JGI/Jamie Grill | Blend Images | Getty Images

Millennials’ retirement prospects appear rockier than these of older generations of Americans.

That’s largely a operate of long-term coverage adjustments — like a later age for full Social Security advantages and a shift to 401(ok)-type plans — longer common lifespans and a much bigger student debt burden relative to cohorts like Generation X and child boomers, in response to retirement specialists.

However, there’s room for optimism as a result of youthful households have some benefits that may enable them to make up misplaced floor.

“Millennials are behind,” stated Craig Copeland, director of wealth advantages analysis on the Employee Benefit Research Institute. “But they have time to catch up, too.”

Millennials, a cohort born from roughly 1981 to 1996, are the nation’s largest grownup era. They’ll be 28 to 43 years outdated this yr.

By comparability, people in Gen X had been born from 1965 to 1980, and child boomers from 1946 to 1964.

‘Deteriorating’ retirement outlook

About 38% of early millennials (these born within the 1980s) can have “inadequate” retirement earnings at age 70, in response to projections from a 2022 Urban Institute study.

By comparability, 28% to 30% of early and late boomers and 35% of early Gen Xers are projected to have insufficient earnings, in response to the research. It measures earnings from Social Security, different authorities money advantages, earnings, pensions and 401(ok)-type plans.

“We do see the retirement outlook deteriorating for future generations,” together with millennials, stated Richard Johnson, director of Urban’s retirement coverage program and co-author of the report.

The Urban research measures earnings inadequacy in two methods: both an lack of ability to exchange no less than 75% of 1’s pre-retirement earnings (i.e., a decline in dwelling requirements), or earnings that falls within the backside quarter of the annual U.S. common wage (i.e., not with the ability to meet fundamental wants), Johnson stated. It assumes all cohorts will get full Social Security advantages below present regulation.

Early millennials of coloration, those that aren’t married, and people with little schooling and restricted lifetime earnings are in an “especially precarious” place, in response to the Urban report.

Millennials’ scholar loans dent their web price

A 2021 paper by the Center for Retirement Research at Boston College had comparable findings.

While millennials seem like boomers and Gen Xers in some ways — they’ve comparable homeownership, marriage charges and labor-market expertise at comparable ages, for instance — they’re “well behind” on complete wealth accumulation, CRR stated.

For instance, millennials ages 34 to 38 have a net-wealth-to-income ratio of 70%, a lot decrease than the 110% and 82% for Gen X and late boomers, respectively, once they had been the identical age, in response to its report. Likewise, web wealth for 31- to 34-year-olds is 53% of their annual earnings, versus 76% and 59% for equally aged Gen Xers and boomers, respectively.

The major motive for the wealth hole: scholar loans, CRR discovered.

Millennials are behind. But they’ve time to catch up, too.

Craig Copeland

director of wealth advantages analysis on the Employee Benefit Research Institute

More than 42% of millennials ages 25 to 36 have scholar debt, versus 24% of Gen Xers at that age, in response to a 2021 EBRI study.

Household wealth for the standard millennial family was about three-quarters that of Gen X on the similar ages ($23,130 vs. $32,359, respectively), regardless of millennials having extra house fairness and bigger 401(ok) balances, EBRI discovered.

“Student loans are really taking a dent out of [millennials’] net worth,” stated Anqi Chen, a co-author of the 2021 CRR report and the middle’s assistant director of financial savings analysis. “It’s unclear how that will play out in the long run.”

To that time, 58% of millennials say debt is a headwind to saving for retirement, in comparison with 34% of boomers, for instance, in response to an annual poll by the Transamerica Center for Retirement Studies.

Why pensions supplied extra safety

Millennials produce other disadvantages in comparison with older generations.

For one, longer lifespans imply they have to stretch their financial savings over extra years. Out-of-pocket healthcare prices and people for companies like long-term care have spiked, and so they’re extra more likely to have youngsters at later ages, specialists stated.

Further, whereas older employees with entry to office retirement plans relied on pension earnings, employees as we speak (particularly these within the non-public sector) largely have 401(ok)-type plans.

“Pensions started to go away in the mid-’90s, when Gen Xers were just starting in the workforce and millennials were still in grade school,” Copeland stated.

More from Personal Finance:

Why working longer is a bad retirement plan

This account is like an ‘extra strength’ Roth IRA

Are U.S. seniors among the developed world’s poorest?

Pensions give a assured earnings stream for all times, with contributions, investing and payouts managed by employers; 401(ok) plans offload that accountability onto employees, who may be ill-equipped to handle it.

In 2020, 12 million private-sector employees had been actively collaborating in pensions, whereas 85 million did so in a 401(ok)-type plan, according to EBRI.

While employees can probably amass a bigger nest egg with a 401(ok), the “big issue” is that advantages do not accrue robotically as with a pension, Copeland stated.

