- Advertisement -

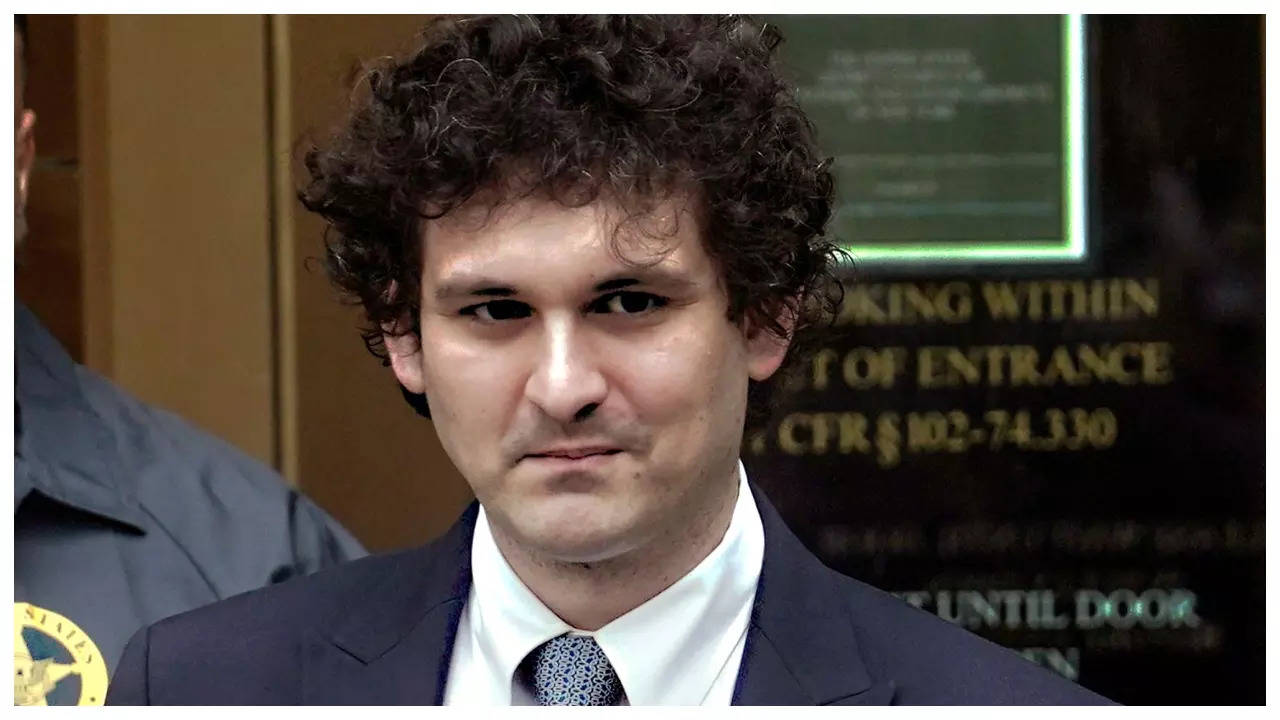

NEW YORK: Sam Bankman-Fried authorised the unlawful use of FTX prospects’ funds and property to plug monetary gaps at an affiliated hedge fund from the exchange’s earliest days, FTX’s co-founder Gary Wang advised a New York jury on Friday, as prosecutors pressed their case that Bankman-Fried was the mastermind behind one of the largest frauds in US historical past.

Eventually, the losses at the hedge fund, Alameda Research, turned so massive that there was no solution to disguise them any longer, Wang mentioned in his second day of testimony.

“FTX was not fine,” Wang mentioned, referring to the now-notorious tweet that Bankman-Fried wrote just a few days earlier than the trade filed for chapter in November 2022.

Prosecutors allege that Bankman-Fried, 31, stole billions of {dollars} from traders and prospects to be able to fund a lavish way of life in The Bahamas and purchase the affect of politicians, celebrities and the public.

Wang was FTX’s chief know-how officer and is a component of what has been known as the “inner circle” of FTX executives who’ve agreed to testify in opposition to Bankman-Fried in trade for leniency in their very own felony instances.

He is predicted to complete his testimony Tuesday. Wang has pleaded responsible to wire fraud, securities and commodities fraud as half of his settlement with prosecutors.

Prosecutors hope to have Caroline Ellison, the former CEO of Alameda and Bankman-Fried’s ex-girlfriend, take the stand Tuesday.

Wang and Bankman-Fried began Alameda in 2017, then based FTX in 2019.

Wang advised the jury that, at the route of Bankman-Fried, he inserted code into FTX’s operations that will give Alameda Research the capacity to make practically limitless withdrawals from FTX and have a line of credit score as much as $65 billion.

Alameda was given these privileges initially as a result of the hedge fund was the main market maker for FTX’s prospects in the exchange’s early days.

Alameda took benefit of its limitless withdrawal capabilities and contours of credit score from the begin, Wang mentioned, in the types of cryptocurrencies in addition to {dollars}. Initially it was just a few million {dollars} however grew over the years.

“It withdrew more funds than it had on exchange,” Wang mentioned including that the cash that it withdrew “was money from (FTX) customers.”

The relationship was successfully a two-approach avenue, the place the trade might assist out the hedge fund and vice versa as FTX shortly grew between 2019 and 2022. At one level, when a loophole in FTX’s software program was exploited to trigger a whole lot of hundreds of thousands of {dollars} in paper losses on a specific cryptocurrency, Wang mentioned Bankman-Fried ordered that loss to be moved onto Alameda’s steadiness sheet as a result of FTX’s monetary situation was extra seen to the public whereas Alameda’s steadiness sheet was not.

