Drakula & Co. | Moment | Getty Images

1. Get an ‘rapid deduction’ from your IRA

One of the first choices is a pretax individual retirement account contribution, in accordance to Mark Steber, chief tax data officer at Jackson Hewitt.

“They’re still very popular and it’s just good planning,” he mentioned.

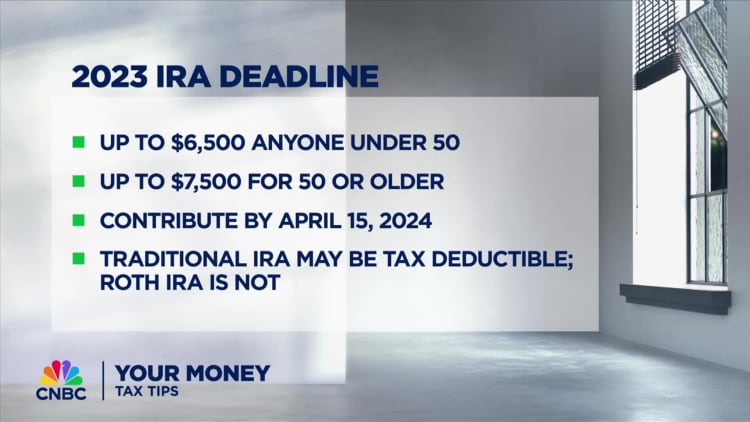

You have till the federal tax deadline for 2023 deposits, which may reduce adjusted gross income, relying on your earnings and office retirement plan participation. For 2023, you can save up to $6,500, with an additional $1,000 for traders age 50 and older.

“You get an immediate deduction” if you happen to qualify, no matter whether or not you itemize tax breaks on your return, Steber mentioned.

Of course, you may additionally take into account a 2023 Roth IRA contribution. That would not supply the upfront tax break, however the cash grows tax-free.

“Typically, if you’re in the 10% or 12% [tax] bracket, you’re probably better putting money into the Roth IRA,” Tommy Lucas, an authorized monetary planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida, beforehand informed CNBC.

2. Save to an ‘underutilized’ spousal IRA

There’s additionally a lesser-known possibility for married {couples} submitting collectively, referred to as a spousal IRA, which is a separate Roth or conventional IRA for nonworking spouses.

“They are underutilized,” mentioned CFP Laura Mattia, CEO of Atlas Fiduciary Financial in Sarasota, Florida. “People don’t always think about them.”

Married {couples} can contribute up to the restrict for every IRA, assuming the working partner has sufficient earned revenue. Of course, you will want to weigh your short- and long-term scenario, together with doable tax penalties, before making any IRA contribution, Mattia mentioned.

3. Add to your well being financial savings account

You also can rating a last-minute deduction with a 2023 health savings account contribution by the tax deadline, which affords a “multitude of benefits” — assuming you might have a high-deductible medical health insurance plan, Steber mentioned.

There are three tax breaks for HSAs: an upfront deduction for contributions, tax-free development and tax-free withdrawals for certified medical bills.

You can deposit up to $3,850 for self-only protection or $7,750 for a household plan for 2023. Investors age 55 and older can save an additional $1,000.