The RBI floated a concept note delving into the dangers and advantages of introducing Central Bank Digital Currencies (CBDCs) in India as a part of their phased implementation technique

The RBI floated a concept note delving into the dangers and advantages of introducing Central Bank Digital Currencies (CBDCs) in India as a part of their phased implementation technique

The story to this point: Earlier in October, the Reserve Bank of India (RBI) floated a concept note enumerating the goals, decisions, advantages and dangers of issuing Central Bank Digital Currencies (CBDC), or e₹ (digital rupee) in India. The Central Government in March notified the mandatory amendments within the Reserve Bank of India Act, 1934, paving the way in which for working a pilot programme and the next issuance of CBDCs.

Broadly, aside from fostering monetary inclusion and decreasing operational prices related to bodily money administration, the e₹ would try to deal with “rapidly mushrooming cryptocurrencies” which the regulator has on a number of events acknowledged can “usher in decentralised finance and disrupt the traditional financial system”.

What is a CBDC? What goal wouldn’t it serve?

The apex regulator defines CBDC as a authorized tender issued by the central financial institution in digital kind. It can be just like the sovereign paper foreign money— albeit digital. Further, e₹ can be accepted as a authorized tender and function a medium of fee and a secure retailer of worth and would transfer away from the aggressive ‘mining’ of cryptocurrencies to an algorithm-based course of. The different options talked about would accord it better utility than a crypto-asset.

It would seem as a legal responsibility on the central financial institution’s steadiness sheet. The prime causes for exploring CBDC’s use case entail fostering monetary inclusion, decreasing prices related to bodily money administration and introducing a extra resilient and modern funds system. More importantly, it might present the overall populace an alternative choice to unregulated cryptocurrencies and theirassociated dangers.

The e₹ may be transformed to any business financial institution cash or money. It can be a fungible authorized tender for which holders needn’t have a checking account – therefore, strengthening the reason for monetary inclusion.

What is the prevailing notion about CBDCs outdoors India?

As per Washington suppose tank Atlantic Council, 105 nations representing 95% of the worldwide GDP are exploring a CBDC. In reality, the International Monetary Fund (IMF) says that the Asia-Pacific area is on the forefront of introducing digital currencies. Countries like Bangladesh and Maldives, which haven’t achieved a lot analysis and improvement about CBDC adoption, areinterested and studying from their friends, as per the IMF.

The rationale for introducing CBDCs fluctuate throughout nations. However, a lot of nationwide regulators’ curiosity stemmed from the surge in crypto uptake noticed in 2020-21. Thus, regulators now endeavour to train extra warning in coping with volatilities triggered by ‘crypto-busts’ and ‘crypto-winters’, or intervals of depressed crypto costs.

Bahamas and Nigeria have been the primary nations to launch their very own CBDCs.

Launched in Oct 2020, the ‘Bahamian Sand Dollar’ is a working example for monetary inclusion. Its main goal was to serve the unbanked and the under-banked populations throughout greater than thirty of its inhabited islands. On comparable strains, East Carribean Central Bank which is the central regulator for Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, St Kitts and Nevis and St Vincent and the Grenadines grew to become the primary foreign money union central financial institution to have a CBDC.

Paper currencies must bodily journey and require sure logistics to be accessible to folks. For these distant island nations, CBDCs as a foreign money would guarantee wider geographical protection. With decidedly decrease logistical challenges than paper foreign money.

Senegal and Ecuador, on the opposite hand, have opted out of launching CBDCs.

It is not only the smaller nations that are exploring CBDCs. As identified by the IMF, 19 G20 nations too are exploring its potentialities. Separately, Asian nations sitting on sure essential technological developments can be helped of their CBDC plunge. For instance, China’s CBDC undertaking was initiated in 2014 with Singapore and Hong Kong SAR getting into the body in 2016 and 2017.

What are the various types of CBDCs?

Based on their utilization and capabilities, CBDCs are categorised into retail (CBDC-R) and wholesale (CBDC-W).

CBDC-R is supposed for retail consumption and may be availed by all together with the personal sector, non-financial customers and companies. On the opposite hand, CBDC-W ismeant for interbank transfers and wholesale transactions by monetary establishments.

