When it involves teens and money, there may be usually a disconnect.

Overall, teenagers are taking a higher curiosity in their very own long-term monetary well being — though far fewer perceive fundamental retirement planning.

In a current survey of 13- to 18-year-olds, 83% stated that they had already thought about their retirement, in response to Junior Achievement and MissionSquare.

But most teenagers mistakenly believed saving money in a checking account was one of the best long-term technique. Only 45% stated investing in shares and bonds with the assistance of a monetary advisor, which might provide a greater long-term return, was the popular technique to go.

“This research shows retirement is more top-of-mind for teens than one might think,” stated Jack Kosakowski, Junior Achievement’s president and CEO. “While young people have given retirement planning some thought, it’s apparent they still need information on the best way to go about it.”

‘The best money-making asset you may possess’

Although retirement can appear very distant, significantly for these simply beginning out, teenagers have a novel alternative others don’t, in response to Ed Slott, an authorized public accountant and founder of Ed Slott and Co.

“The greatest money-making asset you can possess is time,” he stated. “Someone who starts at 15 has a huge advantage even over someone who starts at 25.”

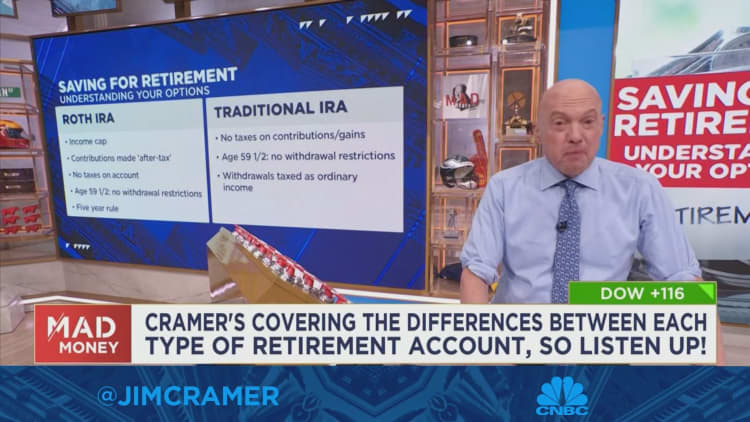

Slott recommends opening a Roth individual retirement account to get a head begin.

Contributions to a Roth IRA are taxed up entrance and earnings develop tax-free. In retirement, withdrawals are fully free of tax and penalties (so long as the account has been open for not less than five years).

Since there are no age restrictions, anybody with earned earnings — say, from a summer time job — can contribute.

Even if a teen solely places some cash away, mother and father can add funds on their kid’s behalf, so long as the mixed quantity does not exceed {the teenager}’s earned earnings for the 12 months. Once contributed, the cash inside a Roth IRA account may be invested appropriately to go well with any kind of long-term purpose.

In Christopher Jackson’s 12th grade private finance class, college students open Roth IRAs with an preliminary grant of $100 from the group, which they then learn to preserve on their very own. Jackson, who teaches at DaVinci Communications High School in Southern California, tells his college students that “this is going to be the most important class they are going to take in their life.”

“My No. 1 goal is to affect their children’s children,” he recently told CNBC.

How Roth IRAs enable you begin saving

While there’s a most IRA contribution restrict of $7,000 for 2024, it is much less about how a lot you save and extra about the act of saving, Slott stated. “It doesn’t have to be a lot. Time is the key asset.”

Meanwhile, each the funding and all of the curiosity, dividends and progress on these property will accumulate tax-free through the years.

If there are extra fast wants earlier than hitting retirement age, account holders can withdraw their contributions at any time with out taxes or penalties if, as an example, they want the cash for college or a down fee on a house down the street, in response to Slott.

However, Slott advises younger adults to view tapping these funds as a final resort.

“Roth money is the last money you should touch because that money is growing the fastest and it will never be eroded by current or future taxes,” he stated.