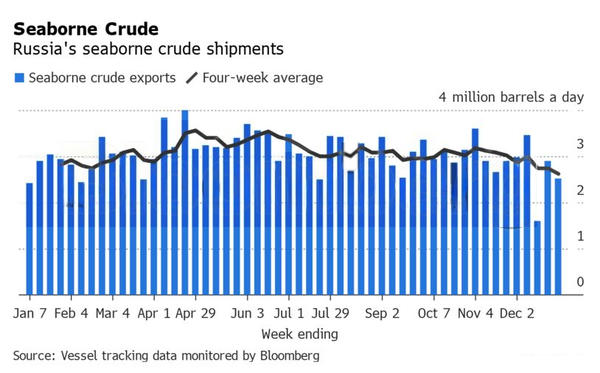

The nation’s total seaborne flows fell by 117,000 barrels a day to 2.615 million barrels on a 4-week common foundation. Volumes additionally declined week-on-week, although they recovered from a mid-month, climate-associated slump.

Inflows to the Kremlin’s battle-chest sagged amid a mix of G-7 and European Union sanctions designed to punish President Vladimir Putin for final February’s invasion of Ukraine.

Storms did seem to play a major position in disrupting flows from Black Sea and Pacific ports final month, with loadings at Kozmino halted by unhealthy climate for greater than 11 days in December, in accordance to pipeline operator Transneft PJSC. But a scarcity of vessels to haul cargoes over the for much longer distances required following an EU ban on seaborne crude imports from Russia may be having an influence.

The EU ban that got here into power on Dec. 5 has closed off Moscow’s closest oil market, which took roughly half Russia’s seaborne exports at the beginning of the yr. With the exception of a small quantity delivered to Bulgaria, seaborne flows of Russian crude to the bloc halted in full, as deliberate.

The ban has led to for much longer voyages for shipments, with journeys now taking a median of 31 days from Baltic ports to India, in contrast with simply seven days from the identical terminals to Rotterdam. That’s placing extra strain on the dwindling fleet of ships whose homeowners are keen to haul Russian cargoes.

The nation is more and more reliant by itself ships and a so-referred to as “shadow fleet” of often older ships owned by small, typically unknown firms which have sprung up in latest months. European-owned tankers can nonetheless carry Russian crude, as lengthy as it was bought at a worth under a $60 a barrel cap, launched on the similar time as the import ban. But few are actually doing so.

Elsewhere, shuttle tankers that haul Russia’s Sokol crude are ready for much longer than ordinary to switch cargoes to different ships off the South Korean port of Yeosu, lowering the variety of cargoes they’re in a position to carry every month.

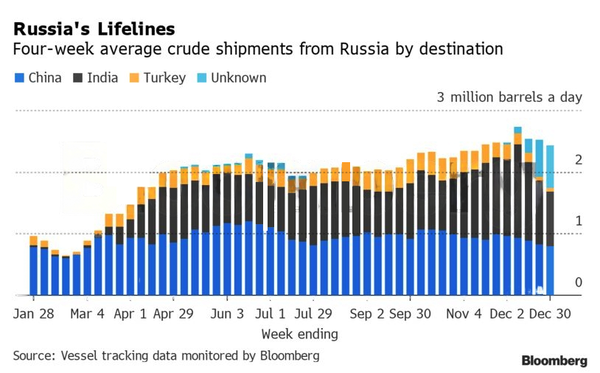

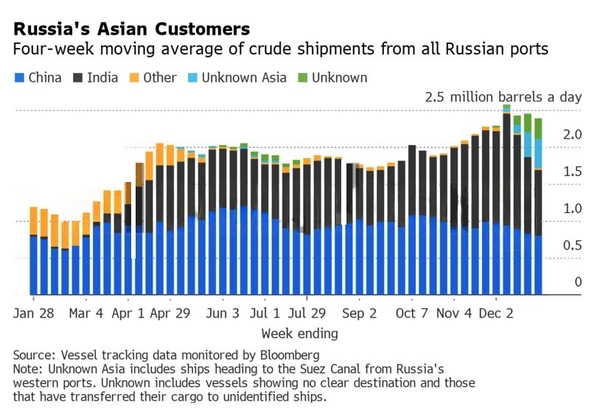

Meanwhile, the quantity of crude on vessels heading to China, India and Turkey, the three nations which have emerged as the one vital patrons of displaced Russian provides, plus the portions on ships which might be but to present a ultimate vacation spot, fell within the 4 weeks to Dec. 30 to common 2.42 million barrels a day.

Tankers hauling Russian crude have gotten extra cagey about their ultimate locations. Vessels carrying 19 million barrels of Russian crude, the equal of 680,000 barrels a day of exports, left port exhibiting no clear ultimate vacation spot within the 4 weeks to Dec. 30. It stays possible that many leaving Baltic and Black Sea terminals will start to sign Indian ports as soon as they go by the Suez Canal, whereas shipments to the United Arab Emirates have gotten extra widespread.

There has been a resurgence in ship-to-ship transfers of Russian crude, each off the Spanish north African metropolis of Ceuta and off the Greek coast close to Kalamata. The VLCC Lauren II has taken one 100,000-ton cargo at Ceuta and is probably going to take two extra earlier than heading round Africa to Asia, releasing up the smaller vessels able to loading at Russia’s Baltic terminals to shuttle cargoes over shorter distances.

