Many finance teams are facing a challenge: finding enough digital talent to help with their transformation efforts. Hiring new people isn’t enough. Nearly half of the traditional finance roles need to shift into digital finance positions. This means employees must learn to adapt and create new technology solutions.

Finance teams see digital transformation as a way to handle complex operations and the growing presence of technology in their work. To maximize their returns on these digital investments, they need to boost productivity from their current workforce, blending tech skills with traditional finance tasks.

However, many organizations focus too much on training staff to use existing technologies. They often overlook the need for fresh digital finance talent to truly reach their transformation goals.

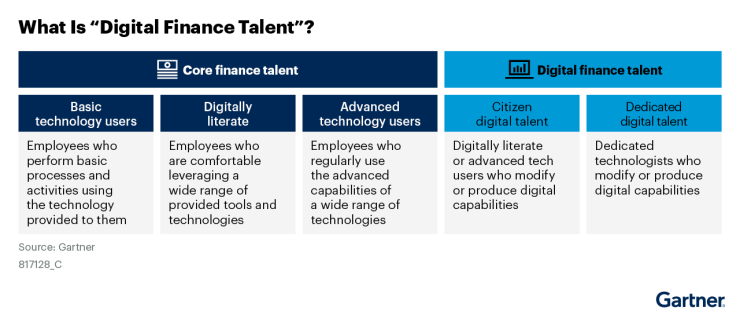

It’s vital for finance to seek out “digital finance talent” rather than just relying on traditional finance skills.

To tackle this, finance leaders need a plan:

Transform finance staff into tech creators

Finance roles need to evolve. Leaders should redesign these roles to include tech creation. This will help finance employees become involved in shaping technology processes. It’s not just about keeping the books anymore; it’s about driving technology that makes finance better.

Finance positions, especially in accounting and analytics, will need to change significantly in the coming years. These areas are prime for applying new finance technology. However, this shift will impact a wider range of finance roles as companies continue to evolve.

Shift routine roles into tech producers for more automation

Much of finance work is routine and can be slow. By automating these tasks, companies can reduce inefficiencies. Streamlining these roles lets employees focus on more critical, creative tasks. For instance, accountants, who often deal with repetitive processes, can benefit the most from automation.

To start this transformation, finance leaders should reshape role responsibilities, daily tasks, and performance goals. They can provide training and support for employees looking to dive into technology. This changes the culture so accountants feel encouraged to explore new tech tools.

Some companies take a strong approach, providing clear testing and training on new technologies. For example, at a global insurance firm, a leader launched a program where interested finance workers learned to automate manual processes. They aimed to create efficient solutions quickly.

Others blend leadership guidance and employee initiative. For instance, a financial analyst at another insurance company took part in a program to develop her digital skills. By identifying her challenges and turning them into digital solutions, she showcased autonomy and innovation.

Transform analytical roles into tech producers for better decision-making

Financial analysts can drive business decisions with enhanced tech skills. Transitioning from using tools to producing tech capabilities opens new doors for analysis. Analysts can shift from basic operational tasks to strategic support for the entire organization.

This means moving beyond tools like Excel and using more advanced technologies, such as low-code automation, artificial intelligence, and machine learning, to improve planning and forecasting.

To encourage this shift, performance measures for analysts should focus on the accuracy and impact of their insights for the organization. As finance grows more complex, blending traditional responsibilities with tech skills becomes essential.

By transforming finance roles into digital talent, companies can maximize their finance transformation efforts while addressing the skills gap in today’s workforce.

Source link

Technology,Automation,Analytics