Sundar Pichai, chief govt officer of Alphabet Inc., throughout Stanford’s 2024 Business, Government, and Society discussion board in Stanford, California, US, on Wednesday, April 3, 2024.

Justin Sullivan | Getty Images

As tech’s behemoths get set to report earnings this week, they achieve this going through a mountain of drama.

At Google, there have been protests and restructurings, whereas Tesla simply introduced mass layoffs, value cuts and a Cybertruck recall. Microsoft’s OpenAI relationship faces recent scrutiny and Facebook mother or father Meta’s main rollout of its new synthetic intelligence assistant final week did not go so nicely.

The troubling information comes alongside a generative AI gold rush, as Big Tech gamers race the brand new know-how into their huge portfolios of merchandise and options to make sure they don’t fall behind in a market that is predicted to top $1 trillion in income inside a decade.

Wall Street has been overtly jittery concerning the upcoming outcomes, pushing the tech-heavy Nasdaq Composite down 5.5% last week, the steepest weekly droop since November 2022. Nvidia, which has emerged as an AI darling, plunged 14%, main the slide.

“Whether this tech sell-off continues, I think really depends on how the mega-cap tech reports,” stated King Lip, chief strategist at BakerAvenue Wealth Management, in an interview with CNBC’s “Closing Bell” on Monday. “Valuations have definitely been more reasonable now, now that we’ve had a little bit of a correction.”

Lip stated that within the final couple of weeks his agency has “trimmed some of our tech exposure.”

Tech firms have been pouring report sums into rising generative AI startups and investing closely in Nvidia’s processors to construct AI fashions and run huge workloads. While that market is growing quickly, traders are growing anxious that different points at hand might result in a pullback in spending.

On this week’s earnings calls, firms are prone to proceed highlighting their efforts to chop prices and bolster income, an efficiency theme that is been operating throughout the trade since early final 12 months.

Tesla kicks off tech earnings season after the shut of buying and selling on Tuesday, with shares of the electrical car maker buying and selling at their lowest since January 2023. Meta, coming off its greatest weekly inventory slide since August, follows on Wednesday. Microsoft and Google mother or father Alphabet report on Thursday, giving Wall Street an in depth look at how companies are planning their budgets for AI infrastructure.

Here are among the greatest points going through the Big Tech firms of their stories this week.

Tesla

A Tesla Cybertruck sits on so much at a Tesla dealership on April 15, 2024 in Austin, Texas.

Brandon Bell | Getty Images

Tesla shares fell for a seventh straight day on Monday and at the moment are down 43% 12 months so far. Elon Musk’s EV firm is predicted to report a decline in gross sales of about 5%, which might be the primary year-over-year income drop since 2020, when the Covid pandemic disrupted operations.

Tesla’s earnings comply with a bruising quarterly deliveries report and extra value cuts to the corporate’s autos and its premium driver help system.

Last week, the EV maker stated it was shedding greater than 10% of its workforce, and the identical day executives Drew Baglino and Rohan Patel introduced their departures.

“As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity,” Musk wrote in a memo saying the layoffs.

Two days later, Musk knowledgeable workers via email that the corporate had despatched out “incorrectly low” severance packages to some laid-off staff. And on April 12, Tesla issued a voluntary recall of greater than 3,800 Cybertrucks to repair a “stuck pedal” difficulty depicted in a viral TikTookay video.

“Since late 2023, sentiment on Tesla (TSLA) has deteriorated,” wrote John Murphy, an analyst at Bank of America, in a notice on Monday.

Meta

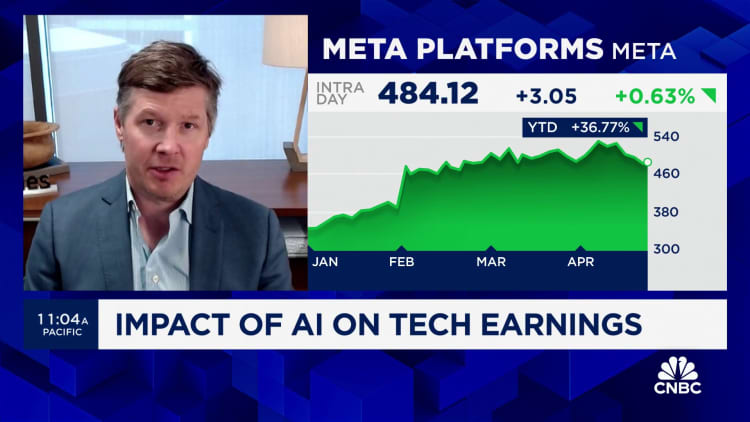

Meta has been wager for traders this 12 months regardless of final week’s slip. The inventory is up 36% in 2024 after nearly tripling final 12 months, when CEO Mark Zuckerberg instructed Wall Street that 2023 can be the corporate’s “year of efficiency.”