Crude flows by vacation spot:

On a 4-week common foundation, total seaborne exports fell by 117,000 barrels a day. At 2.615 million barrels a day, 4-week common flows have been the bottom for the yr. Shipments to Europe have dried up virtually fully, whereas these to Asia additionally slipped.

All figures exclude cargoes recognized as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export by Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from these shipped by Russian firms. Transit crude is particularly exempted from the EU sanctions.

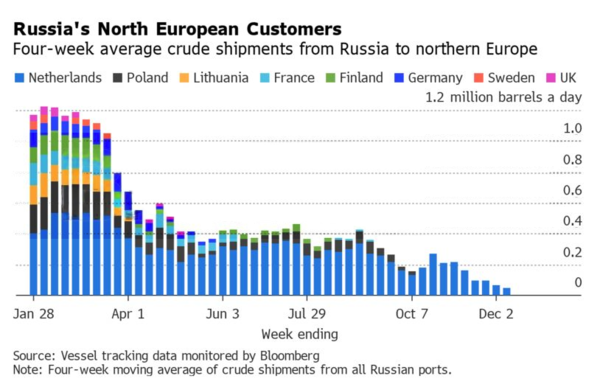

Europe

Russia’s seaborne crude exports to European nations fell to 167,000 barrels a day within the 28 days to Dec. 30, with Bulgaria the only European vacation spot. These figures don’t embrace shipments to Turkey.

A market that consumed greater than 1.5 million barrels a day of quick-haul crude, coming from export terminals within the Baltic, Black Sea and Arctic has been misplaced virtually fully, to get replaced by lengthy-haul locations in Asia which might be way more pricey and time-consuming to serve.

No Russian crude was shipped to northern European nations within the 4 weeks to Dec. 30.

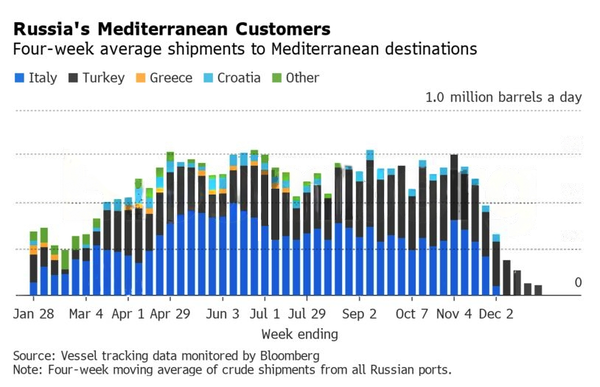

Exports to Mediterranean nations continued to fall, slipping to 57,000 barrels a day on common within the 4 weeks to Dec. 30 and setting one other low for the yr. Flows to the area fell for a eighth week.

Turkey was the one vacation spot for Russian seaborne crude into the Mediterranean, however flows there additionally fell, dropping to the bottom since Russia’s invasion of Ukraine on a 4-week common foundation. Shipments to the nation within the 4 weeks to Dec. 30 have been one-sixth the degrees seen at the beginning of November, although a few of the ships which might be but to present locations may find yourself in Turkey.

Flows to Bulgaria, now Russia’s solely Black Sea marketplace for crude, slipped again from a 10-week excessive to 167,000 barrels a day. Bulgaria secured a partial exemption from the EU ban, which ought to help inflows now that the embargo has come into power.

Asia

Four-week common shipments to Russia’s Asian clients, plus these on vessels exhibiting no ultimate vacation spot, which generally find yourself in both India or China, edged decrease within the week to Dec. 30. While the quantity heading to India seems to have slumped, historical past reveals that a lot of the cargoes on ships initially exhibiting no ultimate vacation spot find yourself there.

The equal of greater than 400,000 barrels a day was on vessels exhibiting locations as both Port Said or Suez, or which have already been or are anticipated to be transferred from one ship to one other off the South Korean port of Yeosu. Those voyages usually finish at ports in India and present up within the chart under as “Unknown Asia.”

The “Unknown” volumes, working at 284,000 barrels a day within the 4 weeks to Dec. 30, are these on tankers exhibiting a vacation spot of Gibraltar, Malta or no vacation spot in any respect. Most of these cargoes go on to transit the Suez Canal, however some may find yourself in Turkey.

Flows by export location

Aggregate flows of Russian crude fell by 269,000 barrels a day, or 9%, within the seven days to Dec. 30. Baltic shipments have been down by 25% from the earlier week, whereas these from the Black Sea have been up 16%. Volumes loaded from the Arctic terminal at Murmansk additionally fell, whereas these from the Pacific have been little modified. Figures exclude volumes from Ust-Luga and Novorossiysk recognized as Kazakhstan’s KEBCO grade.

Export income

Inflows to the Kremlin’s battle chest from its crude-export obligation fell by $15 million, or 12%, to $108 million within the seven days to Dec. 30, whereas the 4-week common revenue fell by $three million to $110 million. Though weekly export obligation revenues have rebounded from the slump seen within the week to Dec. 16, the much less unstable 4-week common was the bottom for the yr.

The December obligation charge was $5.91 a barrel, primarily based on a median Urals worth of $71.1 a barrel, in accordance to figures from the Russian Ministry of Finance. The obligation charge for January is 61% decrease at $2.28 a barrel, its lowest since June 2020, when oil costs have been hit by the Covid-19 disaster.

However, the drop is due partially to a change within the formulation used to calculate obligation charges for 2023, with the nation transferring away from taxing exports and shifting the burden to manufacturing as a part of its multi-yr tax maneuver. The plan sees export obligation phased out totally by the beginning of 2024.