Alameda’s deep monetary ties to FTX had been in distinction to Bankman-Fried’s public statements that the hedge fund was “no different” from another FTX customer.

The losses at Alameda reached as a lot as USD 14 billion in the months main as much as the exchange’s chapter. Bankman-Fried and Wang mentioned options to the issues at Alameda in the summer time of 2022, together with shutting down the hedge fund, however by then it was too late.

“(Alameda) had no way of repaying this,” Wang testified.

FTX filed for chapter November 11. Wang testified that, inside hours of FTX submitting for chapter, Bankman-Fried ordered him to ship the bulk of FTX’s remaining property to the securities regulators in The Bahamas as an alternative of to the US authorities dealing with the chapter.

Bankman-Fried mentioned the Bahamian regulators “appeared extra pleasant to him, they usually appeared extra prone to let him keep in management of the firm in comparison with the US,” Wang testified.

Following this trade, Wang contacted the FBI on November 17, saying he knew what he had performed was fallacious and he wished to keep away from an extended jail sentence for his crimes.

In opening statements this week, Bankman-Fried’s attorneys claimed that Wang and different FTX lieutenants didn’t do their jobs, together with organising acceptable monetary hedges that will have protected FTX from final yr’s crash in crypto costs.

They mentioned Bankman-Fried believed he was managing a liquidity disaster attributable to cryptocurrency values that collapsed by over 70 per cent and criticism from one of his largest rivals that precipitated a run on his corporations by prospects in search of to get well their deposits.

In their cross examination of Wang on Friday, Bankman-Fried’s attorneys tried to downplay any particular relationship between Alameda and FTX, saying it was commonplace for market-making entities equivalent to Alameda to have losses or borrow funds from an trade.

Eventually, the losses at the hedge fund, Alameda Research, turned so massive that there was no solution to disguise them any longer, Wang mentioned in his second day of testimony.

“FTX was not fine,” Wang mentioned, referring to the now-notorious tweet that Bankman-Fried wrote just a few days earlier than the trade filed for chapter in November 2022.

Prosecutors allege that Bankman-Fried, 31, stole billions of {dollars} from traders and prospects to be able to fund a lavish way of life in The Bahamas and purchase the affect of politicians, celebrities and the public.

Wang was FTX’s chief know-how officer and is a component of what has been known as the “inner circle” of FTX executives who’ve agreed to testify in opposition to Bankman-Fried in trade for leniency in their very own felony instances.

He is predicted to complete his testimony Tuesday. Wang has pleaded responsible to wire fraud, securities and commodities fraud as half of his settlement with prosecutors.

Prosecutors hope to have Caroline Ellison, the former CEO of Alameda and Bankman-Fried’s ex-girlfriend, take the stand Tuesday.

Wang and Bankman-Fried began Alameda in 2017, then based FTX in 2019.

Wang advised the jury that, at the route of Bankman-Fried, he inserted code into FTX’s operations that will give Alameda Research the capacity to make practically limitless withdrawals from FTX and have a line of credit score as much as $65 billion.

Alameda was given these privileges initially as a result of the hedge fund was the main market maker for FTX’s prospects in the exchange’s early days.

Alameda took benefit of its limitless withdrawal capabilities and contours of credit score from the begin, Wang mentioned, in the types of cryptocurrencies in addition to {dollars}. Initially it was just a few million {dollars} however grew over the years.

“It withdrew more funds than it had on exchange,” Wang mentioned including that the cash that it withdrew “was money from (FTX) customers.”

The relationship was successfully a two-approach avenue, the place the trade might assist out the hedge fund and vice versa as FTX shortly grew between 2019 and 2022. At one level, when a loophole in FTX’s software program was exploited to trigger a whole lot of hundreds of thousands of {dollars} in paper losses on a specific cryptocurrency, Wang mentioned Bankman-Fried ordered that loss to be moved onto Alameda’s steadiness sheet as a result of FTX’s monetary situation was extra seen to the public whereas Alameda’s steadiness sheet was not.

Alameda’s deep monetary ties to FTX had been in distinction to Bankman-Fried’s public statements that the hedge fund was “no different” from another FTX customer.

The losses at Alameda reached as a lot as USD 14 billion in the months main as much as the exchange’s chapter. Bankman-Fried and Wang mentioned options to the issues at Alameda in the summer time of 2022, together with shutting down the hedge fund, however by then it was too late.

“(Alameda) had no way of repaying this,” Wang testified.

FTX filed for chapter November 11. Wang testified that, inside hours of FTX submitting for chapter, Bankman-Fried ordered him to ship the bulk of FTX’s remaining property to the securities regulators in The Bahamas as an alternative of to the US authorities dealing with the chapter.

Bankman-Fried mentioned the Bahamian regulators “appeared extra pleasant to him, they usually appeared extra prone to let him keep in management of the firm in comparison with the US,” Wang testified.

Following this trade, Wang contacted the FBI on November 17, saying he knew what he had performed was fallacious and he wished to keep away from an extended jail sentence for his crimes.

In opening statements this week, Bankman-Fried’s attorneys claimed that Wang and different FTX lieutenants didn’t do their jobs, together with organising acceptable monetary hedges that will have protected FTX from final yr’s crash in crypto costs.

They mentioned Bankman-Fried believed he was managing a liquidity disaster attributable to cryptocurrency values that collapsed by over 70 per cent and criticism from one of his largest rivals that precipitated a run on his corporations by prospects in search of to get well their deposits.

In their cross examination of Wang on Friday, Bankman-Fried’s attorneys tried to downplay any particular relationship between Alameda and FTX, saying it was commonplace for market-making entities equivalent to Alameda to have losses or borrow funds from an trade.

- Advertisement -