Gold prices are facing a downturn, reaching $4,077 an ounce after a rough session. This slump follows a steep drop of nearly 6.3% just a day earlier, marking the most significant fall in over a decade.

Suki Cooper from Standard Chartered Plc pointed out that “technical selling” is a major factor in this decline. She noted that gold prices have been in the “overbought” range since early September. However, Cooper and her team anticipate a rebound in gold’s value next year.

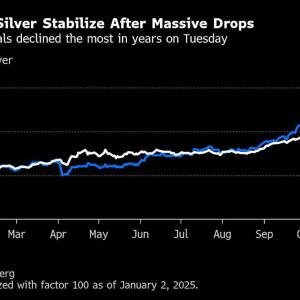

This shift comes after a strong rally that began in mid-August. Investors have flocked to gold, often referred to as a “safe haven,” especially amid economic uncertainty and ongoing trade tensions. Central banks around the world have also been diversifying their reserves away from the US dollar, contributing to increased demand for gold.

Interestingly, retail investors have shown a growing interest in gold lately. Social media has buzzed with images of long lines at bullion retailers as people seek to invest. In fact, options trading on major gold-backed ETFs has surged, reflecting this heightened enthusiasm.

President Trump’s trade strategies and geopolitical tensions have further fueled interest in precious metals. As markets fluctuate, though, experts like those at Citigroup are cautious. They’ve downgraded their gold recommendations, highlighting that current pricing may have outstripped actual demand.

In recent weeks, investors have had to navigate the uncertainty created by the US government shutdown. This has left them without crucial data on futures positions in the gold market, making decision-making tricky.

Overall, gold remains a topic of keen interest. With a remarkable increase of about 55% this year, the metal continues to capture attention, despite its recent volatility. The future for gold is still promising, especially as central banks look to maintain their gold reserves.

Source link

Bloomberg, Spot gold, retail investors, Standard Chartered Plc, technical indicators