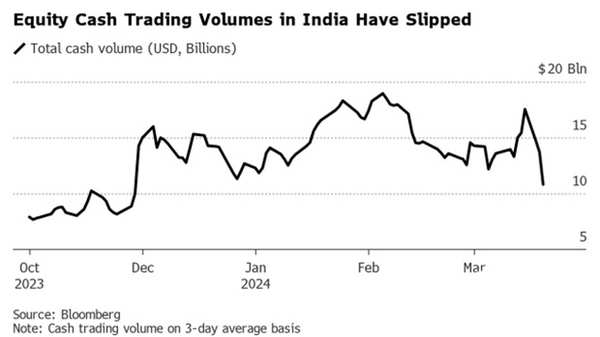

The each day money buying and selling quantity has shrunk to $10 billion from a document $19 billion in early February, with latest classes account for the majority of the decline, knowledge compiled by Bloomberg present.

Warnings from India’s securities regulator that small caps are overheating has sparked a pullback in native shares, with the gauge of such companies tumbling greater than 6% this month. Individual traders, who usually drive money volumes, are seemingly maintain off on recent purchases till the market stabilizes, maintaining buying and selling exercise subdued.

“Retail investors were caught on the wrong side” they usually have a tendency to remain on the sidelines till a transparent pattern emerges, stated Ashish Kyal, founding father of Waves Strategy Advisors Pvt.

Despite the broader market downturn, urge for food for big deals stays sturdy amongst establishments. Block trades have topped $7 billion this yr, set for his or her finest quarter in 14 years, the information present.

Smallcap rout dents Indian equity volumes amid big block deals – Newz9

Equity buying and selling volumes in India have fallen to the bottom stage since December because the selloff in shares of smaller firms slows the frenzy of retail traders into the nation’s $4.three trillion market, whilst establishments snap up massive deals.

- Advertisement -

- Advertisement -