CBDC-R may be significantly helpful for a regulator to make sure monetary inclusion. Being digitally based mostly, it may bolster fee mechanisms. On the opposite hand, CBDC-W can assist enhance the effectivity of interbank funds or securities settlement, as has been noticed in Project Jasper, Canada’s CBDC undertaking, in addition to Project Ubin— Singapore’s CBDC undertaking.

Now coming to the query of accessibility; in different phrases— how the asset would stream within the provide chain. The two instructed mannequin sorts are the token-based system and the account-based system.

The former would stream into circulation like a banknote and may be electronically transferred from one entity to a different. Token possession is prima face verified— the possessor of e₹ is by default deemed as its proprietor, identical to banknotes. Only the authenticity of the token is to be verified.

In distinction, the account-based system would require the payer to confirm that he has the authority to make use of the account and in possession of adequate steadiness to hold forth a transaction – just like current digital transaction strategies. It requires sustaining a document of balances and transactions of all holders of the CBDC and point out his/her possession of financial balances.

What would the ‘supply chain’ be like?

The previously-illustrated distribution mannequin might doubtlessly be built-in to both the single-tier or the double-tier mannequin.

As the identify would possibly counsel, within the Direct CBDC system the central financial institution manages the complete provide chain from issuing CBDCs, to sustaining accounts and verifying transactions. Its server is concerned in all funds.

The double-tier mannequin provides to the provision chain the position of an middleman (or a service supplier). This provide chain is additional categorised into two, specifically, the oblique mannequin and the hybrid mannequin.

The oblique mannequin entails customers holding an account/pockets with a financial institution, or service supplier. The obligation to offer CBDCs to retail prospects would fall on the service supplier and never the central financial institution. The latter would solely be concerned in guaranteeing that the wholesale steadiness is similar to the retail balances of its retail prospects; in different phrases, scrutinising whether or not the CBDCs being given to retail prospects are equal to what the intermediaries have been allotted.

In distinction, whereas the middleman handles retail funds within the hybrid mannequin, the central financial institution offers CBDCs immediately by intermediaries. In different phrases, the central financial institution in addition to the intermediaries preserve the ledger of all transactions and handle funds. The regulator would function a backup technical infrastructure permitting it to restart the fee system if intermediaries run into insolvency or technical outages.