“The old pension system didn’t work for everyone,” Johnson stated. “But it did provide more security than the 401(k) system does today.”

Meanwhile, the final main Social Security overhaul, in 1983, step by step raised this system’s “full retirement age” to 67 years old. (This is the age at which individuals born in 1960 or later can get 100% of their earned profit.)

That improve, from age 65, delivers an effective 13% benefit cut for impacted employees, according to the Center on Budget and Policy Priorities.

Congress may deliver more benefit cuts to shore up Social Security’s shaky monetary footing; such reductions would doubtless influence youthful generations.

Millennials have benefits, too

Of course, millennials even have benefits that imply as we speak’s gloomy retirement prospects will not essentially grow to be actuality.

For one, whereas millennials shoulder extra scholar debt, they’re additionally extra educated. That will make it simpler to save lots of for retirement, in response to a Brookings Institution report. Higher instructional attainment usually interprets to larger wages; larger earners additionally have a tendency to save lots of extra of their earnings, be more healthy, and have much less bodily demanding jobs, it stated.

Pensions additionally usually incentivize retirement at a comparatively early age, which means 401(ok) accountholders may keep within the workforce longer, making it simpler to finance their retirement, in response to the report’s authors, William Gale, Hilary Gelfond and Jason Fichtner.

The outdated pension system did not work for everybody. But it did present extra safety than the 401(ok) system does as we speak.

Richard Johnson

director of the Urban Institute’s retirement coverage program

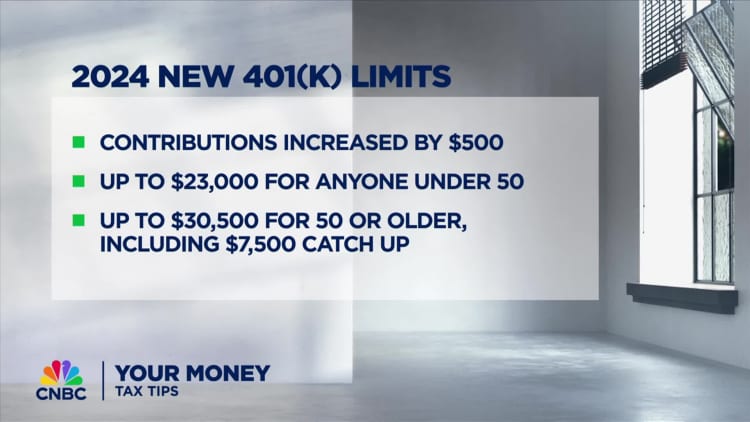

401(ok) plans are additionally adapting to spice up participation and financial savings for coated employees.

For instance, automated enrollment and automated contribution will increase have grown more popular with employers. A current regulation, Secure 2.0, additionally made it easier for workers to receive a 401(k) match from their employer whereas paying down scholar debt.

Vanguard Group, an asset supervisor and retirement plan supplier, discovered that 401(ok) enhancements have helped put a subset of millennials (age 37 to 41) forward of older cohorts in retirement preparedness. For instance, the standard “early” millennial is projected to exchange 58% of their job earnings with retirement earnings, relative to 50% for late boomers (age 61 to 65), in response to a current Vanguard report.

So, whereas there’s trigger for concern, there’s additionally room for optimism, specialists stated.

“You’re not really going to know for 40, 50 years” how this performed out, stated Copeland.

What to do in case you’re behind on retirement financial savings

Young savers who really feel behind on constructing their nest egg ought to strive rising their financial savings incrementally, in response to Sean Deviney, an authorized monetary planner primarily based in Fort Lauderdale, Florida.

The purpose is to ultimately save no less than as much as your full firm matching contribution; retirement planners usually advocate contributing no less than 15% of pay to a 401(ok), between a employee’s and firm’s contribution.

Savers who cannot do that ought to begin small as an alternative of forgoing saving fully, Deviney stated.

“Even if you just start with 1% of pay — one penny on every dollar — it starts that automated savings process for you,” Deviney stated. “If you do it in small steps, it’s much easier than trying to do some massive change.”

Automate financial savings to the extent doable so it is on auto pilot, similar to by turning on a operate that robotically escalates financial savings by 1% or extra every year, he added.

However, households ought to generally first prioritize paying down “bad” debt like credit card bills, which carry a high interest rate, Deviney stated. Build up a couple of months of emergency financial savings and ensure you’re not spending extra than you make every month; in any other case, households may extra readily flip to bank cards to fund their way of life.

Further, do not forgo your retirement financial savings to save lots of for a kid’s faculty schooling, he stated. There are some ways to fund schooling — grants, scholarships and loans, for instance — however “not a lot of ways to fund your own retirement,” he stated.