Against this backdrop, there have been calls from sections of India Inc for a big fiscal stimulus, together with printing money, to nurse the economy again to well being and assist sectors flattened by the virus. TOI spoke to a cross-part of specialists — former central financial institution governors, bankers and economists — to get a way of whether or not printing money is required to get the expansion engines roaring once more.

While there are issues over an hostile affect on India’s sovereign rankings, given the extreme hit throughout sectors, it could be time to put aside these fears for the second and deal with taking each attainable step to put the financial system again on monitor, on the earliest…

Monetary enlargement already occurring

– By C Rangarajan

There is little question that authorities expenditure has to stay excessive. The precise stimulus is a consequence of the extent of deficit that’s being maintained. The Budget signifies a deficit of 6.8% for the Centre. The states can have one other 4%. So, the Centre and states’ mixed deficit will probably be round 10.8% of the GDP. The expenditure because of the Covid pandemic will see the Centre’s deficit exceed 6.8% and it might be 7-8% of the GDP.

The authorities has assumed a nominal earnings of 14.4% for 2021-22. Given the lockdown, will probably be round 13.4% — 1 share level much less. The gross tax income that has been assumed is unlikely to be met. Non-tax revenues may even be low regardless of the dividend from the RBI. So, the fiscal deficit of the Centre will probably be 7-8% of the GDP.

This degree of fiscal deficit would require massive borrowing by the federal government with the assist of the RBI. So, in a method, financial enlargement I feel is already occurring in an oblique method. The RBI can be pumping in enormous quantities of liquidity by means of numerous operations. Expenditure is being supported by the borrowing with the assistance of the central financial institution. The RBI can have to be careful for the affect of liquidity on costs.

The expenditure of the federal government will want to be expanded to enhance healthcare infrastructure. It may even want to be for vaccination. The Centre has offered Rs 35,000 crore within the Budget for vaccination and that determine will want to be doubled and, third, if lockdowns lengthen past June, funds could also be wanted to assist susceptible teams and the poor. Besides, there will probably be expenditures to stimulate particular sectors. All of this might be one thing within the vary of Rs 2 lakh crore, or 1% of the GDP. This may name for some quantity of adjustment of different expenditures. Vulnerable teams could be supported by the use of some money switch by means of acceptable mechanisms.

The author was governor of the RBI (As informed to Surojit Gupta)

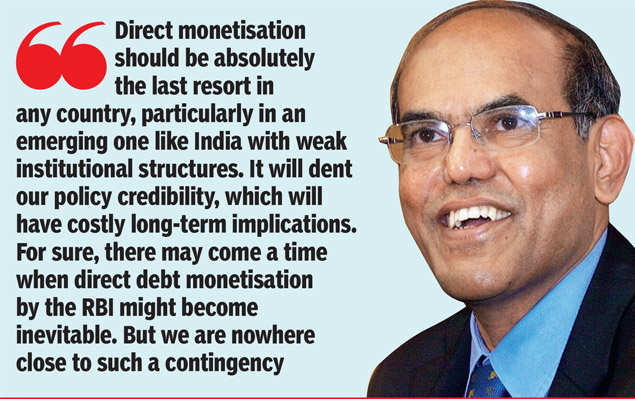

Direct monetisation needs to be final resort

– By D Subbarao

The present state of affairs doesn’t name for the RBI instantly monetising the deficit. The value of doing that will probably be a lot more than the advantages. There is a gigantic quantity of liquidity within the system. Banks are flush with funds and will probably be too blissful to finance the federal government. In the unlikely occasion of liquidity pressures build up, the RBI can all the time resort to open market operations (OMOs).

The query of the RBI instantly monetising the deficit arises if non-public credit score demand picks up and yields spike sharply. We are nowhere close to such a state of affairs. Direct monetisation of the deficit is just not essential, not fascinating, not referred to as for. Even with oblique assist by means of OMOs, the RBI has to be much less aggressive than final 12 months due to inflation issues.

Given the extraordinarily restricted fiscal house, the federal government ought to first strive to reprioritise expenditure throughout the general budgeted ceiling. Last 12 months the security-internet of MNREGA labored very effectively. This time too, the federal government ought to enlarge MNREGA though it could be much less efficient than final 12 months as a result of the pandemic has unfold to rural areas and labour could also be apprehensive about coming in for handbook work. If the MNREGA possibility doesn’t work out, the federal government can have to enlarge the free foodgrain scheme. Direct money transfers needs to be the final resort.

Any spending by the federal government is demand-stimulating. The first desire needs to be to spend on funding — on capital expenditure already deliberate — as this can generate jobs and incomes and create productive belongings. If the well being state of affairs, God forbid, turns into so unhealthy that works can’t be carried out, direct consumption assist will probably be inevitable.

When folks speak about monetisation, they neglect to respect two issues. First, direct monetisation doesn’t imply the RBI giving money free to the federal government. The RBI will cost curiosity, however if you happen to work by means of the dynamics of the mixed steadiness sheet of the federal government and the RBI, it’s going to prove that the federal government will get money at a subsidised rate of interest. That subsidy comes from the banks as they lose their enterprise of lending to the federal government. You don’t want to cripple banks at a time when they’re already struggling. The second factor folks don’t realise is that it’s not simply direct monetisation that can contain the RBI printing money. Even common OMOs imply printing money.

Given the fiscal pressures, there may be little or no wriggle room for the federal government. If direct transfers grow to be completely inevitable, then some reallocation from capital to present expenditure will grow to be essential. Additional borrowing needs to be the final resort. In the hierarchy of contingency planning, I might say spend on capital expenditure and spend on MNREGA. If due to the pandemic in rural areas, there is no such thing as a demand for MNREGA, then resort to enlarged free foodgrain provide and direct money transfers. If you then run wanting money due to income shortfall, resort to extra borrowing.

Direct monetisation needs to be completely the final resort in any nation, notably in an rising one like India with weak institutional constructions. It will dent our coverage credibility, which can have expensive longterm implications. For positive, there might come a time when direct debt monetisation by the RBI may grow to be inevitable. But we’re nowhere shut to such a contingency.

The author was governor of the RBI (As informed to Mayur Shetty)