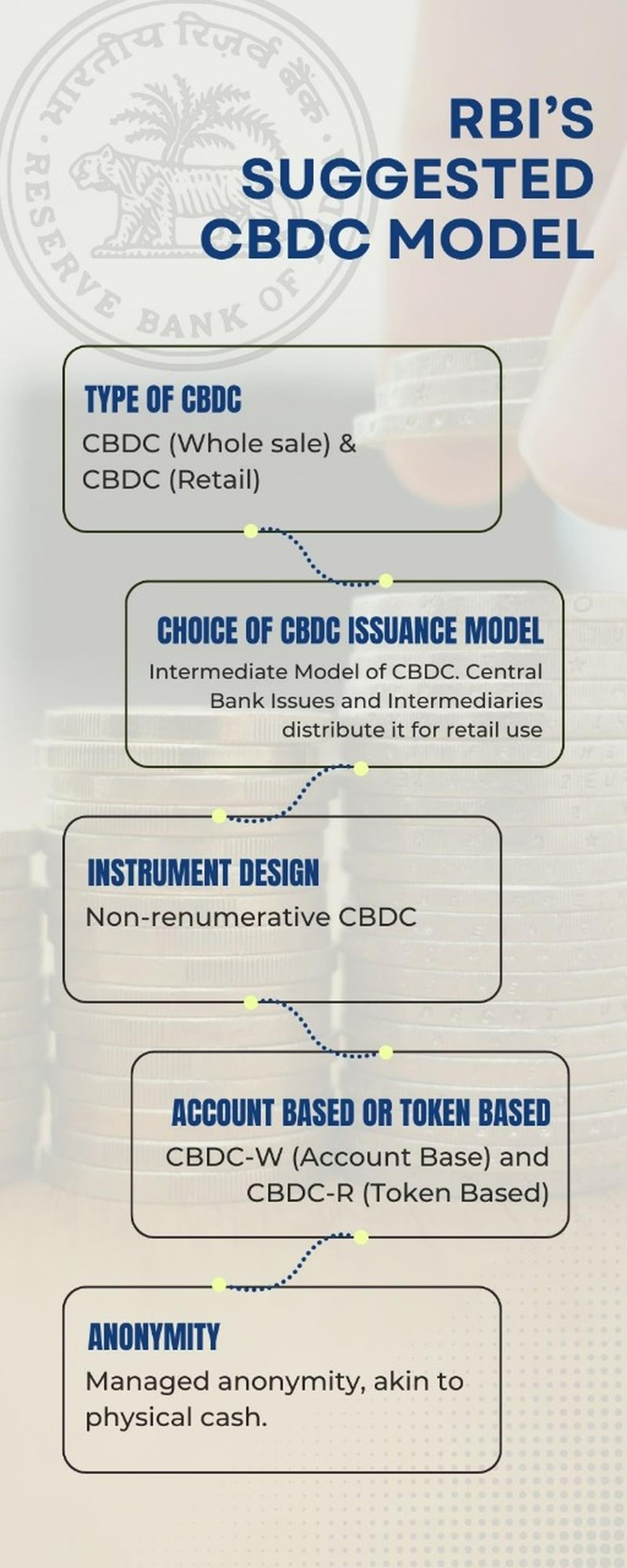

What fashions does the RBI deem appropriate?

The RBI deems the oblique mannequin extra appropriate for India, with the central financial institution creating and issuing tokens to authorised entities referred to as Token Service Providers (TSPs). These TSPs would then distribute the tokens to end-users who undertake retail transactions.

The regulator acknowledges that it could not have a comparative and aggressive benefit over banks in distribution, account-keeping and buyer verification, amongst others. This is very in an surroundings the place know-how is quickly altering.

Further, it deems CBDC-W appropriate for account-based transactions and CBDC-R for token-based transactions. Issuing CBDC-R in a token-based system would assist the regulator with its monetary inclusion targets. Additionally, CBDC-W in an account-based system would facilitate prompt settlement with a well-established authorized standing as transactions would emanate from verified accounts.

Does the concept note level to sure challenges?

The concept note highlighted sure considerations pertaining to information assortment and anonymity, cyber-security, dispute decision and accountability.

About considerations pertaining to information assortment and anonymity, the apex regulator notes that there emerges a risk that nameless digital foreign money would facilitate a shadow financial system and unlawful transactions. Regulators require perception to establish suspicious transactions, reminiscent of these pertaining to cash laundering and terrorism financing, amongst others. Addressing this concern, the IMF recommends instituting a selected threshold (say $10,000) for regulatory oversight.

The apex regulator recognises there may be an elevated likelihood of payment-related frauds in nations with decrease monetary literacy ranges. It states the ecosystem can be a “high-value target” since you will need to preserve public belief. Ensuring monetary literacy and cyber-security thus turns into crucial.

CBDCs would additionally want infrastructure for facilitating offline transactions. The danger of ‘double spending’ is spurred when operations head offline. This is as a result of a CBDC unit might doubtlessly be used greater than as soon as with the ledger requiring an web connection to replace. However, RBI believes it may very well be mitigated to a big extent by technical options and imposing limits on offline transactions. It acknowledges the significance of enhancing offline capabilities for wider use, pointing to solely 825 million of a complete inhabitants of 1.40 billion having web entry in India.

RBI would additionally discover the opportunity of cross-border funds utilizing CBDCs. In a associated context, the IMF has noticed that fragmented worldwide efforts to construct CBDCs would doubtless lead to interoperability challenges and cross-border safety dangers. “Countries are understandably focussed on domestic use, with too little thought for cross-border regulation, interoperability and standard-setting,” it mentioned.

And lastly, monetary implications can be troublesome to establish contemplating that the potential demand can be topic to the implementation framework. However, RBI highlights two broad considerations within the occasion of a monetary disaster. There might both be a possible ‘bank run’, in different phrases, folks withdraw their cash quickly from banks, or a monetary disintermediation that will immediate banks to rely on costlier and fewer secure sources of funding.

The swap from money to CBDC would possibly simply be a transition from one asset to a different and may not influence the banking sector’s steadiness sheet. Similarly, as per the RBI, a swap from deposits to CBDC would shrink the steadiness sheet just like withdrawal of banknotes from an ATM or department.

However, ought to a financial institution’s reserves fall beneath its means to satisfy supervisory liquidity measures, the central regulatory financial institution is likely to be required to inject some liquidity.