RobertCrum | Getty Images

DETROIT – Skyrocketing auto insurance costs helped contribute to inflation accelerating at a faster-than-expected tempo in March and are including to the ever costlier costs for U.S. automobile homeowners.

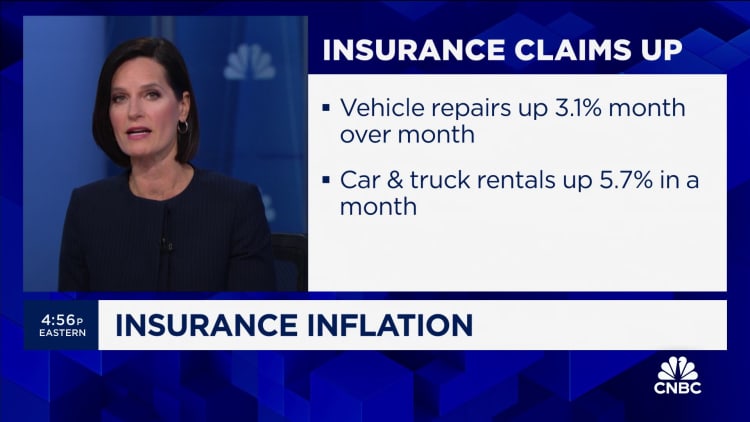

On a month-to-month foundation, car insurance costs as a part of the consumer price index rose by an unadjusted 2.7%, whereas the year-over-year elevated by 22.2%, in accordance to data released Wednesday. The index is a key inflation gauge and a broad measure of the price of items and companies throughout the financial system.

Auto insurance costs have been on the rise for a while, rising each month as a part of the index since December 2021. Since then, costs have elevated by 45.8%, in accordance to U.S. Bureau of Labor Statistics. However, auto insurance stays a small portion of the CPI, with a 2.85% weighting.

The uptick comes on prime of traditionally excessive costs for new and used vehicles because the coronavirus pandemic. It’s additionally change into more and more costlier to restore automobiles due to provide chain shortages, mechanic wage will increase and additional technologies in automobiles resembling microprocessors, cameras and different sensors — all of which contribute to higher automobile and insurance costs.

“There’s not a single factor, but I think the biggest factor is a combination of new cars and more expensive, so if you total your car the replacement cost is really high and a fender bender is very expensive right now,” mentioned Sean Tucker, senior editor at automobile valuation and automotive analysis firm Kelley Blue Book. “The technology in the cars, it’s a very specific problem.”

Instead of getting to substitute a plastic or metal bumper on many automobiles, a easy fender bender can now harm cameras, proximity sensors and various different applied sciences used for newer security options and instruments resembling cruise management, parking and emergency braking.

“Premiums have been on the rise because the cost of what goes into auto insurance has been rising,” David Sampson, CEO and president of the American Property Casualty Insurance Association, advised CNBC. “There’s a long lag time between when the trends emerge and companies see these loss trends existing. It then takes time for them to build that into their rate application filings.”

Earlier this 12 months, Sampson himself had slight harm to a bumper on a 2024 pickup truck on his property that he says was quoted to price him $1,800 to restore or substitute.

“All of the technology that we’ve come to rely on makes makes the replacement or repair of these vehicles really, really, costly,” mentioned Sampson, whose group is the first nationwide commerce affiliation for dwelling, auto and enterprise insurers.

The insurance price will increase on inflation come greater than two years after the Biden administration largely blamed used car prices for pushing inflation higher in January 2022.

Mitchell, an automotive software provider specializing in collision restore and auto insurance sectors, mentioned restore costs have been rising at an annual fee of about 3.5% to 5% prior to the coronavirus pandemic. As of 2022, the will increase have been at 10% or above, with the typical repairable estimate for a automobile at $4,721 in 2023.

Consumers and corporations alike aren’t proud of the will increase. J.D. Power in June reported auto insurers misplaced a mean of 12 cents on each greenback of premium they collected in 2022 — the worst efficiency in additional than 20 years — leading them to increase charges on the expense of buyer satisfaction.

“What I always remind folks is that insurance is based on actuarial science, so it’s not a case of insurers just deciding that they want to increase premiums,” Sampson mentioned. “The filings have to be based on actuarial loss trends in their rate applications in each state.”

The price of auto insurance — which is necessary in nearly each state — varies by supplier, driver, protection and location. Nearly all states have minimal necessities for legal responsibility protection, however there are a lot of different coverages that will or might not be required in a particular state, in accordance to insurance supplier Progressive.

The listing of optionally available and necessary protection areas will be fairly lengthy and costly for drivers, which has led many insurance corporations to supply usage-based insurance, or UBI, applications that base the price of a coverage on a driver’s behaviors utilizing telematics information.

Customers who are new to an insurer have a UBI participation fee of 26%, in accordance to the J.D. Power’s U.S. Auto Insurance Study from June.

The examine, in its 24th 12 months, discovered UBI utilization greater than doubled from 2016 to 2023, with 17% of auto insurance prospects taking part in such applications. Price satisfaction amongst prospects taking part in these applications is 59 factors higher on common than amongst non-participants, in accordance to J.D. Power.

Usage in such applications is barely anticipated to enhance as costs rise and insurers supply reductions or particular costs for safer drivers, in accordance to insurance corporations.

Based on J.D. Power’s survey, UBI applications from Geico, Progressive, State Farm and Liberty Mutual have been ranked above common by prospects. USAA, which companies all branches of the army and their households, ranked the very best.

J.D. Power’s examine additionally discovered the associated fee will increase have led to a greater than 20-year low in buyer satisfaction with auto insurance corporations.

“Overall customer satisfaction with auto insurers has plummeted this year, as insurers and drivers come face to face with the realities of the economy,” Mark Garrett, director of insurance intelligence at J.D. Power, mentioned in a June launch.

— CNBC’s Robert Ferris and Jeff Cox contributed to this text.