But Meta nonetheless faces loads of questions. For one, its Reality Labs division, which homes all the digital actuality applied sciences for the nascent metaverse, is predicted to point out a quarterly lack of over $four billion for a second straight interval.

When it involves AI, Meta debuted its assistant — Meta AI — on WhatsApp, Instagram, Facebook and Messenger final week. It was the corporate’s biggest-ever AI initiative and is ready to go up in opposition to OpenAI’s ChatGPT and Google‘s Gemini.

But Meta AI rapidly led to controversy. The assistant reportedly joined a non-public dad and mom’ group on Facebook and claimed to have a gifted and disabled child, sounding off within the feedback about its experiences with New York-area instructional packages. In another case, it reportedly joined a Buy Nothing discussion board and tried to do free giveaways for nonexistent objects.

Now, Meta has to point out that it is prepared for what’s sure to be a heated election season, as President Joe Biden and Republican Donald Trump put together to sq. off for a second time. Dating again to Trump’s profitable presidential bid in 2016, Facebook has been a problematic place for political discourse and misinformation.

Meta is predicted to report income development of 26% from a 12 months earlier to $36.16 billion, in line with LSEG. That would mark the quickest charge of enlargement for any interval since 2021.

Alphabet

Sundar Pichai, chief govt officer of Alphabet Inc., throughout Stanford’s 2024 Business, Government, and Society discussion board in Stanford, California, US, on Wednesday, April 3, 2024.

Loren Elliott | Bloomberg | Getty Images

On a busy Thursday for tech earnings, Alphabet is prone to seize probably the most consideration.

Last week, finance chief Ruth Porat introduced a restructuring of Google’s finance division, a transfer that may embody layoffs and relocations, as the corporate drives extra sources towards AI.

On the identical day, Google terminated 28 workers, in line with an internal memo seen by CNBC, following a collection of protests in opposition to labor situations and the corporate’s contract to offer the Israeli authorities and navy with cloud computing and synthetic intelligence companies.

The dismissals got here after 9 Google staff had been arrested on trespassing expenses Tuesday night time, staging a sit-in at the corporate’s workplaces in New York and Sunnyvale, California, together with a protest in Google Cloud CEO Thomas Kurian’s workplace. The arrests, livestreamed on Twitch by contributors, coincided with rallies outdoors Google workplaces in New York, Sunnyvale and Seattle, which attracted a whole lot of attendees, in line with staff concerned.

On Thursday, Alphabet CEO Sundar Pichai introduced a consolidation of the corporate’s AI groups, together with accountable AI and associated analysis groups, below the Google DeepMind umbrella. He stated in a memo that “this is a business” and workers shouldn’t “attempt to use the company as a personal platform, or to fight over disruptive issues or debate politics.”

Pichai has struggled to quell worker discontent on a number of issues for the reason that pandemic, as the corporate has been compelled to reckon with slower development than in years previous and an investor base that is develop into more and more involved with prices.

Analysts count on a first-quarter income improve of 13%, which might mark a second straight quarter of year-over-year development within the low teenagers. For 4 straight intervals, between mid-2022 and mid-2023, enlargement was in single digits as advertisers pulled again resulting from hovering inflation and rising rates of interest.

Alphabet shares are up 12% this 12 months, topping the S&P 500, which has gained 5.1%.

Microsoft

Microsoft CEO Satya Nadella (R) speaks as OpenAI CEO Sam Altman (L) appears on in the course of the OpenAI DevDay occasion on November 06, 2023 in San Francisco, California. Altman delivered the keynote tackle at the primary ever Open AI DevDay convention.

Justin Sullivan | Getty Images

As for Microsoft, the corporate seemed to narrowly avoid a European Union antitrust probe into its relationship with OpenAI, after EU regulators had pointed to the likelihood earlier this 12 months.

Microsoft has invested greater than $10 billion in OpenAI, whose ChatGPT chatbot kicked off the generative AI increase in late 2022. AI has been a significant focus of Microsoft’s earnings calls since then, as the corporate serves as OpenAI’s key know-how accomplice via its Azure cloud infrastructure.

Microsoft has invested billions of {dollars} in AI startup Anthropic as nicely, and has taken stakes in Mistral, Figure and Humane.

The firm’s place in AI has been the largest driver behind its ascent to $Three trillion in market cap, passing Apple as probably the most priceless U.S. firm. However, the inventory is just up 6.8% this 12 months, trailing lots of its friends, and a few analysts see potential weak point in elements of Microsoft’s buyer base, notably small and medium-sized companies.

“MSFT has more SMB and consumer exposure than any other stock we cover,” wrote analysts at Guggenheim, in a notice dated April 21. “And while those cohorts have held up surprisingly well during this soft macro period, we are starting to see some indications of weakening demand from them.”

Microsoft is predicted to report gross sales development of 15% within the first quarter, in line with LSEG, however analysts are projecting a slowdown over every of the following three intervals.