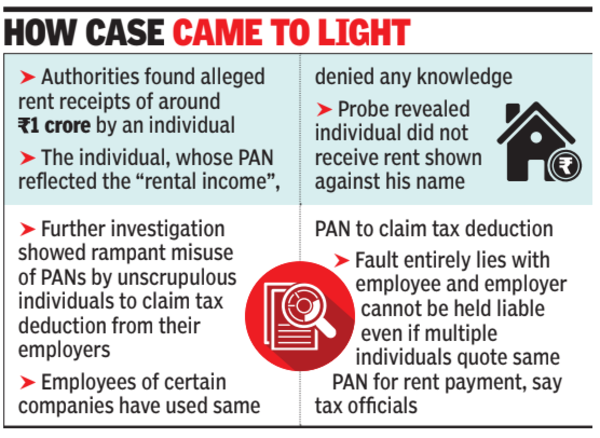

The instances first got here to gentle when authorities discovered alleged lease receipts of round Rs 1 crore by a person.When confronted, the person whose PAN mirrored the “rental income” denied any data. Further probe revealed that the person certainly didn’t obtain the lease that was proven towards his identify.

The case prompted the earnings tax department to additional examine the matter and it turned out that there was rampant misuse of PANs by unscrupulous people to assert tax deduction from their employers. So a lot in order that officers have now come throughout instances the place staff of sure corporations have used the identical PAN to assert tax deduction.

Tax officers stated the department is now going after these staff, who’ve made bogus claims to recuperate the tax. It is unclear if authorized motion can be deliberate towards them. The case displays one other occasion of PAN being misused with out the holder truly figuring out about it. In this case, what has sophisticated the matter is that at present TDS (tax deducted at supply) is relevant just for month-to-month lease of over Rs 50,000 or annual fee in extra of Rs 6 lakh. So, quite a bit of staff have been misusing the profit to keep away from paying tax on rental earnings.

“Most of the financial transactions are linked to PAN. With use of latest technology and automated processes and data analytics, it is not very difficult for tax authorities to track fake claims. This may not only entail tax payments later but also will result in levy of penal interest, penalty and even lead to prosecution in extreme cases. Where rent is paid to the parent, the rent should be paid through cheque or by way of electronic transfer (and not through cash) to demonstrate the genuineness of the transaction and that parent too needs to report that rental income in his or her return,” stated Kuldip Kumar, accomplice at Mainstay Tax Advisors.

Tax officers stated the fault solely lies with the worker and the employer can’t be held liable even when a number of people quote the identical PAN for lease fee. “Employers are not expected to make a deep investigation, but the onus is also on them to have reasonable checks and balances, while obtaining the proof of rent paid to allow HRA exemption. In fact, in some of the cases, employers have their policy that where any employee is caught having submitted a fake claim for HRA or LTA etc, such employee may be terminated from employment,” stated Kumar.