An official accustomed to the deliberations advised ET, “Some areas in finance and insurance, (and) even in defence, could still be looked at in terms of further reduction. Brainstorming is going on, but it has not reached anywhere.”

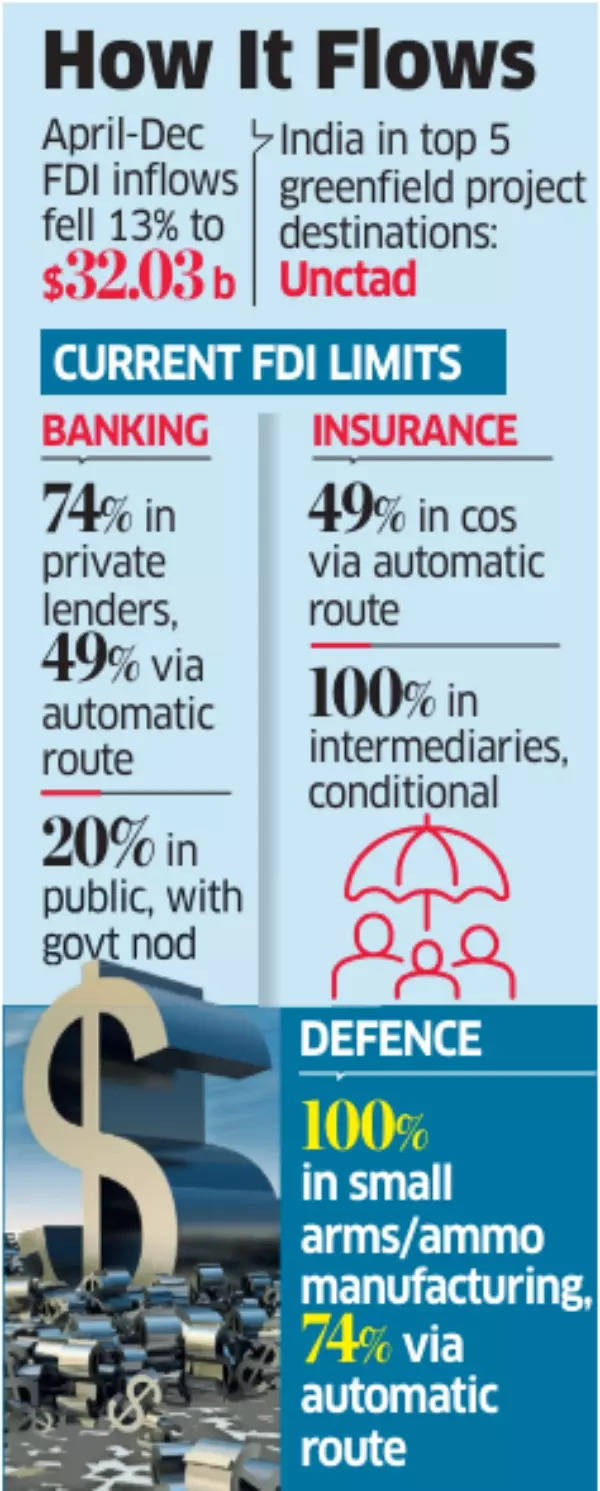

The closing choice will likely be made after consultations amongst officers and stakeholders. During the interval of April-December 2023, FDI fairness inflows skilled a 13% year-on-year decline, amounting to $32.03 billion. The United Nations Conference on Trade and Development (Unctad) has attributed this droop in FDI in growing nations to weak investment and financial uncertainty.

FDI Limits

The banking, monetary providers and insurance coverage (BFSI) sector, together with outsourcing and R&D, attracted the highest inflows, amounting to $5.18 billion throughout April-December 2023. The Indian authorities believes that the nation ought to additional chill out its FDI guidelines, regardless of having a extra liberal coverage in comparison with another nations.

An official acknowledged, “We are more liberal than most of the Asean countries, which are generally considered very open.”

Currently, India permits 74% FDI in personal sector banking, with as much as 49% permitted by way of the automated route and authorities approval required past that threshold. In public sector banking, the FDI cap is ready at 20% by way of the authorities route.

Also Read |India’s Mission 2047: How India aims to become a developed economy – high speed expressways, electric mobility, digital payments & more

The insurance coverage sector permits 49% FDI in insurance coverage corporations by way of the automated route and 100% in insurance coverage intermediaries, topic to sure circumstances.

The defence business is topic to industrial licence below the Industries (Development & Regulation) Act, with FDI allowed as much as 100% in the manufacture of small arms and ammunition below the Arms Act, of which as much as 74% is permitted by way of the automated route, topic to circumstances. Between April 2000 and December 2023, FDI fairness inflows in the defence sector amounted to $16.38 million.