Today, nonetheless, fast commerce is quick changing into ubiquitous for a lot of millennial and Gen Z households. Companies have moved past groceries to ship objects starting from followers and T-shirts to jewelry and iPhones.

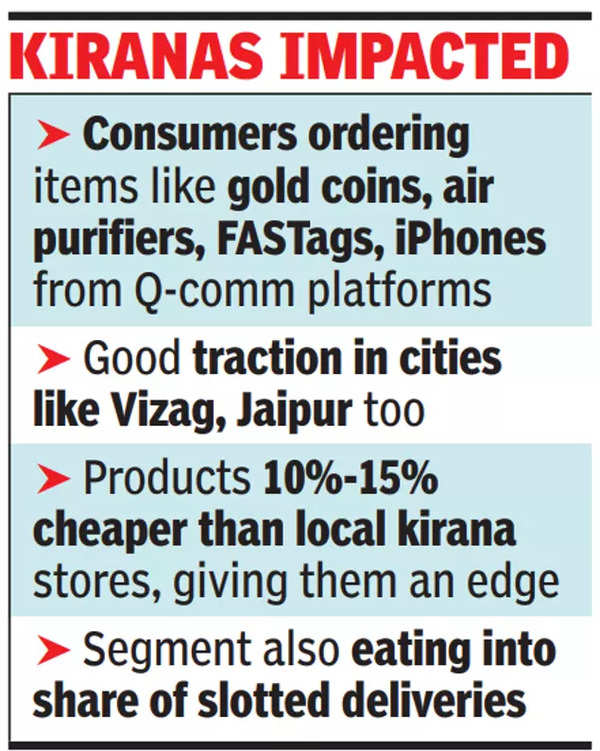

In a latest be aware, Goldman Sachs mentioned Blinkit’s implied valuation – estimated at $13 billion – is now increased than that of mum or dad Zomato’s core meals supply enterprise, indicating the speedy growth of the phase. Though nonetheless largely a metro play, Q-commerce is discovering takers in cities like Vizag, Nagpur, Kochi, Jaipur and Lucknow, executives at Swiggy Instamart and BigBasket advised TOI.

‘Q-commerce accounts for 50% of online grocery market’

In the previous one yr, half the brand new clients that we’ve got added are all pure play fast commerce clients, who typically don’t make deliberate purchases and find yourself shopping for 4-15 instances a month from our platform,” mentioned Seshu Kumar Tirumala, chief shopping for and merchandising officer at BigBasket.

For IPO-certain Swiggy, growth of Instamart in non-metros like Jaipur and Kochi has greater than doubled prior to now 12 months. “Given the wide array of products, we are seeing good traction in both metros and non-metros,” mentioned Phani Kishan, CEO, Swiggy Instamart.

According to analysts, a share of grocery spends within the high 7-8 cities could also be shifting from native kirana shops to fast commerce.

“Incremental purchases solely cannot justify the growth of quick commerce. Some parts of offline purchases and scheduled online deliveries have moved to the segment. The platforms are also getting sales from impulse purchases which will not go to kirana stores,” mentioned Satish Meena, advisor at market analysis agency Datum Intelligence.

With platforms like Zepto, Swiggy Instamart and Blinkit increasing into classes like magnificence and private care (BPC), toys, electronics, stationery objects, a share of e-commerce gross sales is certain to get impacted. At current, non-grocery objects account for about 15%-20% of fast commerce purchases.

“If consumers can get a toy or a BPC item on a quick commerce platform instantly, they won’t wait for Amazon and Flipkart to deliver it to them. That is why players like Flipkart have started working on the quick commerce model,” Meena mentioned. “Consumers have been ordering everything, from gold coins during the festive season to air purifiers, FASTags, headphones, toys and more,” mentioned Kishan.

Goldman Sachs estimates the dimensions of the net grocery market, by way of gross order worth (GOV), to be about $11 billion as of FY24. Of this, fast commerce already makes up 50% or $5 billion. Q-commerce platforms have additionally been capable of worth merchandise about 10%-15% cheaper than native kirana shops, giving them an edge within the recreation. “Given the scale of platforms such as Blinkit, they are able to get pricing/sourcing advantage from manufacturers,” mentioned analysts on the agency.

“We want to become an attractive option even when compared to the best discount grocers in the offline space. If we can give consumers access to better prices and 10-minute deliveries, why won’t they buy from Zepto?” co-founder and CEO Aadit Palicha had advised TOI earlier.

In phrases of pockets share, fast commerce probably accounts for five%-6% of a family’s grocery spends.