Bankers have responded to queries about their degree of IT capabilities in gentle of the RBI motion on Kotak Mahindra Bank freezing digital onboarding and issuing bank cards.They stated that investments in IT functionality are a steady course of and can’t be thought-about as executed and dusted.

Previously, expertise primarily replicated guide duties. Now, investments cowl numerous areas, reminiscent of dealing with billions of month-to-month transactions throughout channels, enabling integration with different companies and providers, leveraging analytics for focused gross sales, and using synthetic intelligence for customer support with out human involvement.

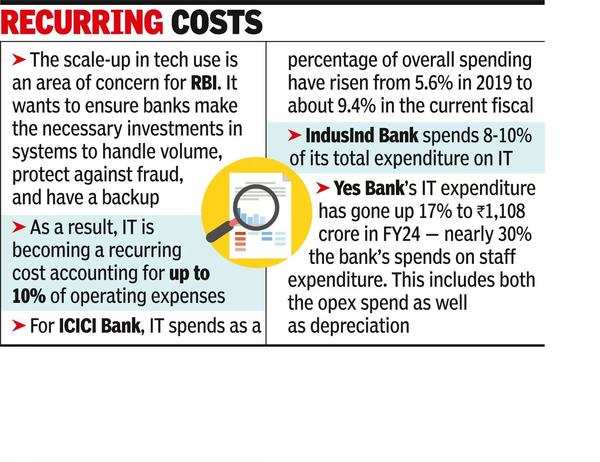

The scale-up in the usage of expertise is an space of concern for the Reserve Bank of India, which desires to make sure that banks have made the mandatory investments in programs to deal with the quantity, shield in opposition to fraud, and have a backup.

“Our IT and cybersecurity spending as a percentage of overall spending between 2019 and the current fiscal year has moved up from 5.6% to about 9.4%,” stated Sandeep Batra, Executive Director of ICICI Bank, in an earnings name after the financial institution’s outcomes. The financial institution stated that expertise spending would proceed to develop at a sooner tempo than general expenses, however the fee of development of tech expenses, given the massive tempo, would average.

Bankers stated that the problems cited by RBI in the case of Kotak – managing IT tools, updating software program, controlling consumer entry, vendor threat administration, and information safety technique – are a part of the RBI’s guidelines in supervision. “These are issues that have to be constantly addressed. A bank cannot say that it has addressed the issues once and for all.”

According to Sumant Kathpalia, MD & CEO of IndusInd Bank, the financial institution spends 8-10% of its complete expenditure on info expertise. He added that the personal lender has a board-degree committee that’s continuously evaluating its expertise capabilities.

Yes Bank stated that its IT expenditure has gone up 17% to Rs 1108 crore in FY24, which is sort of 30% of what the financial institution spends on workers expenditure. The expenditure consists of the opex spend in addition to depreciation. “About 10% of our operating costs are coming from technology, and we are conscious of making sure that we keep investing in technology, information security, and infrastructure for our future scale,” a financial institution official stated.

Subrat Mohanty, Executive Director in cost of banking operations at Axis Bank, stated that the financial institution has made investments to deal with the surge in digital transactions whereas guaranteeing system resilience and information safety. “This is a constant kind of work that we have been at for the last three to four years. And fundamentally, this requires a very strong and new-gen technology architecture, which separates the core banking system from the middleware, and then middleware from the frontend systems where most of the transactions are happening, which we have done,” he stated.