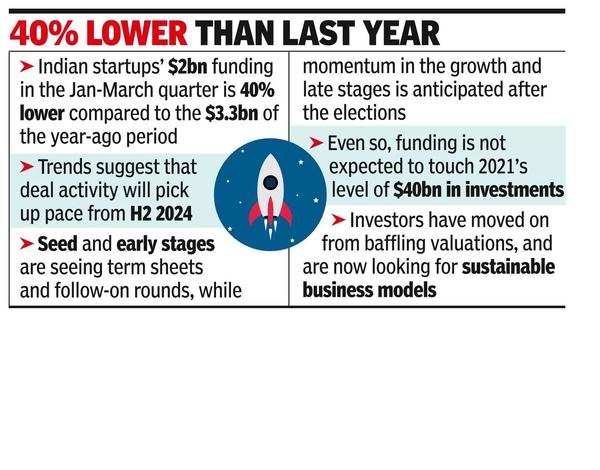

A studying of the tendencies in quarterly funding, nonetheless, confirmed that the ecosystem, which has been fighting a slowdown in investments for the reason that previous 12-18 months, has remained regular.Funding in Oct-Dec 2023 and July-Sept 2023 hovered across the $2 billion vary.

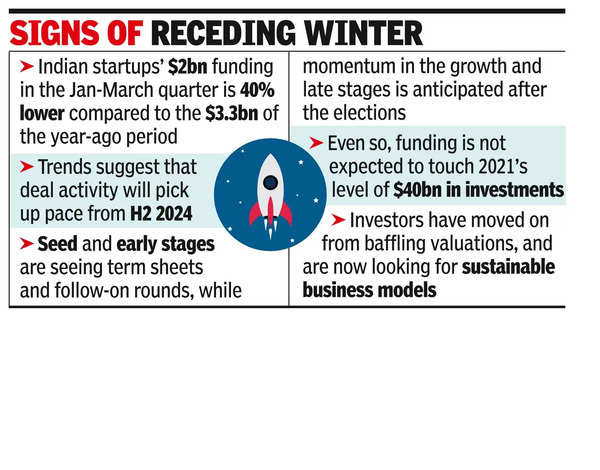

Investors consider the funding winter might lastly be receding and that deal exercise will choose up tempo from the second half of the year. “Things had started moving a bit from the end of last year itself. In the seed and early stages, we have seen term sheets and follow-on rounds happening. After the elections, we should see more action in the growth and late stages,” Varun Malhotra, companion at fintech targeted enterprise capital agency Quona Capital, instructed TOI.

India has already added two unicorns to its fleet 4 months into 2024 – Bhavish Aggarwal’s AI enterprise Krutrim and fintech SaaS Perfios. This is to not say that funding shall be again to ranges seen in 2021 when startups had raised near $40 billion in funding. That year was an outlier. In the current setting, whereas buyers will proceed to take time to judge offers, particularly late stage ones, these which have managed to steadiness progress and profitability in the previous two years will get funding on the proper valuations.

“Investors are cherry-picking deals. We will not go back to crazy funding and valuations. That phase has passed. Investors are looking for sustainable business models. Some of the spaces which had boomed during Covid like edtech, some segments of Web 3 for instance, are not being able to attract any investments,” mentioned Somshubhro Pal Choudhury, companion at Bharat Innovation Fund. Investors are actually exploring new areas like deeptech and AI which have extra defensible moats, he added.

From $462 million in Jan, funding into startups touched over $750 million in Feb and March, knowledge confirmed, due to a better variety of home buyers and micro VCs supporting early stage offers. “There will be enough traction in companies which are raising their first institutional rounds like series A, B as investors will be able to come in at the right price,” mentioned Abhishek Prasad, managing companion at Cornerstone Ventures.

Industry insiders mentioned that progress and late stage offers are additionally in the works, though they’re taking extra time to shut given the strict investor vigil. In sectors like fast commerce the place investor urge for food is large, gamers like Zepto are understood to be negotiating new rounds. Prasad would not anticipate many down rounds to occur except corporations are in dire want of funds. “We will also see a lot of secondary deals happen. There are lots of funds reaching end of life in several late stage companies,” he added.