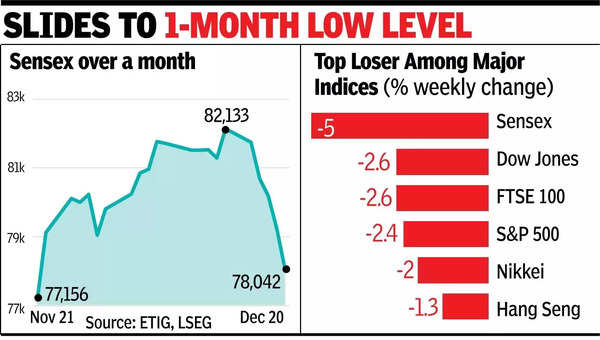

MUMBAI: Across-the-board promoting pulled the sensex down by practically 1,200 points on Friday as overseas funds bought closely once more in the closing hours. This was the fifth consecutive session of losses for the index, shedding practically 4,100 points or 5% through the week.

A bunch of world and home elements – a hawkish assertion from the US central financial institution chief, steady overseas fund promotingRupee plunging to a brand new all-time low and weak commerce knowledge – weighed on investor sentiment, market gamers mentioned.

In these 5 periods, the Sensex has erased the good points that had been gathered in the final 4 weeks, analysts identified. From its Sept 26 all-time peak of 85,978 points, the sensex is now down 7,936 points or 9.2%.

Like in the previous couple of periods, on Friday additionally overseas portfolio traders (FPIs) had been web sellers at about Rs 3,600 crore, BSE knowledge confirmed. In distinction, once more like in the previous couple of periods home funds had been web patrons, recording a web influx of Rs 1,374 crore. Nifty on Friday misplaced 364 points or 1.5% to 23,588 points.

“Disappointment regarding the slower-than-anticipated rate cuts by the US Fed has adversely affected global market sentiment. This bearish outlook is particularly impacting the domestic market, which is already contending with high valuations and low earnings growth,” mentioned Vinod Nair of Geojit. Financial Services.

“The selloff (this week) has been widespread, with significant declines in mid- and small-cap stocks, where valuation premiumisation is at historical peak. The IT sector is notably underperforming as it was among the best performers in anticipation of rapid rate cuts. in 2025,” Nair mentioned.

Analysts are suggesting excessive warning. According to Osho Krishnan of Angel One, weak world cues initiated the downward transfer in the Indian market however the comply with-up selloff showcased Bears’ eagerness to paint the market crimson forward of Christmas. “The advance declines have strongly turned to favor bears, and it is advisable to avoid trying to catch the falling knife with anticipation of bottom-fishing.”

The day’s session left traders poorer by Rs 9 lakh crore with BSE’s market capitalization now at Rs 449 lakh crore. From its all-time excessive peak at Rs 492 lakh crore, traders have misplaced about Rs 43 lakh crore value of wealth. Among the 30 Sensex shares, 28 closed in the crimson. Of these, Reliance Industries, HDFC Bank and Mahindra contributed probably the most to the day’s loss in the index. Nestle and Titan closed solely marginally increased, BSE knowledge confirmed.