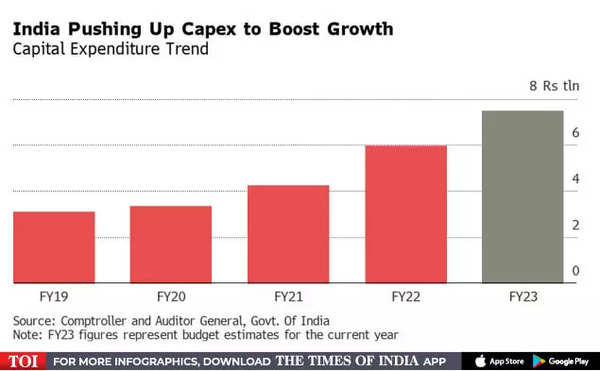

To promote itself as a gorgeous vacation spot for overseas capital, Asia’s third-largest economic system has leaned on sturdy capital spending, rising its infrastructure budget 39% and 26% within the final two years. But as recessionary woes unfold globally, India’s tax collections and asset gross sales are likely to fall, analysts say.

When finance minister Nirmala Sitharaman presents this yr’s funds on Feb. 1, she faces the daunting process of balancing a dedication to narrowing the fiscal deficit with preserving the engines of progress properly-oiled. India’s ambition to change into the world’s manufacturing unit hinges on enhancing infrastructure and smoothing out logistics — areas that also want loads of authorities funding.

Government businesses additionally face the problem of managing capability limits, in accordance to Rupa Rege Nitsure, an economist at L&T Finance Ltd. “The statistical base is very high and to spend above it year after year is not feasible within the given resource constraints,” she mentioned.

A likely slowdown in authorities income will additional impression spending. For fiscal yr 2024, which begins on April 1, progress in tax collections could average from the 30% tempo seen in 2021 and 2022, economists from HSBC Holdings Plc. mentioned.

India’s nominal gross home product progress, which isn’t adjusted for inflation, could decelerate to 10% or lower within the coming fiscal yr from an estimated 15.4% within the present monetary yr. “Such a slow growth rate would have serious implications for the macro-economy and financial markets,” Motilal Oswal Investment Services wrote in a report to shoppers earlier this month.

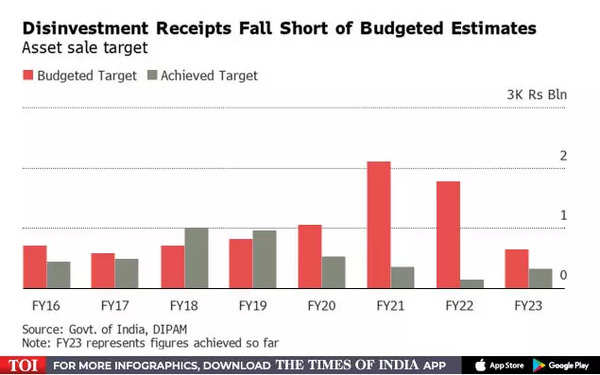

In the previous few years, tax assortment outpaced nominal progress as the federal government tightened compliance guidelines. The advantages of these measures could have already peaked. At the identical time, asset gross sales are floundering and aren’t anticipated to rebound a yr earlier than India’s nationwide elections, that are slated for 2024.

India focused $7.9 billion in privatization income this monetary yr, however to date they’ve raised nearly half of that quantity.

Madhavi Arora, an economist at Emkay Global Financial Services, warned of a state of affairs the place authorities spending and personal funding will each slow in India.

In such a situation, the “domestic growth story will lack the next lever of secular growth amid missing capex turnaround,” she mentioned.