“Taking all these factors into consideration, the real GDP growth for 2022-23 is projected at 6. 8%, with Q3 at 4. 4% and Q4 at 4. 2%, with risks evenly balanced. Real GDP growth is projected at 7. 1% for Q1FY24 and at 5. 9% for Q2,” the RBI mentioned in its financial coverage assertion. It had earlier estimated the financial system to develop at 7%.

Several multilateral businesses, funding banks and economists have lower India’s GDP growth forecast for the present monetary yr due to affect of the slowing world growth triggered by geopolitical tensions. The authorities expects growth in 2022-23 at nearer to 7%.

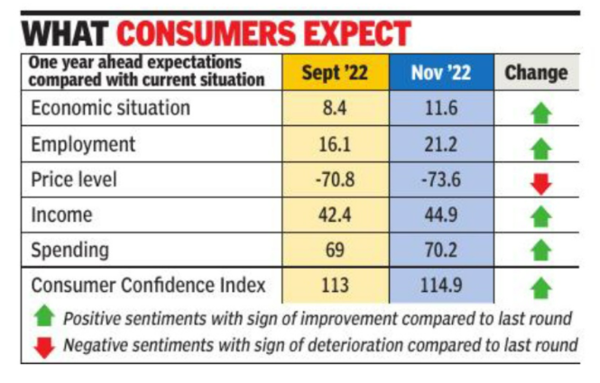

On growth, the financial coverage committee’s assertion mentioned the agricultural outlook has brightened, with prospects of a superb rabi harvest. The sustained rebound involved-intensive sectors is supporting city consumption. Robust and broad-based mostly credit score growth and authorities’s thrust on capital spending andinfrastructure ought to bolster funding exercise. According to the RBI’s survey, shopper confidence is bettering.

It mentioned that assuming anaverage crude oil value (Indian basket) of $100 per barrel, inflation is projected at 6. 7% in 2022-23, with Q3 at 6. 6% and This fall at 5. 9%, and dangers evenly balanced. CPI (shopper value index) inflation for Q1FY24 is projected at 5% and for Q2 at 5. 4% on the belief of a traditional monsoon.

RBI deputy governor Michael Patra reiterated the governor’s assertion that the battle towards inflation is way from over. “So, we remain on guard. . . far from neutral until we see a durable decline in inflation and it is staying within the tolerance band. The moderation of rate hikes from a continuous 50bps increase tells you for the shift in the wind. We feel that the worst of inflation is over but the moderation of inflation will be very grudging and very uneven. So, we must shepherd inflation first firmly into the tolerance band and then to the target. ”

“The inflation trajectory going ahead would be shaped by both global and domestic factors. In case of food, while vegetable prices are likely to see seasonal winter correction, prices of cereals and spices may stay elevated in the near term on supply concerns,” the MPC assertion mentioned.