Paytm’s Rs 18,300 crore share sale through preliminary public providing (IPO), the nation’s largest IPO, will open for subscription at 10:00 am on Monday. The firm is planning to promote shares within the worth band of Rs 2,080-2,150 per share and a retail investor can bid for minimal one lot of six shares as much as most of 15 tons. At the higher worth band one lot of Paytm shares will price Rs 12,900.

Here are 10 issues to find out about Paytm IPO:

-

Paytm’s IPO consists of recent subject of Rs 8,300 crore and a proposal on the market (OFS) by present shareholders value Rs 10,000 crore.

-

Apart from Paytm’s managing director and CEO Vijay Shekhar Sharma, traders like Japan’s SoftBank, China’s Ant Group and Alibaba in addition to Elevation Capital are among the many prime traders diluting their stakes within the IPO.

-

Paytm goes to utilise the returns from the IPO for varied actions like “acquisition of consumers and merchants and providing them with greater access to technology and financial services”. The firm may even put money into new enterprise ventures, partnerships and acquisitions, whereas the remaining funds might be used for different company actions.

-

Ahead of the IPO, Paytm allotted shares value Rs 8,235 crore to greater than 100 institutional traders, together with the federal government of Singapore, forward the nation’s largest inventory market itemizing.

-

Paytm garnered curiosity from 122 institutional traders who purchased greater than 38.Three million shares for Rs 2,150 apiece, in keeping with a regulatory doc dated November 3.

-

BlackRock Global Funds, Canada Pension Plan Investment Board and Abu Dhabi Investment Authority have been among the many traders.

-

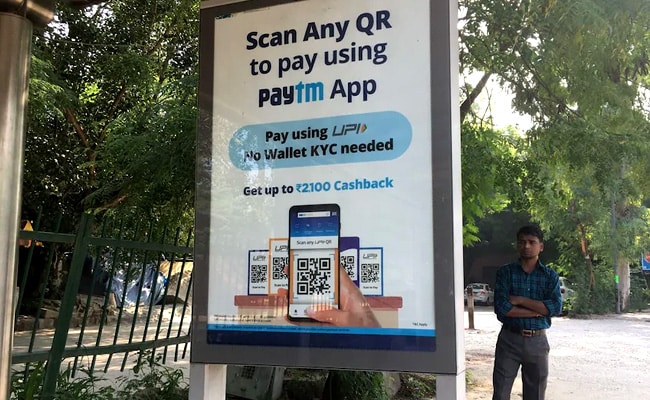

Launched a decade in the past as a platform for cell recharging, Paytm grew shortly after ride-hailing agency Uber listed it as a fast fee possibility. Its use swelled additional in 2016 when a ban on high-value foreign money financial institution notes in India boosted digital funds.

-

Several firms together with Paytm have tapped capital markets this 12 months in a fund-raising frenzy on the again of report highs hit by the Indian inventory market, which has outperformed Asian friends up to now this 12 months.

-

In India, 157 firms together with TPG-backed Nykaa, Oyo Hotels and Rooms and on-line insurance coverage aggregator Policybazaar have raised $17.22 billion through IPOs this 12 months as of October 31, in contrast with $8.54 billion raised by 49 firms in the identical interval final 12 months, in keeping with Refinitiv knowledge.

-

Paytm’s IPO is prone to be the largest within the nation’s company historical past, breaking a report held by Coal India Ltd, which raised Rs 15,000 crore greater than a decade earlier.