Nvidia is set to announce its quarterly earnings soon, and investors are watching closely. With tough competition from companies like AMD and Broadcom, many are eager to see how Nvidia will perform. Analysts from Goldman Sachs are optimistic, predicting a revenue surprise of around $2 billion, bringing projected earnings to about $67.3 billion for the fourth quarter.

Nvidia shares have recently dropped about 13% from their peak, causing some investors to hesitate. While the quarterly results are important, Goldman Sachs believes that what happens next, especially for 2026 and 2027, will matter even more. They think investors might already expect strong results, making future guidance crucial.

The explosion of AI applications over the past year, especially after the launch of OpenAI’s ChatGPT, has significantly driven demand for Nvidia’s advanced graphics processing units (GPUs). This demand was unexpected, and many jumped on Nvidia stocks as the company consistently beat earnings estimates. As of now, almost every major portfolio includes Nvidia, reflecting a strong belief in its potential.

Goldman Sachs recently set a price target of $250 for Nvidia shares, suggesting a 35% increase. They base this on solid predictions for revenue growth driven by major data center projects. Reports show Amazon and Alphabet are planning to spend over $200 billion in capital, likely benefiting Nvidia.

Demand from AI companies and potential business from governments could also boost Nvidia. The company is also transitioning to new chips, with hopes for a successful rollout of its Rubin chips later this year.

However, challenges remain. Nvidia faces increased competition from firms like Broadcom and AMD, which could impact its market share. Restrictions on sales to China have also cut into its revenue, pushing Nvidia to reevaluate this market.

Investors should weigh potential risks, including:

- Slower spending on AI infrastructure

- Growing competition

- Supply chain disruptions

Nvidia’s high stock volatility means it could see significant ups and downs, reflecting broader market trends. While the outlook is positive, uncertainty remains.

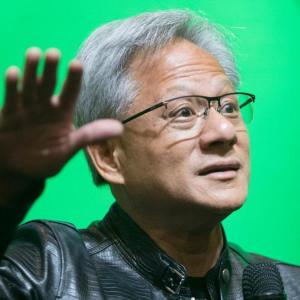

Nvidia’s CEO, Jensen Huang, recently mentioned the vast potential of AI, suggesting that the shift to this technology is just beginning. As they’ve changed how computing operates, Nvidia stands at the forefront.

In conclusion, Nvidia shows promise for growth, but it’s essential for investors to stay alert to the risks and market dynamics.

For a deeper dive into Nvidia’s journey, TheStreet provides a detailed overview.

Source link

Goldman Sachs, Nvidia, stock price target, quarterly earnings, Nvidia