A search engine called Pearl claims to offer a unique service. It provides answers generated by AI, with a human stepping in for follow-up questions. However, a lawsuit filed by the Federal Trade Commission (FTC) says the company’s real goal is to trap consumers into unwanted recurring charges. This scheme has reportedly affected hundreds of thousands of people.

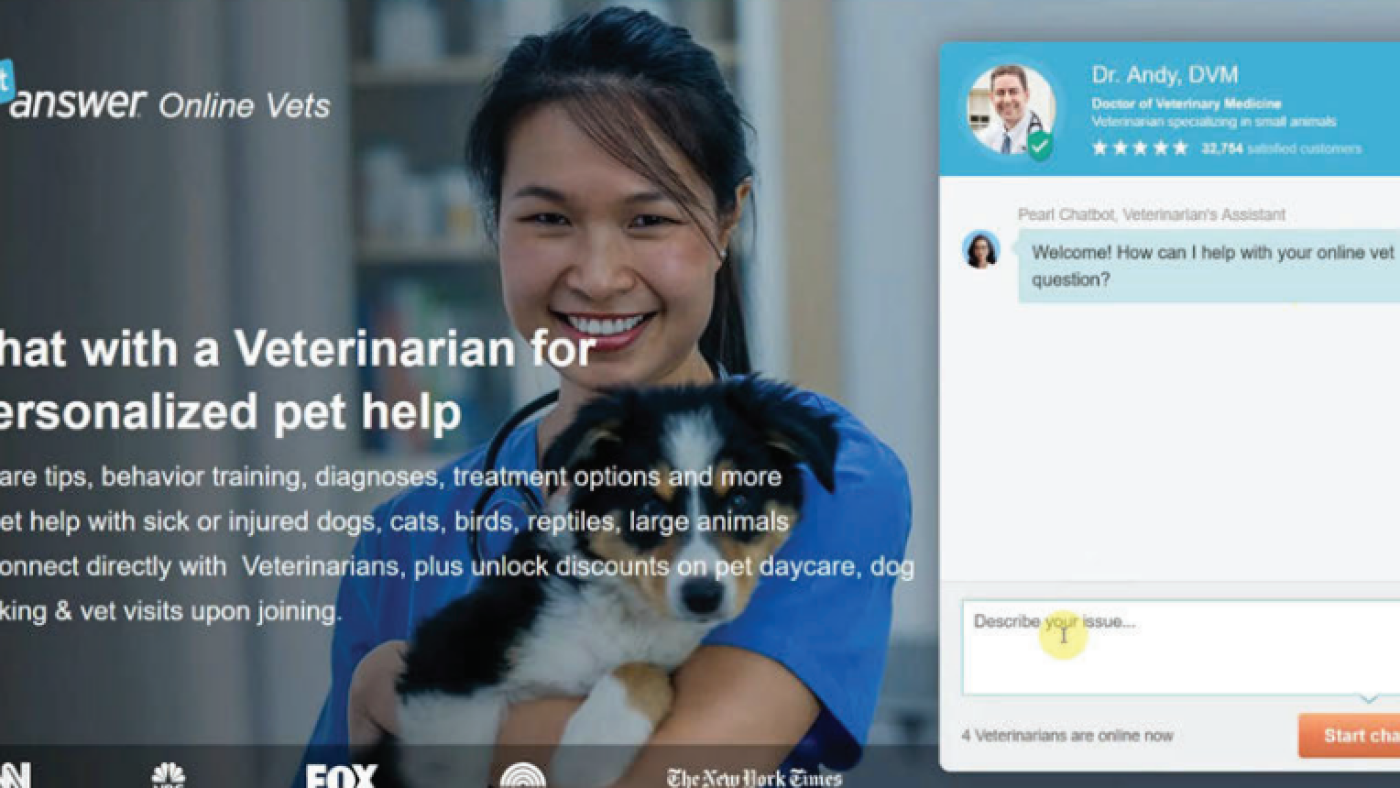

Here’s how it works: Users clicking on ads land on various sites like JustAnswer.com and AskALawyer.com. An assistant chatbot guides them through the process and encourages them to sign up for a Q&A service for either $1 or $5. Once users enter their credit card info, they often find themselves hit with much higher monthly fees—up to $79—without clear warning. The fine print reveals that these charges keep coming until the user cancels, which can be a hassle.

The FTC says this has led to a flood of complaints and describes the practice as “rampant consumer deception.” JustAnswer’s CEO, Andy Kurtzig, allegedly knew about these deceptive practices but chose not to change them. In response to the lawsuit, the company stated it clearly presents its pricing and allows easy cancellation through various channels.

The lawsuit calls out JustAnswer for violating consumer protection laws and seeks to stop its deceptive practices. The company, which has around 700 employees and raised about $50 million, is an example of what’s known as “dark patterns.” This term describes tactics that trick consumers into signing up for services they may not want.

Lina Khan, the former chair of the FTC, has been vocal against such corporate behaviors, pointing out that many tech firms have used similar tactics. Research by experts like Lior Strahilevitz from the University of Chicago Law School shows that consumers often overlook fine print before making online purchases. He notes that while the FTC frequently takes action against companies employing these dark patterns, they remain profitable because many consumers don’t catch the extra charges in time.

With more people using AI and online services, it’s crucial for consumers to stay vigilant. Always read the fine print before signing up for any service to avoid unexpected fees. For more on the FTC’s stance against deceptive practices, check out the Federal Trade Commission site.