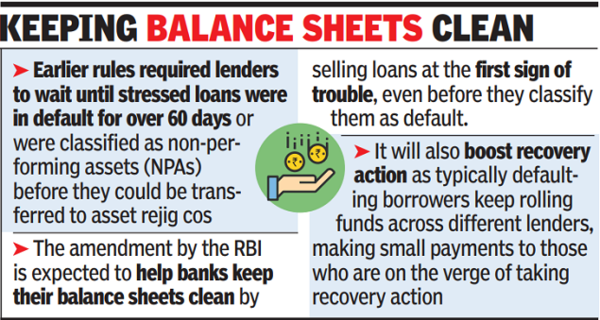

Earlier, lenders had to wait till the loans had been in default for greater than 60 days or labeled as non-performing belongings (NPAs) for them to be transferred to ARCs. This leisure will assist banks preserve their steadiness sheets clear by promoting loans on the first signal of hassle, even before they classify them as default.

The means to sell additionally facilitates the consolidation of debt distributed amongst completely different lenders. Often, defaulting debtors handle to delay restoration motion by rolling funds throughout completely different lenders, making small funds to those that are on the verge of taking motion.

“There will be two distinct advantages. One, debt aggregation will be faster, as lenders do not have to wait for 60 days after default. Second, early sale of NPA will have better turnaround potential,” UV ARC director Hari Hara Mishra mentioned.

A senior govt at a personal financial institution informed TOI that dangerous loans in India are at a document low. While the clear-up of steadiness sheets has taken place, the restoration course of continues to be a tortuous one for banks. By the time a foul mortgage is resolved, banks would have had to put aside a considerable sum of money by means of ageing provisions.

A pressured mortgage that isn’t in default will fetch higher returns for banks, the banker mentioned. Also, promoting loans before they’re labeled as default will be sure that banks keep a clear steadiness sheet.

The change in norms comes forward of India’s shift in the direction of a more recent type of accounting (IND-AS) the place provisions have to be made on anticipated credit score losses moderately than precise defaults. Under the brand new framework, lenders have to begin making provisions if the chance of default over the anticipated lifetime of the mortgage has elevated considerably.